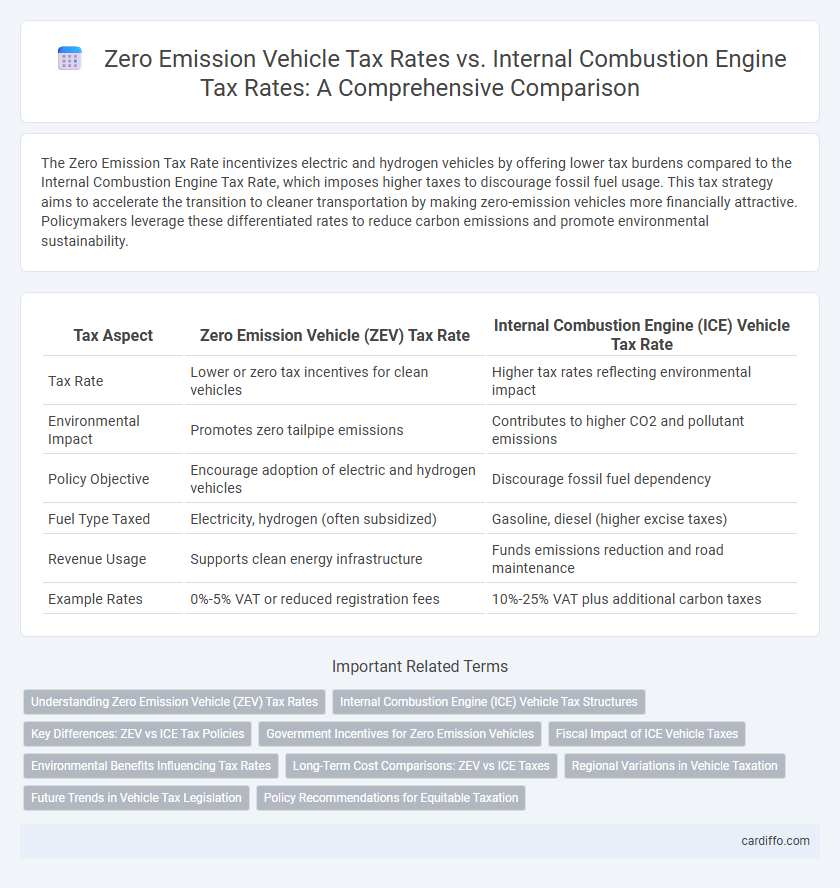

The Zero Emission Tax Rate incentivizes electric and hydrogen vehicles by offering lower tax burdens compared to the Internal Combustion Engine Tax Rate, which imposes higher taxes to discourage fossil fuel usage. This tax strategy aims to accelerate the transition to cleaner transportation by making zero-emission vehicles more financially attractive. Policymakers leverage these differentiated rates to reduce carbon emissions and promote environmental sustainability.

Table of Comparison

| Tax Aspect | Zero Emission Vehicle (ZEV) Tax Rate | Internal Combustion Engine (ICE) Vehicle Tax Rate |

|---|---|---|

| Tax Rate | Lower or zero tax incentives for clean vehicles | Higher tax rates reflecting environmental impact |

| Environmental Impact | Promotes zero tailpipe emissions | Contributes to higher CO2 and pollutant emissions |

| Policy Objective | Encourage adoption of electric and hydrogen vehicles | Discourage fossil fuel dependency |

| Fuel Type Taxed | Electricity, hydrogen (often subsidized) | Gasoline, diesel (higher excise taxes) |

| Revenue Usage | Supports clean energy infrastructure | Funds emissions reduction and road maintenance |

| Example Rates | 0%-5% VAT or reduced registration fees | 10%-25% VAT plus additional carbon taxes |

Understanding Zero Emission Vehicle (ZEV) Tax Rates

Zero Emission Vehicle (ZEV) tax rates are typically lower or offer incentives compared to Internal Combustion Engine (ICE) tax rates, encouraging the adoption of environmentally friendly transportation. These tax policies often include reduced registration fees, tax credits, or exemptions for ZEVs, which are designed to promote lower carbon emissions and align with climate goals. Understanding the differences in tax rates between ZEVs and ICE vehicles is crucial for consumers considering long-term cost savings and environmental impact.

Internal Combustion Engine (ICE) Vehicle Tax Structures

Internal Combustion Engine (ICE) vehicle tax structures often include higher excise taxes and fuel levies designed to discourage fossil fuel consumption and reduce carbon emissions. These tax rates are typically calculated based on engine size, fuel efficiency, and emissions standards, resulting in varied costs that penalize higher-emission vehicles. Compared to zero emission tax rates, ICE vehicle taxes incentivize a transition to cleaner technologies by economically disincentivizing traditional gasoline and diesel-powered cars.

Key Differences: ZEV vs ICE Tax Policies

Zero Emission Vehicle (ZEV) tax rates often include incentives such as rebates or reduced registration fees to encourage adoption of electric and hydrogen-powered vehicles. In contrast, Internal Combustion Engine (ICE) tax policies typically impose higher fees or taxes based on fuel consumption and emissions to discourage fossil fuel use. Key differences lie in the focus on environmental impact, with ZEV policies aimed at promoting clean energy, while ICE tax rates are designed to penalize carbon-intensive vehicles.

Government Incentives for Zero Emission Vehicles

Government incentives for zero emission vehicles (ZEVs) include tax credits, rebates, and reduced registration fees that significantly lower the effective cost compared to internal combustion engine (ICE) vehicles. These incentives aim to accelerate the adoption of electric vehicles (EVs) by offsetting higher upfront prices and promoting environmental benefits. Policies such as zero emission tax rates foster cleaner transportation alternatives, reducing greenhouse gas emissions and supporting national sustainability goals.

Fiscal Impact of ICE Vehicle Taxes

The fiscal impact of Internal Combustion Engine (ICE) vehicle taxes remains significant as governments rely on these revenues to fund infrastructure and environmental programs. Zero Emission Vehicle (ZEV) tax rates often provide reduced or zero rates to incentivize cleaner technology adoption, potentially decreasing traditional ICE tax revenue streams. Policymakers face challenges balancing ICE tax rates to maintain fiscal stability while promoting zero-emission transportation.

Environmental Benefits Influencing Tax Rates

Zero Emission Tax Rates incentivize environmentally friendly transportation by significantly lowering taxes on electric and hydrogen vehicles, reducing carbon emissions and air pollution. Internal Combustion Engine Tax Rates remain higher to discourage fossil fuel consumption and fund environmental initiatives targeting greenhouse gas reduction. These tax rate differentials reflect governments' strategic use of fiscal policy to promote sustainable transportation and combat climate change effectively.

Long-Term Cost Comparisons: ZEV vs ICE Taxes

Zero Emission Vehicle (ZEV) tax rates typically offer long-term financial advantages over Internal Combustion Engine (ICE) tax rates due to lower ongoing tax liabilities and incentives designed to promote clean energy adoption. Over extended periods, owners of ZEVs benefit from reduced or waived road use taxes, registration fees, and possible government rebates, which significantly lower total vehicle taxation costs compared to ICE vehicles burdened by higher fuel and emission taxes. Data indicates that lifetime tax expenses for ICE vehicles are substantially higher, reflecting stricter environmental tax policies aimed at discouraging fossil fuel reliance.

Regional Variations in Vehicle Taxation

Regional variations in vehicle taxation reveal significant differences between the zero emission tax rate and the internal combustion engine (ICE) tax rate, reflecting local environmental policies and economic priorities. Areas with aggressive climate goals often impose higher tax rates on ICE vehicles to discourage fossil fuel use while offering reduced or zero tax rates for zero emission vehicles (ZEVs), incentivizing cleaner transportation options. These tax rate disparities influence consumer behavior and vehicle adoption patterns, emphasizing the role of tailored regional tax frameworks in advancing sustainable mobility.

Future Trends in Vehicle Tax Legislation

Future vehicle tax legislation is shifting towards favoring zero emission tax rates to accelerate the adoption of electric vehicles and reduce carbon emissions. Internal combustion engine tax rates are expected to increase progressively, reflecting stricter environmental regulations and higher carbon pricing mechanisms worldwide. This trend incentivizes manufacturers and consumers to prioritize zero emission vehicles, aligning with global sustainability targets and clean energy commitments.

Policy Recommendations for Equitable Taxation

Implement a differential tax structure prioritizing zero emission vehicles by significantly lowering tax rates compared to internal combustion engine (ICE) vehicles to promote cleaner transportation. Introduce graduated tax credits and rebates for low-income households purchasing zero emission vehicles, ensuring equitable access and minimizing financial burden. Regularly reassess tax rates based on emissions data to align with climate goals while maintaining fairness across socioeconomic groups.

Zero Emission Tax Rate vs Internal Combustion Engine Tax Rate Infographic

cardiffo.com

cardiffo.com