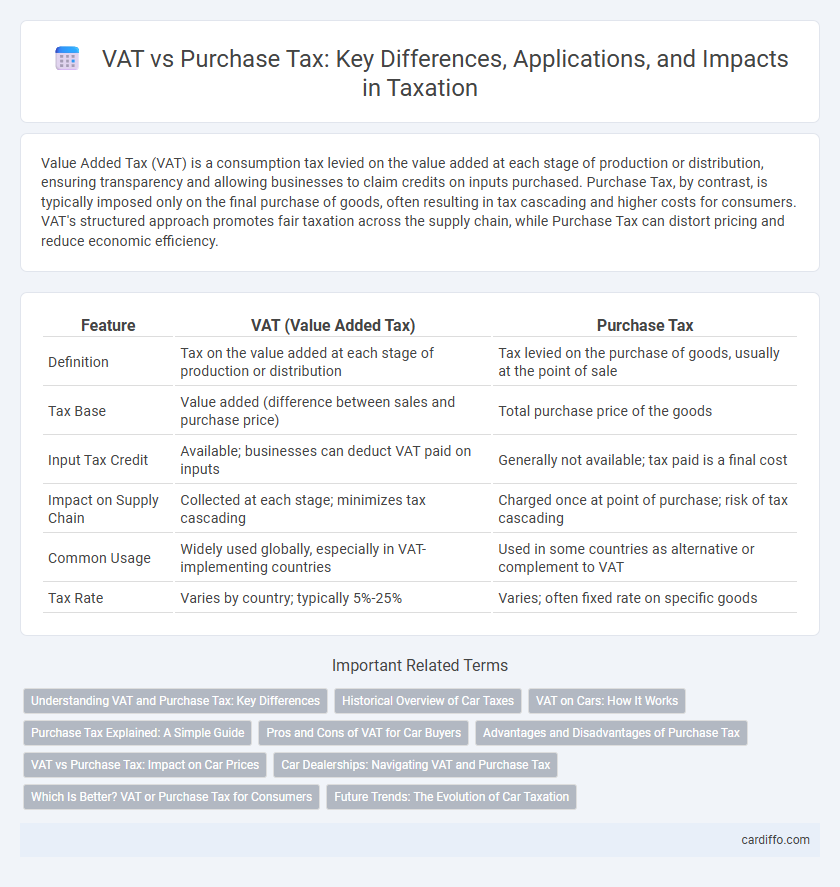

Value Added Tax (VAT) is a consumption tax levied on the value added at each stage of production or distribution, ensuring transparency and allowing businesses to claim credits on inputs purchased. Purchase Tax, by contrast, is typically imposed only on the final purchase of goods, often resulting in tax cascading and higher costs for consumers. VAT's structured approach promotes fair taxation across the supply chain, while Purchase Tax can distort pricing and reduce economic efficiency.

Table of Comparison

| Feature | VAT (Value Added Tax) | Purchase Tax |

|---|---|---|

| Definition | Tax on the value added at each stage of production or distribution | Tax levied on the purchase of goods, usually at the point of sale |

| Tax Base | Value added (difference between sales and purchase price) | Total purchase price of the goods |

| Input Tax Credit | Available; businesses can deduct VAT paid on inputs | Generally not available; tax paid is a final cost |

| Impact on Supply Chain | Collected at each stage; minimizes tax cascading | Charged once at point of purchase; risk of tax cascading |

| Common Usage | Widely used globally, especially in VAT-implementing countries | Used in some countries as alternative or complement to VAT |

| Tax Rate | Varies by country; typically 5%-25% | Varies; often fixed rate on specific goods |

Understanding VAT and Purchase Tax: Key Differences

Value Added Tax (VAT) is a consumption tax levied on the value added to goods and services at each stage of production or distribution, whereas Purchase Tax is a one-time tax imposed only at the point of purchase, often on specific goods. VAT allows for input tax credits, enabling businesses to deduct the VAT paid on purchases from their VAT liability, while Purchase Tax does not offer such credits. The key difference lies in VAT's multi-stage tax collection and broader applicability compared to the single-stage, limited scope of Purchase Tax.

Historical Overview of Car Taxes

Car taxes have evolved significantly with purchase tax preceding VAT as the primary vehicle taxation method. Purchase tax, introduced mid-20th century, was levied on the sale price of cars, influencing consumer behavior and automotive market dynamics. The introduction of Value Added Tax (VAT) in the late 20th century shifted taxation toward a multi-stage tax system, taxing value addition at each production and distribution phase, enhancing transparency and revenue collection efficiency.

VAT on Cars: How It Works

VAT on cars applies a percentage tax on the sale price, recoverable by businesses if the vehicle is used for taxable activities, unlike purchase tax which is a one-time tax embedded in the price. Businesses must keep detailed invoices to claim VAT input credits on car purchases, ensuring compliance with tax authorities. The VAT rate varies by country but typically ranges between 15% and 25%, impacting the total cost and cash flow for companies acquiring vehicles.

Purchase Tax Explained: A Simple Guide

Purchase Tax applies to the acquisition of specific goods and services, typically levied at the point of purchase and often included in the sale price. Unlike Value-Added Tax (VAT), which is charged at each stage of the supply chain and recoverable by businesses, Purchase Tax is usually non-recoverable and targets final consumers. Understanding the differences between Purchase Tax and VAT is crucial for compliance and accurate financial reporting in tax law.

Pros and Cons of VAT for Car Buyers

VAT on car purchases offers transparency by clearly showing tax amounts included in the price, enabling buyers to claim input tax credits if registered for VAT, which can reduce overall tax liability. However, VAT increases the upfront purchase cost and may complicate transactions for private buyers or those not eligible for tax credits. Unlike purchase tax, which is a one-time fee, VAT applies to each stage of the supply chain, potentially raising the final price but ensuring better tax accountability.

Advantages and Disadvantages of Purchase Tax

Purchase tax applies only to specific goods at the point of purchase, simplifying tax collection for targeted items but limiting its scope compared to VAT's broad-based application. It exempts many products from additional taxation, reducing administrative burden for both sellers and buyers, though it may encourage black market transactions to avoid taxes on high-cost goods. The fixed rate of purchase tax provides predictability for consumers, but lacks the input tax credit mechanism of VAT, potentially increasing costs for businesses and reducing overall economic efficiency.

VAT vs Purchase Tax: Impact on Car Prices

VAT (Value Added Tax) directly affects car prices by increasing the final sale amount through a percentage added at each stage of production and distribution. Purchase Tax, often a one-time levy on the transaction value, can significantly inflate the upfront cost of a vehicle but does not accumulate through the supply chain. The choice between VAT and Purchase Tax systems influences consumer affordability, manufacturer pricing strategies, and overall market competitiveness in the automotive sector.

Car Dealerships: Navigating VAT and Purchase Tax

Car dealerships must carefully differentiate between VAT and purchase tax to ensure compliant financial management and accurate pricing strategies. VAT, typically charged on the sale and purchase of vehicles, allows for input tax credit, whereas purchase tax is a one-time tax levied on the acquisition of certain vehicles, often impacting overall cost structures. Understanding the specific regulations and exemptions in each jurisdiction helps dealerships optimize tax liabilities and maintain competitive pricing for customers.

Which Is Better? VAT or Purchase Tax for Consumers

Value-Added Tax (VAT) offers consumers greater transparency and fairness by taxing value added at each stage of production, reducing tax cascading and often leading to lower overall prices compared to Purchase Tax, which is typically imposed only at the point of purchase and can result in higher costs due to cumulative taxation effects. VAT enables input tax credits, allowing businesses to reclaim VAT paid on inputs, which tends to be reflected in lower consumer prices, whereas Purchase Tax lacks such mechanisms, often increasing the final price for consumers. For consumers seeking price efficiency and clearer tax incidence, VAT generally presents a better option than Purchase Tax.

Future Trends: The Evolution of Car Taxation

Future trends in car taxation indicate a shift from traditional VAT and purchase tax models toward more dynamic, usage-based systems powered by digital technology. Governments are increasingly adopting telematics and data analytics to implement real-time road usage charges, reducing reliance on upfront taxes like VAT and purchase tax. This evolution aims to promote environmental sustainability and incentivize low-emission vehicles through targeted tax incentives and adjustable rates.

VAT vs Purchase Tax Infographic

cardiffo.com

cardiffo.com