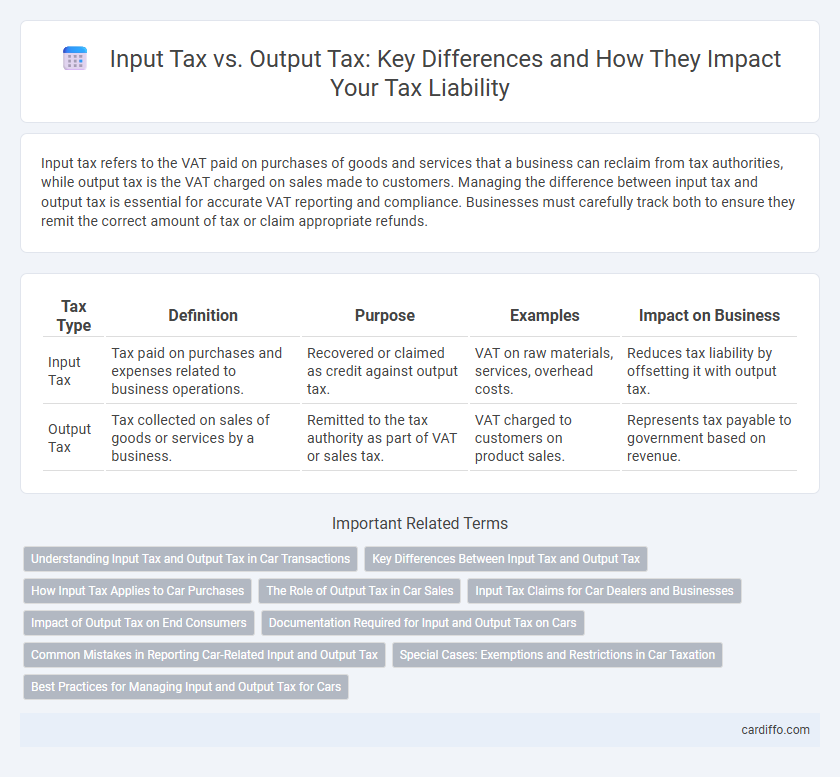

Input tax refers to the VAT paid on purchases of goods and services that a business can reclaim from tax authorities, while output tax is the VAT charged on sales made to customers. Managing the difference between input tax and output tax is essential for accurate VAT reporting and compliance. Businesses must carefully track both to ensure they remit the correct amount of tax or claim appropriate refunds.

Table of Comparison

| Tax Type | Definition | Purpose | Examples | Impact on Business |

|---|---|---|---|---|

| Input Tax | Tax paid on purchases and expenses related to business operations. | Recovered or claimed as credit against output tax. | VAT on raw materials, services, overhead costs. | Reduces tax liability by offsetting it with output tax. |

| Output Tax | Tax collected on sales of goods or services by a business. | Remitted to the tax authority as part of VAT or sales tax. | VAT charged to customers on product sales. | Represents tax payable to government based on revenue. |

Understanding Input Tax and Output Tax in Car Transactions

Input tax in car transactions refers to the VAT paid on purchasing vehicles, parts, or related services, which businesses can claim as a credit against their tax liability. Output tax is the VAT charged on selling cars or providing automotive services, collected from customers and remitted to the tax authorities. Accurate tracking of input and output tax ensures compliance with VAT regulations and helps in calculating the net tax payable or refundable in automotive sales.

Key Differences Between Input Tax and Output Tax

Input tax refers to the VAT paid on purchases and expenses that businesses can reclaim, while output tax is the VAT charged on sales and services rendered to customers. The fundamental difference lies in their roles within the VAT system: input tax reduces tax liability by offsetting VAT on inputs, whereas output tax contributes to VAT collection by being added to the selling price. Accurate tracking of input and output tax ensures compliance with tax regulations and determines the net VAT payable or refundable in a tax period.

How Input Tax Applies to Car Purchases

Input tax on car purchases refers to the value-added tax (VAT) paid by businesses when acquiring vehicles used for business purposes, which can be reclaimed if the car is used wholly and exclusively for taxable activities. The ability to recover input tax depends on the local tax jurisdiction's rules, often limiting claims on passenger cars versus commercial vehicles due to mixed private and business use. Proper documentation and adherence to tax authority guidelines ensure accurate input tax claims, reducing overall VAT liability for the business.

The Role of Output Tax in Car Sales

Output tax in car sales represents the value-added tax (VAT) charged by dealers on the sale price, which must be remitted to the tax authorities. This tax is crucial for calculating the net VAT liability, as it offsets the input tax paid on car purchases and related expenses. Effective management of output tax ensures compliance and accurate financial reporting in the automotive sector.

Input Tax Claims for Car Dealers and Businesses

Car dealers and businesses can claim input tax credits on the GST paid for purchases directly related to their commercial activities, such as acquiring vehicles and business supplies. Accurate record-keeping and valid tax invoices are essential for maximizing input tax claims and ensuring compliance with tax authorities. Properly managing input tax claims reduces the overall GST liability, improving cash flow and profitability for car dealerships and businesses.

Impact of Output Tax on End Consumers

Output tax, charged by businesses on sales, directly affects the final price paid by end consumers, as it is typically passed on through increased product or service costs. This tax increases the overall expenditure for consumers, reducing their purchasing power and influencing demand for taxed goods. Understanding the impact of output tax is crucial for policymakers to balance revenue generation with consumer affordability and market competitiveness.

Documentation Required for Input and Output Tax on Cars

Input tax on cars requires detailed purchase invoices, registration documents, and proof of payment to validate the claim for input VAT credit. Output tax documentation includes sales invoices, delivery receipts, and accurate tax computation records for vehicles sold or leased. Maintaining comprehensive records ensures compliance with tax authorities and facilitates audit processes for both input and output VAT on automotive transactions.

Common Mistakes in Reporting Car-Related Input and Output Tax

Common mistakes in reporting car-related input and output tax include incorrectly apportioning input tax for private versus business use and failing to maintain accurate mileage logs to substantiate claims. Taxpayers often overlook the necessity of separating GST on fuel purchases from non-deductible expenses such as fines or personal use kilometers. Misclassification of taxable versus exempt supplies related to vehicle sales or leases can also lead to inaccurate output tax reporting and potential penalties.

Special Cases: Exemptions and Restrictions in Car Taxation

In car taxation, input tax is generally the VAT paid on vehicle purchases and related expenses, while output tax is the VAT collected on the sale or use of the vehicle. Special cases arise with exemptions for electric vehicles and restrictions on claiming input tax for personal use cars, as these impact the deductible VAT amounts. Understanding the specific rules for exempt vehicles, such as government or charitable organizations, is crucial to ensure compliance and optimize tax benefits.

Best Practices for Managing Input and Output Tax for Cars

Managing input tax for cars requires meticulous documentation of purchase invoices to maximize VAT reclaim, ensuring compliance with local tax regulations. Output tax should be accurately calculated on sales or lease transactions, reflecting the correct tax rate to avoid penalties. Maintaining clear records of input and output tax enables efficient reconciliation and optimizes overall tax liability management.

Input Tax vs Output Tax Infographic

cardiffo.com

cardiffo.com