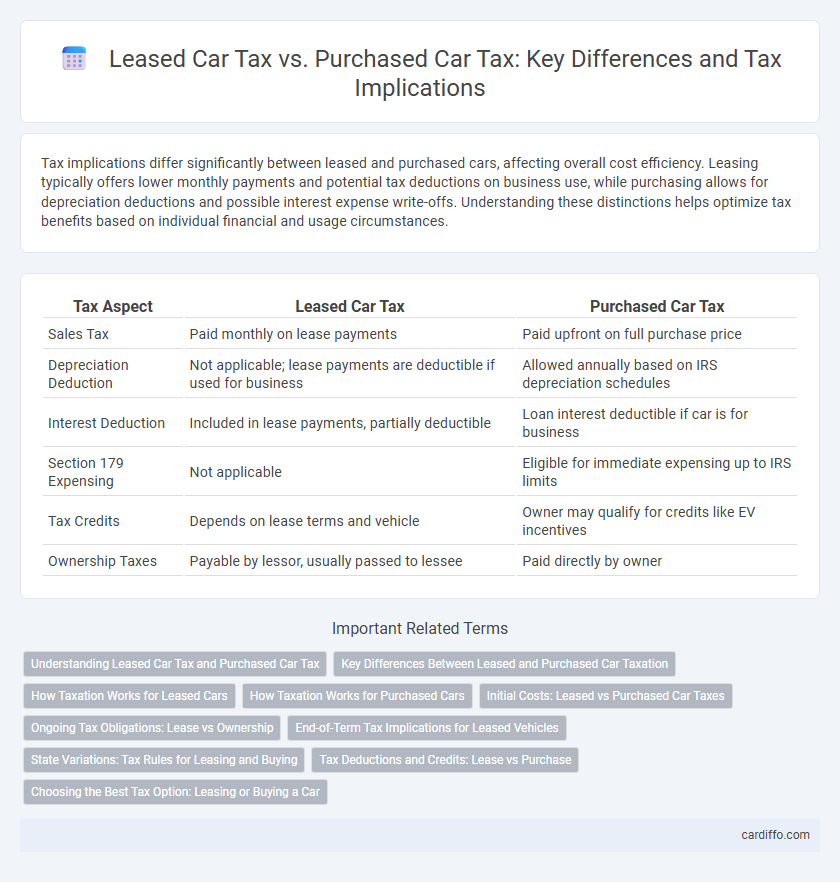

Tax implications differ significantly between leased and purchased cars, affecting overall cost efficiency. Leasing typically offers lower monthly payments and potential tax deductions on business use, while purchasing allows for depreciation deductions and possible interest expense write-offs. Understanding these distinctions helps optimize tax benefits based on individual financial and usage circumstances.

Table of Comparison

| Tax Aspect | Leased Car Tax | Purchased Car Tax |

|---|---|---|

| Sales Tax | Paid monthly on lease payments | Paid upfront on full purchase price |

| Depreciation Deduction | Not applicable; lease payments are deductible if used for business | Allowed annually based on IRS depreciation schedules |

| Interest Deduction | Included in lease payments, partially deductible | Loan interest deductible if car is for business |

| Section 179 Expensing | Not applicable | Eligible for immediate expensing up to IRS limits |

| Tax Credits | Depends on lease terms and vehicle | Owner may qualify for credits like EV incentives |

| Ownership Taxes | Payable by lessor, usually passed to lessee | Paid directly by owner |

Understanding Leased Car Tax and Purchased Car Tax

Leased car tax primarily involves paying sales tax on monthly lease payments rather than the full vehicle price, often resulting in lower upfront tax costs. Purchased car tax requires paying sales tax on the total purchase price at the time of sale, impacting immediate cash flow but potentially offering tax deductions such as depreciation for business use. Understanding these differences can help individuals and businesses optimize tax liabilities based on their vehicle acquisition strategy.

Key Differences Between Leased and Purchased Car Taxation

Leased car tax typically involves paying sales tax on monthly lease payments, whereas purchased car tax requires paying the full sales tax upfront on the vehicle's purchase price. Ownership of a purchased car allows for depreciation deductions and potential tax credits, while leased cars often have limitations on deductible expenses due to lack of ownership. Tax treatment varies based on state regulations, lease terms, and whether the vehicle is used for personal or business purposes.

How Taxation Works for Leased Cars

Taxation for leased cars typically involves paying sales tax on the monthly lease payments rather than the entire vehicle value upfront, which can reduce initial tax burden. Lease payments are often considered operating expenses, allowing businesses to deduct them as a cost of doing business, subject to specific IRS limits and conditions. Personal use of a leased car may require imputing income or adjusting deductions based on the proportion of business versus personal use.

How Taxation Works for Purchased Cars

Taxation on purchased cars involves paying sales tax based on the vehicle's purchase price, which varies by state and can sometimes be deducted from income taxes if used for business purposes. Ownership of the vehicle results in property tax obligations in certain jurisdictions, calculated annually based on the car's value and age. Depreciation deductions can be claimed for purchased cars used in business, reducing taxable income over time according to IRS guidelines.

Initial Costs: Leased vs Purchased Car Taxes

Leased car taxes are typically calculated based on the monthly lease payments rather than the vehicle's full purchase price, resulting in lower initial tax outlays compared to purchasing a car outright. When buying a car, buyers must pay sales tax on the entire purchase price upfront, significantly increasing initial costs. This difference in tax treatment impacts overall cash flow and can influence the decision between leasing and purchasing from a financial planning perspective.

Ongoing Tax Obligations: Lease vs Ownership

Leased cars often incur consistent monthly tax payments incorporated into lease fees, reflecting ongoing tax obligations without ownership benefits. Purchased vehicles require annual property taxes and potential registration fees, with owners bearing full responsibility for tax compliance. Understanding these differences aids in optimizing tax planning for leased versus owned vehicles.

End-of-Term Tax Implications for Leased Vehicles

Leased car tax implications at the end of the term primarily involve potential taxes on excess mileage, wear and tear charges, and disposition fees rather than ownership-based taxes. Unlike purchased vehicles, leased cars do not incur depreciation tax deductions since the lessee doesn't own the asset, shifting tax considerations to usage and condition fees imposed by lessors. Understanding the residual value and lease-end charges is crucial for accurately assessing tax liabilities associated with leased vehicles.

State Variations: Tax Rules for Leasing and Buying

State tax regulations for leased and purchased vehicles vary significantly, influencing overall cost and tax obligations. In some states, leasing a car may incur sales tax only on the monthly payments, while purchasing requires paying sales tax upfront on the entire vehicle price. Other states apply similar tax rates regardless of acquisition method but differ in tax credits, registration fees, and deductible expenses related to leased versus owned cars.

Tax Deductions and Credits: Lease vs Purchase

Leased car tax deductions typically allow businesses to deduct lease payments as a business expense, offering consistent monthly tax benefits without owning the vehicle. Purchased car tax deductions enable depreciation claims, including Section 179 and bonus depreciation, which reduce taxable income over several years, along with deductions on interest paid for financed vehicles. Tax credits are generally more limited for leased vehicles, whereas purchased cars may qualify for specific credits, such as electric vehicle tax credits, enhancing overall tax savings.

Choosing the Best Tax Option: Leasing or Buying a Car

Leased car tax benefits typically include deductible lease payments and potential lower sales tax, making leasing attractive for short-term use and cash flow management. Purchased car tax advantages often involve depreciation deductions and eligibility for investment tax credits, favoring long-term ownership and asset accumulation. Evaluating factors such as vehicle usage, tax regulations, and financial goals is essential for optimizing tax savings when choosing between leasing or buying a car.

Leased Car Tax vs Purchased Car Tax Infographic

cardiffo.com

cardiffo.com