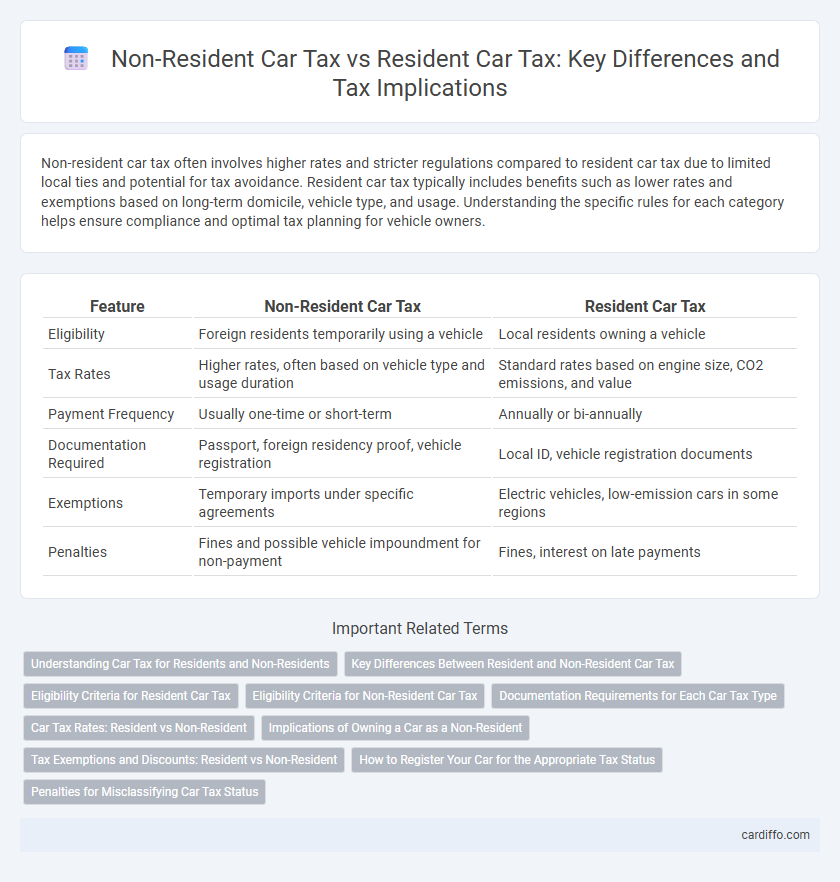

Non-resident car tax often involves higher rates and stricter regulations compared to resident car tax due to limited local ties and potential for tax avoidance. Resident car tax typically includes benefits such as lower rates and exemptions based on long-term domicile, vehicle type, and usage. Understanding the specific rules for each category helps ensure compliance and optimal tax planning for vehicle owners.

Table of Comparison

| Feature | Non-Resident Car Tax | Resident Car Tax |

|---|---|---|

| Eligibility | Foreign residents temporarily using a vehicle | Local residents owning a vehicle |

| Tax Rates | Higher rates, often based on vehicle type and usage duration | Standard rates based on engine size, CO2 emissions, and value |

| Payment Frequency | Usually one-time or short-term | Annually or bi-annually |

| Documentation Required | Passport, foreign residency proof, vehicle registration | Local ID, vehicle registration documents |

| Exemptions | Temporary imports under specific agreements | Electric vehicles, low-emission cars in some regions |

| Penalties | Fines and possible vehicle impoundment for non-payment | Fines, interest on late payments |

Understanding Car Tax for Residents and Non-Residents

Non-residents are typically subject to different car tax regulations compared to residents, often paying higher rates or limited exemptions due to their temporary status. Residents benefit from standard car tax rates tied to vehicle emissions, engine size, and age, reflecting local environmental policies and road usage. Understanding the distinction is crucial for compliance and cost management, as non-residents may face additional fees or requirements such as temporary permits or import duties.

Key Differences Between Resident and Non-Resident Car Tax

Non-resident car tax typically applies to vehicles registered outside the country but used temporarily within its borders, often featuring higher rates or shorter validity periods compared to resident car tax. Resident car tax is based on permanent vehicle registration within the country and benefits from standardized rates and exemptions tied to residency status. Key differences include eligibility criteria, tax calculation methods based on residency duration, and compliance requirements set by local tax authorities.

Eligibility Criteria for Resident Car Tax

Resident Car Tax eligibility requires the vehicle owner to have established permanent residency within the jurisdiction, typically proven through a valid local address and registration documentation. Tax authorities often mandate that vehicles registered under Resident Car Tax display compliance with local emission standards and relevant insurance policies. The duration of residency, usually exceeding six months, is a crucial factor distinguishing eligibility from Non-Resident Car Tax status.

Eligibility Criteria for Non-Resident Car Tax

Eligibility for Non-Resident Car Tax primarily requires proof of temporary stay in the jurisdiction without establishing permanent residence, often evidenced by a valid visa or work permit. Vehicles must be registered outside the country and used for a limited duration, typically less than six months per year, to qualify. Documentation confirming non-residency status and imported vehicle details is essential for assessment under non-resident tax provisions.

Documentation Requirements for Each Car Tax Type

Non-resident car tax requires submitting proof of foreign residency, vehicle registration documents from the home country, and a declaration of temporary vehicle importation. Resident car tax mandates providing local residency proof, valid vehicle registration within the state, and up-to-date insurance certificates. Both tax types often require a completed application form but differ primarily in residency verification and import declarations.

Car Tax Rates: Resident vs Non-Resident

Resident car tax rates generally depend on vehicle type, engine size, and emissions, often resulting in lower rates for residents benefiting from local tax incentives. Non-resident car tax rates tend to be higher, reflecting additional fees or surcharges imposed on foreign-registered vehicles using local roads. Understanding the differential in car tax rates between residents and non-residents is essential for budgeting and compliance in cross-border vehicle ownership.

Implications of Owning a Car as a Non-Resident

Non-resident car tax regulations often involve higher rates and limited exemptions compared to resident car tax policies, impacting the overall cost of vehicle ownership. Non-residents may face stricter registration requirements, increased import duties, and restrictions on vehicle usage duration within the country. Understanding these implications is critical for non-resident car owners to ensure compliance and avoid penalties related to taxation and vehicular regulations.

Tax Exemptions and Discounts: Resident vs Non-Resident

Resident car tax systems often provide exemptions and discounts based on long-term ownership, environmental standards, and local residency status, such as reduced rates for electric vehicles or low-emission cars. Non-resident car tax regulations typically offer limited or no exemptions, with taxes calculated on vehicle usage within the jurisdiction, often lacking residency-based discounts. Understanding the distinctions in tax benefits between resident and non-resident car owners is essential for optimizing financial obligations related to vehicle taxation.

How to Register Your Car for the Appropriate Tax Status

Registering your car for the correct tax status requires submitting proof of residency or non-residency to the local Department of Motor Vehicles (DMV). Non-resident car tax registration typically involves providing a valid foreign address and proof of temporary stay, while resident car tax registration mandates a permanent in-state address and valid identification. Ensure you complete the proper tax forms, pay the applicable fees, and update your status promptly to avoid penalties or misclassification.

Penalties for Misclassifying Car Tax Status

Misclassifying car tax status between non-resident and resident categories can lead to significant penalties, including fines up to PS1,000 and possible back payments for unpaid taxes. Authorities rigorously enforce correct classification to ensure compliance with Vehicle Excise Duty regulations, and repeated offenses may trigger further legal actions. Proper documentation and timely communication with the DVLA are essential to avoid costly penalties and maintain lawful vehicle operation.

Non-Resident Car Tax vs Resident Car Tax Infographic

cardiffo.com

cardiffo.com