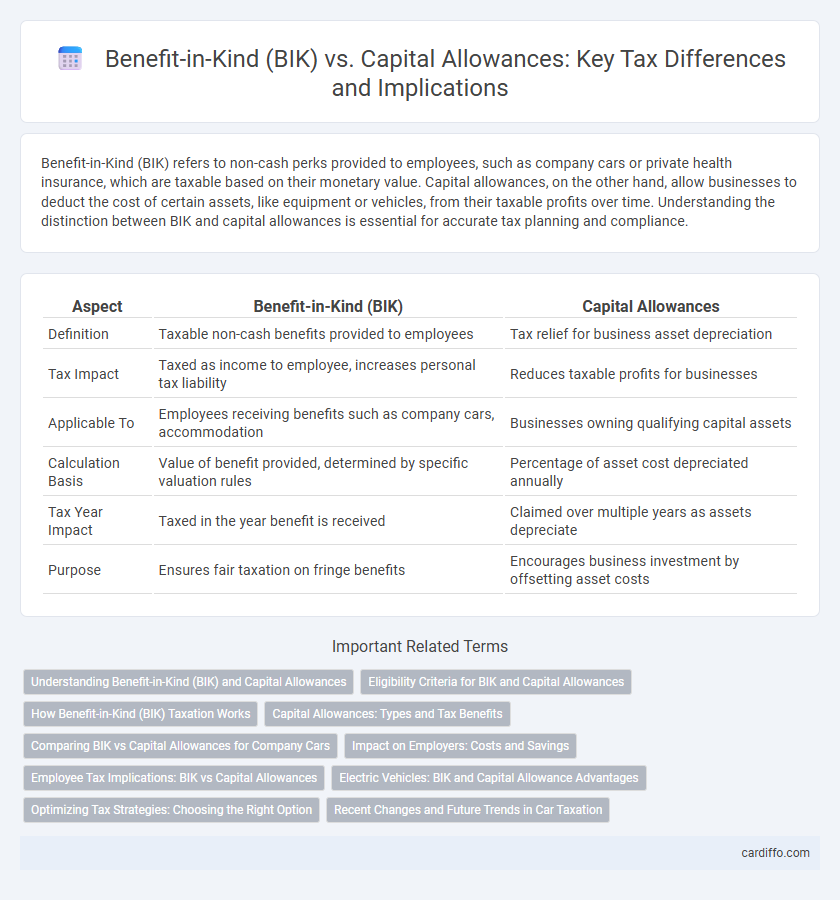

Benefit-in-Kind (BIK) refers to non-cash perks provided to employees, such as company cars or private health insurance, which are taxable based on their monetary value. Capital allowances, on the other hand, allow businesses to deduct the cost of certain assets, like equipment or vehicles, from their taxable profits over time. Understanding the distinction between BIK and capital allowances is essential for accurate tax planning and compliance.

Table of Comparison

| Aspect | Benefit-in-Kind (BIK) | Capital Allowances |

|---|---|---|

| Definition | Taxable non-cash benefits provided to employees | Tax relief for business asset depreciation |

| Tax Impact | Taxed as income to employee, increases personal tax liability | Reduces taxable profits for businesses |

| Applicable To | Employees receiving benefits such as company cars, accommodation | Businesses owning qualifying capital assets |

| Calculation Basis | Value of benefit provided, determined by specific valuation rules | Percentage of asset cost depreciated annually |

| Tax Year Impact | Taxed in the year benefit is received | Claimed over multiple years as assets depreciate |

| Purpose | Ensures fair taxation on fringe benefits | Encourages business investment by offsetting asset costs |

Understanding Benefit-in-Kind (BIK) and Capital Allowances

Benefit-in-Kind (BIK) refers to non-cash benefits provided by an employer to employees, such as company cars or private medical insurance, which are taxable based on their monetary value. Capital Allowances allow businesses to deduct the cost of certain capital assets, like machinery or vehicles, from their taxable profits, reducing overall tax liability. Understanding the distinction ensures correct tax treatment, with BIK impacting employee tax obligations and Capital Allowances benefiting business tax calculations.

Eligibility Criteria for BIK and Capital Allowances

Eligibility for Benefit-in-Kind (BIK) typically applies to employees receiving non-cash perks such as company cars, private medical insurance, or accommodation as part of their remuneration package. Capital Allowances eligibility is restricted to businesses investing in qualifying tangible fixed assets like machinery, equipment, or commercial vehicles, used for trade purposes. Determination of BIK eligibility hinges on the provision of taxable benefits by employers, while Capital Allowances depend on the ownership and use of capital assets in business operations.

How Benefit-in-Kind (BIK) Taxation Works

Benefit-in-Kind (BIK) taxation applies when employees receive non-cash benefits from their employer, such as company cars or private medical insurance, which are valued and taxed based on their taxable benefit rates set by HMRC. The taxable amount is added to the employee's income and subject to income tax, with the employer paying National Insurance contributions on the value of the benefit. Unlike capital allowances, which allow businesses to deduct the cost of certain fixed assets over time to reduce taxable profits, BIK directly impacts employee tax liabilities without affecting the company's capital expenditure claims.

Capital Allowances: Types and Tax Benefits

Capital allowances enable businesses to deduct the cost of qualifying capital assets from their taxable profits, reducing overall tax liability. Key types include Annual Investment Allowance (AIA), First Year Allowance (FYA), and Writing Down Allowance (WDA), each offering specific tax relief advantages based on asset category and expenditure timing. These allowances accelerate tax relief on purchases like machinery, vehicles, and commercial property improvements, optimizing cash flow and enhancing investment capacity.

Comparing BIK vs Capital Allowances for Company Cars

Benefit-in-Kind (BIK) tax on company cars is calculated based on the vehicle's list price and CO2 emissions, influencing the employee's taxable income and the company's National Insurance contributions. Capital allowances allow companies to claim tax relief on the purchase cost of company cars, with rates varying depending on the car's CO2 emissions, incentivizing lower-emission vehicles through first-year allowances or writing down allowances. Comparing BIK and capital allowances highlights the importance of balancing employee benefits with corporate tax planning, where electric and low-emission cars reduce BIK rates and maximize capital allowance benefits.

Impact on Employers: Costs and Savings

Benefit-in-Kind (BIK) increases employer costs through additional National Insurance contributions and potential tax reporting obligations, impacting overall payroll expenses. Capital Allowances provide tax relief by enabling employers to deduct the cost of qualifying capital assets from taxable profits, resulting in significant cash flow savings. Balancing BIK liabilities against Capital Allowance benefits is crucial for optimizing employer tax strategies and minimizing net expenditure.

Employee Tax Implications: BIK vs Capital Allowances

Benefit-in-Kind (BIK) represents taxable non-cash employee compensation, which increases an employee's taxable income and results in higher income tax and National Insurance contributions. Capital Allowances apply to business assets, enabling employers to reduce taxable profits, but they do not directly affect employee tax liabilities. Understanding the difference helps employees recognize that BIK increases their personal tax burden, while Capital Allowances influence the employer's tax position without additional tax charges on employees.

Electric Vehicles: BIK and Capital Allowance Advantages

Electric vehicles (EVs) offer significant tax benefits through Benefit-in-Kind (BIK) rates that are substantially lower than those for petrol or diesel vehicles, reducing employee tax liabilities. Capital allowances for EVs enable businesses to claim 100% first-year allowances on qualifying vehicles, accelerating tax relief on purchases. These incentives collectively promote cost savings and support the adoption of environmentally friendly company car fleets.

Optimizing Tax Strategies: Choosing the Right Option

Optimizing tax strategies involves weighing the immediate tax relief of Benefit-in-Kind (BIK) against the long-term depreciation advantages from Capital Allowances. BIK often leads to a taxable benefit on personal income, while Capital Allowances reduce the taxable profit of a business over time, improving cash flow. Careful analysis of company cash flow, vehicle usage, and employee tax brackets ensures selection of the most efficient route for minimizing overall tax liabilities.

Recent Changes and Future Trends in Car Taxation

Recent changes in car taxation emphasize stricter Benefit-in-Kind (BIK) rates for low-emission vehicles to promote environmental sustainability. Capital allowances have been adjusted to incentivize businesses to invest in electric and hybrid cars by offering enhanced first-year allowances. Future trends indicate a shift towards dynamic BIK rates aligned with real-time emissions data and expanded capital allowance schemes targeting zero-emission company fleets.

Benefit-in-Kind (BIK) vs Capital Allowances Infographic

cardiffo.com

cardiffo.com