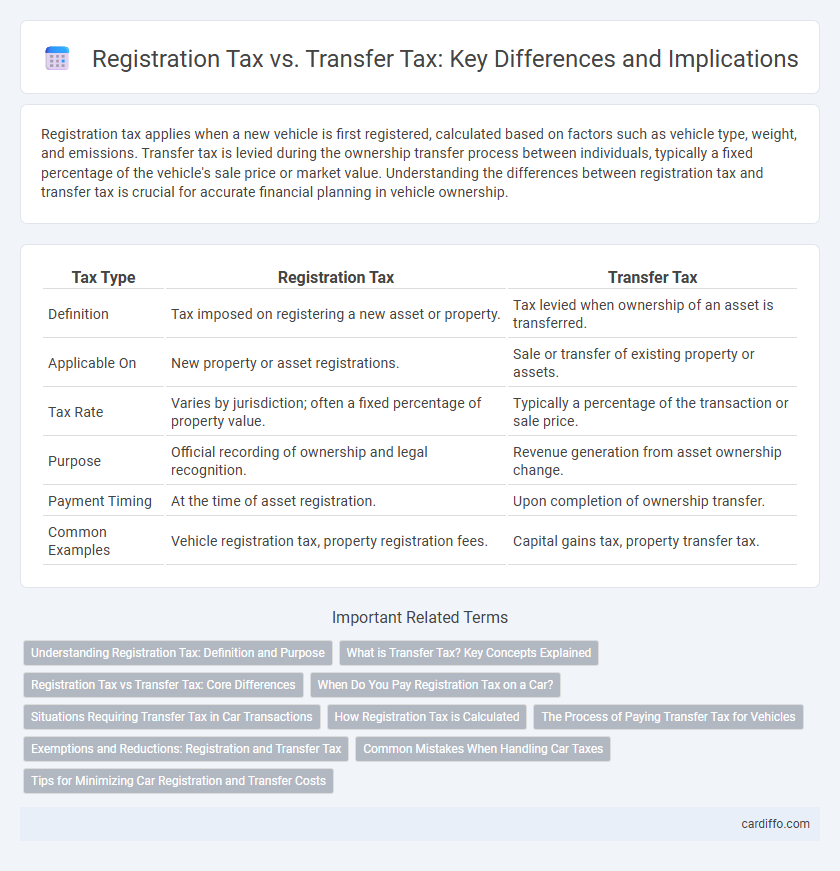

Registration tax applies when a new vehicle is first registered, calculated based on factors such as vehicle type, weight, and emissions. Transfer tax is levied during the ownership transfer process between individuals, typically a fixed percentage of the vehicle's sale price or market value. Understanding the differences between registration tax and transfer tax is crucial for accurate financial planning in vehicle ownership.

Table of Comparison

| Tax Type | Registration Tax | Transfer Tax |

|---|---|---|

| Definition | Tax imposed on registering a new asset or property. | Tax levied when ownership of an asset is transferred. |

| Applicable On | New property or asset registrations. | Sale or transfer of existing property or assets. |

| Tax Rate | Varies by jurisdiction; often a fixed percentage of property value. | Typically a percentage of the transaction or sale price. |

| Purpose | Official recording of ownership and legal recognition. | Revenue generation from asset ownership change. |

| Payment Timing | At the time of asset registration. | Upon completion of ownership transfer. |

| Common Examples | Vehicle registration tax, property registration fees. | Capital gains tax, property transfer tax. |

Understanding Registration Tax: Definition and Purpose

Registration tax is a government-imposed fee levied on the official recording of legal documents, particularly in real estate transactions, ensuring the legitimacy and public recognition of ownership. Its primary purpose is to provide a legal framework for property rights, protect parties involved, and generate revenue for public administration. Unlike transfer tax, which specifically targets the value of transferring ownership, registration tax covers the administrative costs of maintaining accurate governmental records.

What is Transfer Tax? Key Concepts Explained

Transfer Tax is a government-imposed levy on the transfer of ownership of property or assets, typically calculated as a percentage of the transaction value. Key concepts include its application during sales, inheritance, and gifts, with rates varying by jurisdiction and asset type, such as real estate or securities. Unlike Registration Tax, which covers administrative costs of recording the transfer, Transfer Tax directly affects the taxable amount of the transaction itself.

Registration Tax vs Transfer Tax: Core Differences

Registration tax is a one-time fee imposed on the official recording of property ownership, reflecting administrative and legal processing costs, while transfer tax is a percentage-based levy applied to the property's sale price or assessed value during ownership transfer. Registration tax ensures the new ownership is legally recognized in public records, whereas transfer tax primarily generates revenue for local or state governments based on the transaction value. Understanding these distinctions clarifies tax obligations during property transactions and highlights the different roles each tax plays in real estate transfers.

When Do You Pay Registration Tax on a Car?

You pay registration tax on a car at the time of the initial vehicle registration or when registering a newly imported vehicle. This tax is calculated based on factors such as the car's purchase price, engine size, CO2 emissions, and its age. Transfer tax, in contrast, is paid during the change of ownership, typically when a used car is sold or transferred between private parties.

Situations Requiring Transfer Tax in Car Transactions

Transfer tax applies during the sale or ownership transfer of a vehicle when the title is officially changed from the seller to the buyer. Situations requiring transfer tax include private sales, inheritance, gifting, and dealer-to-buyer transactions where ownership registration is updated. Registration tax, by contrast, is typically paid upon the initial registration of a new or imported car, separate from transfer tax obligations.

How Registration Tax is Calculated

Registration tax is calculated based on the assessed value of the property, which may be determined by either the purchase price or the official property valuation, whichever is higher. The tax rate varies depending on jurisdiction and property type, often ranging between 0.5% to 2% of the property's assessed value. Unlike transfer tax, which is usually a fixed percentage on the sale price, registration tax considers additional factors such as property location, usage, and legal classification.

The Process of Paying Transfer Tax for Vehicles

Paying transfer tax for vehicles involves submitting the required documents, such as the vehicle registration certificate and proof of sale, to the local tax authority or vehicle registration office. The transfer tax amount is calculated based on the vehicle's value, model year, and regional tax rates. Once the payment is processed and confirmed, the new owner receives updated registration reflecting the transfer.

Exemptions and Reductions: Registration and Transfer Tax

Exemptions and reductions for registration tax often apply to property transactions involving first-time homebuyers, charitable organizations, or government incentives promoting affordable housing. Transfer tax exemptions typically include intra-family property transfers, inheritance, and transactions below a specific monetary threshold, with reductions available for residential property or energy-efficient renovations. Understanding these distinctions enhances strategic tax planning and compliance in property acquisitions.

Common Mistakes When Handling Car Taxes

Common mistakes when handling car taxes include confusing registration tax with transfer tax, leading to incorrect payment amounts and delays. Registration tax is typically levied based on vehicle specifications and must be paid by the new owner before driving, whereas transfer tax is a one-time fee on the change of ownership, often calculated as a percentage of the vehicle's value. Failing to recognize these differences causes tax filing errors, penalties, and legal complications during vehicle transactions.

Tips for Minimizing Car Registration and Transfer Costs

Maximize savings on car registration and transfer taxes by thoroughly researching state-specific tax rates and deadlines to avoid penalties and surcharges. Utilize available tax credits or exemptions, such as electric vehicle incentives or trade-in deductions, to significantly reduce payable amounts. Maintain detailed records of vehicle history and purchase agreements to ensure accurate tax assessments and negotiate potential reductions during transfers.

Registration Tax vs Transfer Tax Infographic

cardiffo.com

cardiffo.com