First-year road tax is typically higher than annual road tax because it often includes additional environmental or registration fees aimed at new vehicles. Annual road tax, on the other hand, is a recurring cost that reflects the vehicle's emissions, engine size, or weight, and varies depending on local regulations. Understanding the differences between these two taxes helps vehicle owners budget accurately and comply with legal requirements.

Table of Comparison

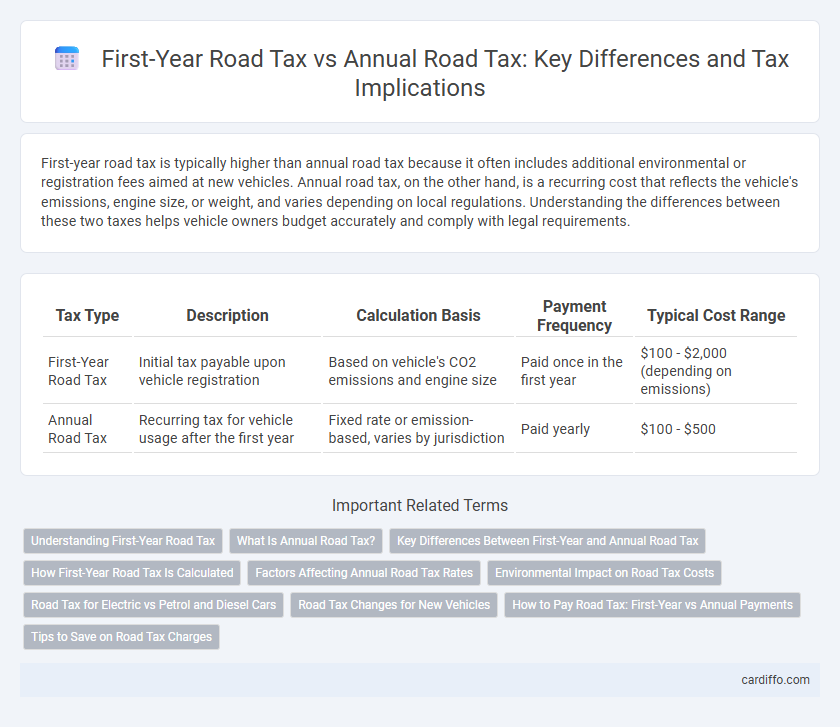

| Tax Type | Description | Calculation Basis | Payment Frequency | Typical Cost Range |

|---|---|---|---|---|

| First-Year Road Tax | Initial tax payable upon vehicle registration | Based on vehicle's CO2 emissions and engine size | Paid once in the first year | $100 - $2,000 (depending on emissions) |

| Annual Road Tax | Recurring tax for vehicle usage after the first year | Fixed rate or emission-based, varies by jurisdiction | Paid yearly | $100 - $500 |

Understanding First-Year Road Tax

First-year road tax is typically higher than the annual road tax because it includes an additional fee based on factors such as a vehicle's CO2 emissions and engine size, designed to encourage environmentally friendly choices. Unlike the regular annual road tax, which remains consistent year over year, the first-year road tax varies significantly depending on the vehicle's emission rating and registration details. Understanding the calculation and purpose of first-year road tax helps vehicle owners anticipate their initial costs and plan for ongoing tax expenses.

What Is Annual Road Tax?

Annual road tax is a mandatory fee imposed by government authorities on vehicle owners for using public roads, supporting infrastructure maintenance and development. This tax is typically calculated based on factors such as vehicle type, engine size, fuel type, and emissions, ensuring a fair contribution to road upkeep. Unlike the first-year road tax, which may be higher or calculated differently due to new vehicle registration fees or emissions standards, the annual road tax is a recurring charge applied every subsequent year.

Key Differences Between First-Year and Annual Road Tax

First-year road tax typically includes higher rates or additional surcharges due to initial vehicle registration fees, whereas annual road tax is a standardized recurring charge based on vehicle emissions or engine size. The key difference lies in the first-year tax often reflecting extra administrative costs and environmental levies not applied in subsequent years. Understanding these distinctions helps vehicle owners accurately budget for ongoing tax obligations related to road usage.

How First-Year Road Tax Is Calculated

First-year road tax is calculated based on the vehicle's CO2 emissions, engine size, and fuel type, making it typically higher than the standard annual road tax. Manufacturers provide emissions data used by tax authorities to determine specific rates under the Vehicle Excise Duty (VED) system. This method incentivizes the purchase of low-emission vehicles by imposing higher initial costs on those with greater environmental impact.

Factors Affecting Annual Road Tax Rates

Annual road tax rates are influenced by vehicle-specific factors such as engine size, emissions levels, and vehicle weight, reflecting environmental policies and road usage impact. Changes in government regulations and updates to emission standards can cause fluctuations in these rates each year. The first-year road tax is typically higher due to initial registration fees and stricter emissions assessments targeting newer vehicles.

Environmental Impact on Road Tax Costs

First-year road tax often reflects higher rates due to stricter emissions criteria targeting new vehicles with larger environmental impacts, while annual road tax typically adjusts based on ongoing emissions performance and vehicle age. Low-emission and electric vehicles frequently benefit from reduced rates or exemptions in both first-year and annual road tax categories, encouraging eco-friendly transportation choices. Governments use these differentiated tax structures to incentivize the adoption of cleaner technologies and reduce overall carbon footprints from road transport.

Road Tax for Electric vs Petrol and Diesel Cars

First-year road tax on petrol and diesel cars is typically higher due to emissions-based pricing, while electric vehicles (EVs) benefit from lower or zero rates as governments promote green transportation. Annual road tax for petrol and diesel cars reflects ongoing CO2 emissions, leading to fluctuating costs based on vehicle efficiency and emission standards. Electric cars incur minimal or no annual road tax, reinforcing their cost-effectiveness and environmental advantages over traditional combustion engines.

Road Tax Changes for New Vehicles

First-year road tax rates for new vehicles are often higher due to emissions-based pricing designed to encourage eco-friendly choices, whereas annual road tax tends to stabilize based on the vehicle's registered emissions class. Changes in road tax rules emphasize reducing carbon footprints by increasing levies on high-emission vehicles during their initial registration year. Government policies frequently update first-year road tax bands, reflecting stricter environmental standards, while subsequent annual road tax charges often remain consistent unless the vehicle's status or emissions profile changes.

How to Pay Road Tax: First-Year vs Annual Payments

Paying road tax for the first year often requires a one-time lump sum covering 12 months from the vehicle registration date, with rates based on vehicle type, emissions, and engine size. Annual road tax payments thereafter are typically renewed on the vehicle's registration anniversary, allowing for monthly, quarterly, or yearly payment options depending on local regulations. Online portals and direct debit systems streamline both first-year and subsequent annual payments, ensuring compliance and avoiding penalties.

Tips to Save on Road Tax Charges

First-year road tax is often higher due to initial registration fees, while annual road tax typically reflects the vehicle's CO2 emissions and engine size. To save on road tax charges, consider choosing vehicles with lower emissions or electric options that may qualify for exemptions or reduced rates. Regularly check for government incentives and discounts, such as low-emission vehicle rebates or updated tax bands, to maximize savings.

First-year road tax vs annual road tax Infographic

cardiffo.com

cardiffo.com