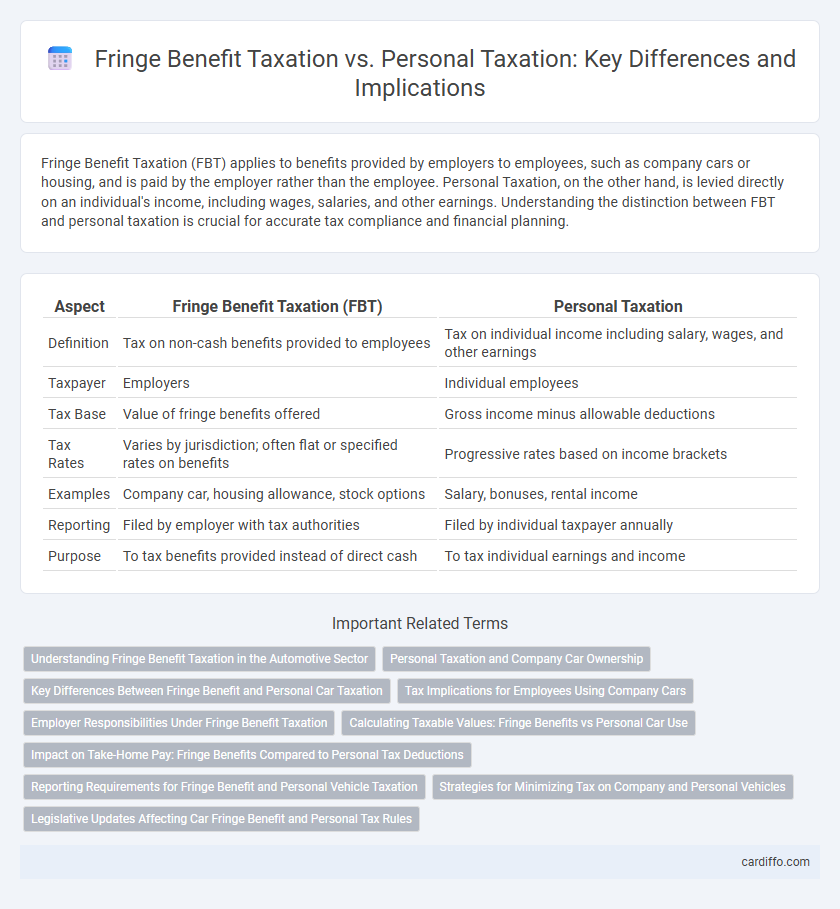

Fringe Benefit Taxation (FBT) applies to benefits provided by employers to employees, such as company cars or housing, and is paid by the employer rather than the employee. Personal Taxation, on the other hand, is levied directly on an individual's income, including wages, salaries, and other earnings. Understanding the distinction between FBT and personal taxation is crucial for accurate tax compliance and financial planning.

Table of Comparison

| Aspect | Fringe Benefit Taxation (FBT) | Personal Taxation |

|---|---|---|

| Definition | Tax on non-cash benefits provided to employees | Tax on individual income including salary, wages, and other earnings |

| Taxpayer | Employers | Individual employees |

| Tax Base | Value of fringe benefits offered | Gross income minus allowable deductions |

| Tax Rates | Varies by jurisdiction; often flat or specified rates on benefits | Progressive rates based on income brackets |

| Examples | Company car, housing allowance, stock options | Salary, bonuses, rental income |

| Reporting | Filed by employer with tax authorities | Filed by individual taxpayer annually |

| Purpose | To tax benefits provided instead of direct cash | To tax individual earnings and income |

Understanding Fringe Benefit Taxation in the Automotive Sector

Fringe Benefit Taxation in the automotive sector targets non-cash benefits provided by employers, such as company cars, fuel allowances, and vehicle maintenance services, which are considered taxable perks under specific regulatory frameworks. This taxation separates these benefits from personal income, ensuring that the value of automotive fringe benefits is correctly assessed and taxed to prevent underreporting of employee compensation. Understanding the thresholds, valuation methods, and exemptions applicable to automotive fringe benefits is crucial for compliance and accurate tax reporting in this industry.

Personal Taxation and Company Car Ownership

Personal taxation on company car ownership involves including the taxable value of the car as a fringe benefit in the employee's income. The valuation typically depends on factors such as the vehicle's list price, annual kilometrage, and private use percentage. Accurate reporting ensures compliance with tax regulations and proper calculation of individual income tax liability.

Key Differences Between Fringe Benefit and Personal Car Taxation

Fringe Benefit Taxation (FBT) applies to benefits provided by employers, such as company cars, and is calculated on the taxable value of the benefit rather than personal income. Personal Car Taxation, however, is based on individual use and ownership, typically involving deductions or reimbursements related to business use of a personally owned vehicle. Key differences include the payer identity--employer for FBT versus employee for personal tax--and the method of valuation, with FBT focusing on the benefit's value and personal tax emphasizing actual expenses or mileage claims.

Tax Implications for Employees Using Company Cars

Employees using company cars face distinct tax implications under fringe benefit taxation compared to personal taxation. Fringe Benefit Tax (FBT) requires employers to pay tax on the value of the car benefit, which can increase the employee's taxable income, leading to higher personal tax liabilities. The valuation methods, such as statutory formula or operating cost methods, directly impact the taxable benefit amount reported by employees.

Employer Responsibilities Under Fringe Benefit Taxation

Employer responsibilities under fringe benefit taxation include accurately identifying and valuing all fringe benefits provided to employees according to regulatory guidelines. Employers must report these benefits in tax filings and ensure timely payment of the fringe benefit tax to avoid penalties. Maintaining detailed records and compliance with local tax authorities is essential for managing liability under fringe benefit tax regimes.

Calculating Taxable Values: Fringe Benefits vs Personal Car Use

Calculating taxable values for fringe benefits involves assessing the statutory formula or operating cost methods to determine the taxable value of personal car use provided by an employer. Personal taxation of car use requires evaluating actual reimbursements or declared benefits in kind, ensuring accurate income reporting and compliance with tax regulations. Understanding the differences in valuation techniques is essential for correct fringe benefit tax (FBT) obligations and personal income tax computations.

Impact on Take-Home Pay: Fringe Benefits Compared to Personal Tax Deductions

Fringe benefit taxation directly reduces an employee's net income by increasing taxable income through the value of non-cash benefits such as company cars or housing, whereas personal tax deductions lower taxable income by subtracting eligible expenses like mortgage interest or charitable donations. The inclusion of fringe benefits in taxable income often results in a higher marginal tax rate applied to the total earnings, effectively diminishing take-home pay more significantly than equivalent personal tax deductions. Understanding the differential impact on disposable income is crucial for optimizing compensation packages and personal tax planning.

Reporting Requirements for Fringe Benefit and Personal Vehicle Taxation

Fringe Benefit Taxation requires detailed reporting of non-cash benefits provided by employers, including the use of personal vehicles, with specific valuation methods outlined by tax authorities. Personal Taxation mandates individuals report any vehicle-related benefits or expenses, ensuring proper documentation of business and private use proportions. Accurate records and compliance with reporting guidelines are essential to avoid penalties and maintain transparency in both Fringe Benefit and Personal Vehicle Taxation.

Strategies for Minimizing Tax on Company and Personal Vehicles

Employing tax-efficient methods such as accurately valuing fringe benefits and leveraging exempt thresholds can significantly reduce Fringe Benefit Tax (FBT) liabilities on company vehicles. Personal vehicle usage records and logbooks help differentiate between business and private kilometers, optimizing claims under personal taxation. Structuring vehicle ownership and usage agreements strategically aligns tax obligations, minimizing overall tax burdens on both company and personal vehicles.

Legislative Updates Affecting Car Fringe Benefit and Personal Tax Rules

Recent legislative updates have refined the calculation methods for car fringe benefits, emphasizing stricter valuation rules and updated statutory formulas that impact taxable values. Changes in personal tax regulations now clarify the interaction between fringe benefits and individual income thresholds, aiming to prevent double taxation on non-cash benefits. Taxpayers must comply with revised reporting requirements to accurately reflect car fringe benefits on personal tax returns, ensuring adherence to new compliance standards set forth by tax authorities.

Fringe Benefit Taxation vs Personal Taxation Infographic

cardiffo.com

cardiffo.com