WLTP emissions testing provides a more accurate representation of real-world driving conditions compared to the outdated NEDC method, which often underestimated vehicle emissions. Tax policies now increasingly rely on WLTP data to determine vehicle taxation based on actual CO2 output, promoting fairer tax brackets and encouraging consumers to choose lower-emission vehicles. Transitioning to WLTP standards ensures precise emission measurements that better support environmental goals and tax regulations.

Table of Comparison

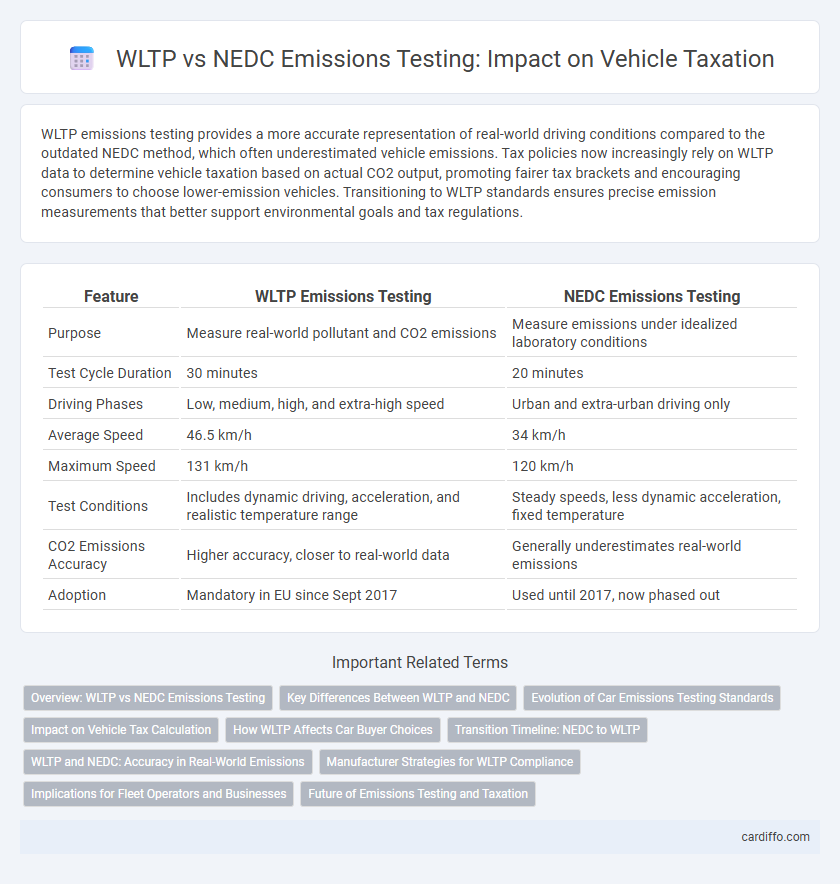

| Feature | WLTP Emissions Testing | NEDC Emissions Testing |

|---|---|---|

| Purpose | Measure real-world pollutant and CO2 emissions | Measure emissions under idealized laboratory conditions |

| Test Cycle Duration | 30 minutes | 20 minutes |

| Driving Phases | Low, medium, high, and extra-high speed | Urban and extra-urban driving only |

| Average Speed | 46.5 km/h | 34 km/h |

| Maximum Speed | 131 km/h | 120 km/h |

| Test Conditions | Includes dynamic driving, acceleration, and realistic temperature range | Steady speeds, less dynamic acceleration, fixed temperature |

| CO2 Emissions Accuracy | Higher accuracy, closer to real-world data | Generally underestimates real-world emissions |

| Adoption | Mandatory in EU since Sept 2017 | Used until 2017, now phased out |

Overview: WLTP vs NEDC Emissions Testing

WLTP (Worldwide Harmonized Light Vehicles Test Procedure) offers a more accurate and comprehensive assessment of vehicle emissions compared to the older NEDC (New European Driving Cycle) standard, reflecting real-world driving conditions with variable speeds, acceleration, and road types. NEDC primarily focused on low-speed, steady-state driving, often underestimating emissions and fuel consumption, leading to discrepancies between laboratory results and actual on-road performance. The transition to WLTP enhances regulatory compliance and tax calculations by providing reliable data for CO2 emissions and pollutant measurements.

Key Differences Between WLTP and NEDC

WLTP (Worldwide Harmonized Light Vehicles Test Procedure) provides more accurate and realistic fuel consumption and CO2 emissions data by simulating real driving conditions compared to the outdated NEDC (New European Driving Cycle). WLTP incorporates varied driving speeds, acceleration patterns, and road types, whereas NEDC relies on standardized, less dynamic testing cycles that often underestimate emissions. These improvements in WLTP directly impact vehicle taxation by enabling more precise calculation of taxes based on actual environmental impact.

Evolution of Car Emissions Testing Standards

The evolution of car emissions testing standards has transitioned from the outdated NEDC (New European Driving Cycle) to the more accurate WLTP (Worldwide Harmonized Light Vehicles Test Procedure). WLTP provides a closer representation of real-world driving conditions by incorporating varied speed, acceleration, and driving patterns, resulting in more precise CO2 and pollutant emission measurements. This shift supports stricter regulatory compliance and more effective taxation policies based on actual vehicle environmental impact.

Impact on Vehicle Tax Calculation

WLTP emissions testing provides more accurate and realistic data by measuring vehicles under varied driving conditions, leading to higher reported CO2 emissions compared to the older NEDC standard. This increase in reported emissions directly impacts vehicle tax calculations, often resulting in higher tax liabilities for car owners due to stricter CO2 thresholds. Governments rely on WLTP data to better align tax rates with actual environmental impact, promoting cleaner vehicle choices and reducing overall carbon emissions.

How WLTP Affects Car Buyer Choices

WLTP emissions testing provides more accurate and real-world data compared to the outdated NEDC, leading to increased transparency for car buyers regarding fuel efficiency and CO2 emissions. This shift influences consumer decisions by highlighting the true environmental impact and potential tax liabilities associated with different vehicles. As a result, buyers tend to prioritize models with lower WLTP-rated emissions to optimize tax benefits and reduce overall ownership costs.

Transition Timeline: NEDC to WLTP

The transition from NEDC to WLTP emissions testing began in September 2017 for new vehicle type approvals in the European Union, with full implementation required by September 2018. WLTP provides more accurate and realistic emissions data by incorporating dynamic driving conditions, replacing the outdated NEDC standard. This shift impacts tax calculations, as WLTP-based figures often lead to revised vehicle taxation rates based on real-world CO2 emissions.

WLTP and NEDC: Accuracy in Real-World Emissions

WLTP (Worldwide Harmonized Light Vehicles Test Procedure) offers significantly improved accuracy in real-world emissions testing compared to the older NEDC (New European Driving Cycle) method by incorporating varied driving conditions, speeds, and durations that better reflect actual road use. Unlike NEDC, which often underestimates emissions due to its outdated and overly simplistic driving cycle, WLTP measures pollutants like CO2, NOx, and particulates more precisely, leading to more reliable tax assessments based on vehicle emissions. Governments and regulatory bodies increasingly favor WLTP data for taxation purposes because it aligns closer with environmental impacts, promoting fairer vehicle tax policies and incentivizing lower-emission vehicles.

Manufacturer Strategies for WLTP Compliance

Manufacturers implement advanced calibration techniques and enhance engine management systems to meet stringent WLTP emissions testing standards, ensuring accurate real-world CO2 and NOx emissions reporting. Strategic shifts include optimizing fuel injection timing, integrating improved after-treatment technologies, and adopting hybrid powertrains to reduce overall emissions. Investment in comprehensive data analytics and simulation tools enables precise compliance with WLTP regulations while maintaining vehicle performance and market competitiveness.

Implications for Fleet Operators and Businesses

WLTP emissions testing provides more accurate and real-world CO2 emission data compared to the outdated NEDC standard, influencing tax liabilities and compliance costs for fleet operators. Businesses face higher tax rates and stricter regulatory requirements under WLTP due to its realistic measurement of fuel consumption and pollutant levels. Adopting WLTP-compliant vehicles helps fleet operators optimize tax efficiency and reduce potential penalties linked to emissions-related regulations.

Future of Emissions Testing and Taxation

The future of emissions testing and taxation will increasingly rely on the Worldwide Harmonized Light Vehicles Test Procedure (WLTP) due to its more accurate and real-world driving cycle measurements compared to the New European Driving Cycle (NEDC). Tax systems are expected to evolve by incorporating WLTP data to better reflect actual vehicle emissions, promoting fairer environmental taxation and incentivizing low-emission vehicle adoption. Governments will leverage WLTP's detailed emission outputs to refine vehicle tax brackets, support carbon reduction goals, and align with stricter future climate policies.

WLTP Emissions Testing vs NEDC Emissions Testing Infographic

cardiffo.com

cardiffo.com