Blocked VAT refers to value-added tax expenses that cannot be reclaimed or deducted from tax liabilities, often due to restrictions on certain goods, services, or jurisdictions. Recoverable VAT is the portion of VAT paid on business-related purchases that can be reclaimed from tax authorities, effectively reducing the net tax burden. Understanding the distinction between blocked and recoverable VAT is essential for accurate tax reporting and optimizing cash flow management.

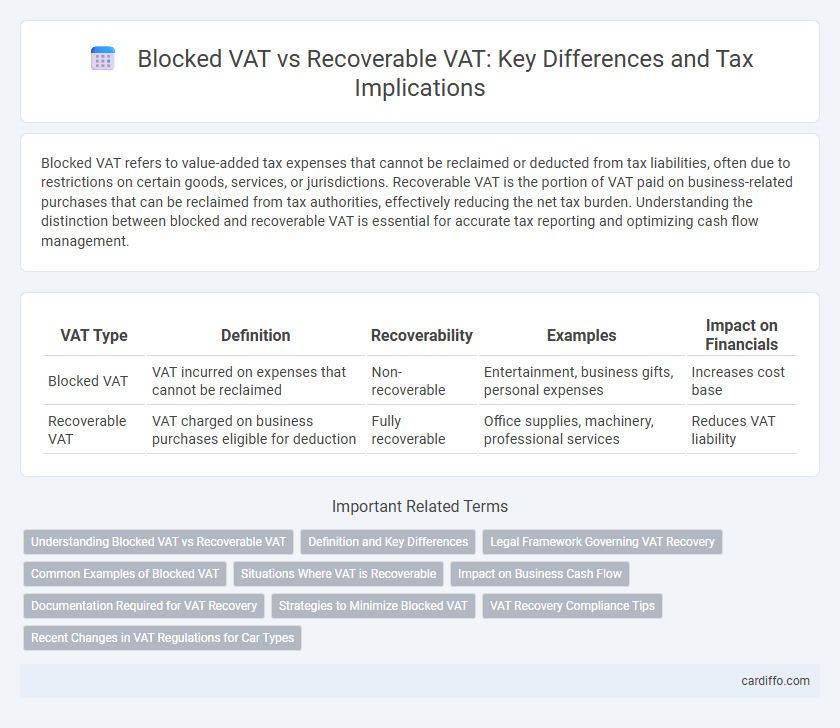

Table of Comparison

| VAT Type | Definition | Recoverability | Examples | Impact on Financials |

|---|---|---|---|---|

| Blocked VAT | VAT incurred on expenses that cannot be reclaimed | Non-recoverable | Entertainment, business gifts, personal expenses | Increases cost base |

| Recoverable VAT | VAT charged on business purchases eligible for deduction | Fully recoverable | Office supplies, machinery, professional services | Reduces VAT liability |

Understanding Blocked VAT vs Recoverable VAT

Blocked VAT refers to input VAT that businesses cannot reclaim due to specific legal restrictions or non-deductible expenses, impacting cash flow and tax planning. Recoverable VAT is the VAT paid on purchases that businesses are entitled to reclaim from tax authorities, effectively reducing the overall VAT cost on taxable goods and services. Accurate identification between blocked and recoverable VAT ensures compliance with tax regulations and maximizes VAT recovery potential.

Definition and Key Differences

Blocked VAT refers to value-added tax expenses that businesses cannot reclaim from tax authorities, often due to restrictions on certain goods or services like entertainment or luxury items. Recoverable VAT, on the other hand, is VAT paid on business-related purchases that companies are entitled to deduct from their VAT liability, reducing overall tax payable. Key differences include the eligibility for recovery, with blocked VAT being non-deductible and recoverable VAT directly impacting a company's tax reclaim and cash flow management.

Legal Framework Governing VAT Recovery

The legal framework governing VAT recovery establishes clear criteria for distinguishing blocked VAT from recoverable VAT, primarily based on the nature of goods and services and their intended use in taxable business activities. Tax regulations stipulate specific conditions under which VAT incurred on expenses is recoverable, with blocked VAT referring to input VAT that is non-deductible due to statutory exclusions or use in exempt transactions. Compliance with these legal provisions ensures accurate VAT accounting, preventing erroneous claims and aligning with jurisdictional tax authority guidelines.

Common Examples of Blocked VAT

Blocked VAT refers to input VAT that businesses cannot reclaim, commonly arising from expenses related to entertainment, passenger vehicles, or non-business activities. Recoverable VAT, in contrast, applies to VAT paid on goods and services used solely for taxable business operations. Examples of blocked VAT include costs associated with business meals, fines or penalties, and personal expenses disguised as business costs.

Situations Where VAT is Recoverable

Recoverable VAT applies when a business purchases goods or services used exclusively for taxable activities, allowing VAT paid to be reclaimed through tax returns. VAT becomes recoverable in cases such as acquiring office supplies, machinery used in production, or professional services directly related to the company's taxable sales. Proper documentation like valid invoices and adherence to local tax regulations is essential to ensure VAT recovery eligibility.

Impact on Business Cash Flow

Blocked VAT represents input VAT that businesses cannot reclaim from tax authorities, directly reducing available cash flow by increasing operational costs. Recoverable VAT, however, allows companies to reclaim VAT paid on purchases, enhancing liquidity and improving working capital management. Efficient VAT recovery strategies optimize cash flow, thereby supporting better financial planning and investment opportunities.

Documentation Required for VAT Recovery

Accurate documentation is essential for VAT recovery, including valid tax invoices, proof of payment, and evidence of the VAT amount charged. Blocked VAT, often related to non-deductible expenses or specific government restrictions, requires clear records demonstrating the nature of the transaction and its exclusion from recoverable VAT. Maintaining comprehensive documentation ensures compliance with tax authorities and streamlines the audit process for both recoverable and blocked VAT claims.

Strategies to Minimize Blocked VAT

Implementing precise invoice management and maintaining thorough documentation ensures VAT incurred on business expenses remains recoverable, reducing blocked VAT exposure. Structuring transactions to maximize input VAT claims through correct classification of goods and services mitigates blocked VAT risks. Leveraging VAT grouping and cross-border VAT recovery schemes enhances cash flow by minimizing irrecoverable VAT amounts.

VAT Recovery Compliance Tips

Blocked VAT refers to VAT expenses that cannot be reclaimed due to specific tax regulations or restrictions, while recoverable VAT is VAT that businesses are legally entitled to recover on eligible purchases. Ensuring proper documentation, accurate categorization of expenses, and regular review of tax laws is critical for maintaining VAT recovery compliance and preventing blocked VAT from eroding cash flow. Implementing automated VAT tracking systems and conducting periodic VAT audits can significantly improve accuracy and maximize VAT recovery potential.

Recent Changes in VAT Regulations for Car Types

Recent changes in VAT regulations have introduced stricter criteria for distinguishing between blocked VAT and recoverable VAT on different car types, particularly targeting luxury and passenger vehicles. Businesses must now carefully assess the VAT treatment based on vehicle classification, usage, and CO2 emissions to determine recoverability, as non-compliant claims can lead to significant penalties. Updated guidance from tax authorities emphasizes documentation requirements and specific thresholds affecting blocked VAT claims for mixed-use vehicles.

Blocked VAT vs Recoverable VAT Infographic

cardiffo.com

cardiffo.com