CO2 emissions tax targets the environmental impact of vehicles by charging based on the amount of carbon dioxide emitted, encouraging greener, low-emission cars. Engine size tax is calculated on the vehicle's engine displacement, which often correlates with fuel consumption and performance but does not directly reflect actual emissions. Choosing a CO2 emissions tax better promotes sustainability by incentivizing consumers to reduce their carbon footprint rather than simply penalizing larger engines.

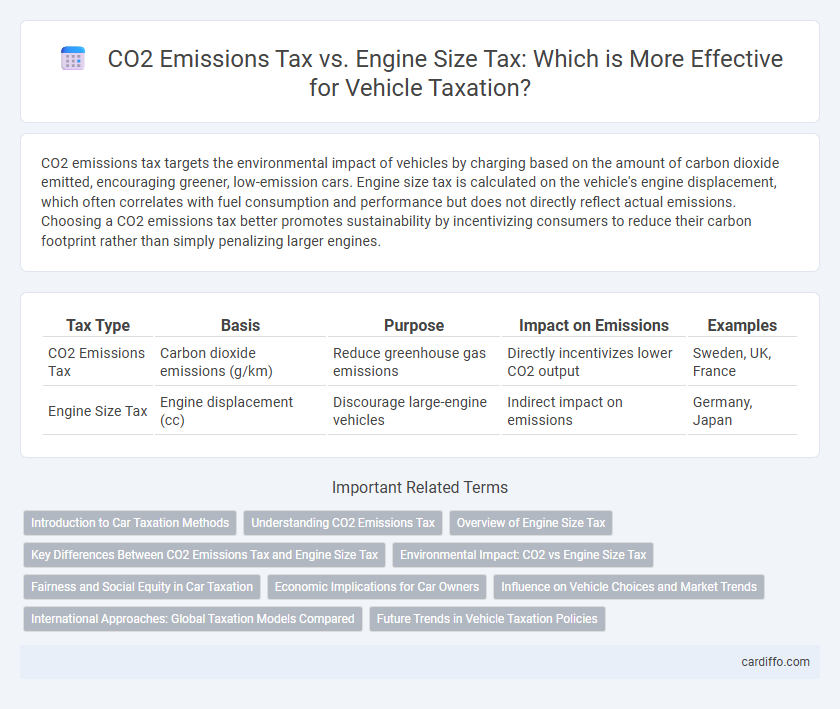

Table of Comparison

| Tax Type | Basis | Purpose | Impact on Emissions | Examples |

|---|---|---|---|---|

| CO2 Emissions Tax | Carbon dioxide emissions (g/km) | Reduce greenhouse gas emissions | Directly incentivizes lower CO2 output | Sweden, UK, France |

| Engine Size Tax | Engine displacement (cc) | Discourage large-engine vehicles | Indirect impact on emissions | Germany, Japan |

Introduction to Car Taxation Methods

Car taxation methods often contrast CO2 emissions tax with engine size tax, reflecting environmental and performance factors. CO2 emissions tax targets the vehicle's environmental impact by charging based on carbon output, encouraging low-emission vehicle adoption. Engine size tax bases fees on displacement volume, historically linked to fuel consumption and power, but less aligned with modern eco-friendly policies.

Understanding CO2 Emissions Tax

CO2 emissions tax directly targets the environmental impact of vehicles by charging based on the amount of carbon dioxide emitted per kilometer, promoting eco-friendly driving choices. This tax system incentivizes manufacturers to produce low-emission engines and encourages consumers to select vehicles with better fuel efficiency and lower greenhouse gas output. Unlike engine size tax, which is based solely on the physical capacity of the engine, CO2 emissions tax more effectively aligns vehicle taxation with environmental sustainability goals.

Overview of Engine Size Tax

Engine size tax is a vehicle taxation method based on the cubic capacity of the engine, typically measured in liters or cubic centimeters (cc), directly influencing annual road tax rates. Larger engine displacement usually results in higher tax rates, incentivizing consumers to opt for smaller, more fuel-efficient vehicles. This tax approach contrasts with CO2 emissions tax, which targets environmental impact by levying fees according to the vehicle's carbon dioxide emissions per kilometer.

Key Differences Between CO2 Emissions Tax and Engine Size Tax

CO2 emissions tax is calculated based on the amount of carbon dioxide a vehicle emits, encouraging the use of environmentally friendly and fuel-efficient cars. In contrast, engine size tax is determined by the engine's displacement volume, often measured in cubic centimeters (cc), which does not directly account for environmental impact. The CO2 emissions tax targets reducing greenhouse gases, while the engine size tax primarily serves as a proxy for vehicle power and fuel consumption.

Environmental Impact: CO2 vs Engine Size Tax

CO2 emissions tax directly targets the carbon footprint of vehicles by charging based on the amount of carbon dioxide emitted, incentivizing the use of cleaner, low-emission technologies and reducing greenhouse gas emissions. Engine size tax, however, is indirectly related to environmental impact, as larger engines typically consume more fuel and emit more CO2, but it does not account for advancements in engine efficiency or alternative fuels. Empirical studies show CO2-based taxation achieves more precise environmental benefits by aligning tax rates with actual emissions, encouraging manufacturers to innovate in fuel efficiency and electric vehicle production.

Fairness and Social Equity in Car Taxation

CO2 emissions tax targets vehicle environmental impact directly, promoting fairness by charging higher emitters more and encouraging cleaner technology adoption. Engine size tax, based on physical attributes, may unfairly penalize smaller vehicles with larger engines or fail to address actual pollution levels, leading to social inequity. Emphasizing CO2 emissions tax supports social equity by aligning taxation with environmental responsibility, benefiting lower-income individuals driving efficient cars.

Economic Implications for Car Owners

CO2 emissions tax incentivizes car owners to choose vehicles with lower environmental impact by directly linking tax rates to carbon output, potentially reducing long-term fuel costs and encouraging sustainable choices. Engine size tax primarily targets the physical displacement of the engine, which may not accurately reflect real-world emissions, potentially leading owners of larger yet efficient engines to face higher costs. This divergence influences economic decision-making by affecting vehicle affordability, resale value, and overall ownership expenses.

Influence on Vehicle Choices and Market Trends

CO2 emissions tax directly incentivizes consumers and manufacturers to prioritize low-emission vehicles, accelerating the shift towards electric and hybrid models in the automotive market. Engine size tax primarily targets larger, less fuel-efficient engines, which can discourage sales of high-displacement vehicles but may not effectively promote cleaner technologies. The market trend shows stronger consumer responsiveness to CO2 emissions tax as it aligns with growing environmental regulations and sustainability goals, driving innovation in green vehicle technologies.

International Approaches: Global Taxation Models Compared

International approaches to CO2 emissions tax emphasize environmental impact by directly charging based on carbon output measured in grams per kilometer, promoting cleaner vehicle technologies worldwide. Engine size tax models, commonly used in countries like the UK and Japan, levy fees based on engine displacement in cubic centimeters, indirectly targeting fuel efficiency but often overlooking actual emissions. Comparative studies reveal CO2 emissions taxes align more closely with global climate goals, offering a more precise incentive for reducing greenhouse gas emissions across diverse automotive markets.

Future Trends in Vehicle Taxation Policies

Future vehicle taxation policies increasingly prioritize CO2 emissions tax over engine size tax to effectively address climate change goals and reduce carbon footprints. Governments aim to incentivize low-emission and electric vehicles by setting higher tax rates on vehicles with greater CO2 output rather than solely on engine displacement. This shift aligns with international commitments to carbon neutrality and encourages innovation in sustainable automotive technologies.

CO2 emissions tax vs engine size tax Infographic

cardiffo.com

cardiffo.com