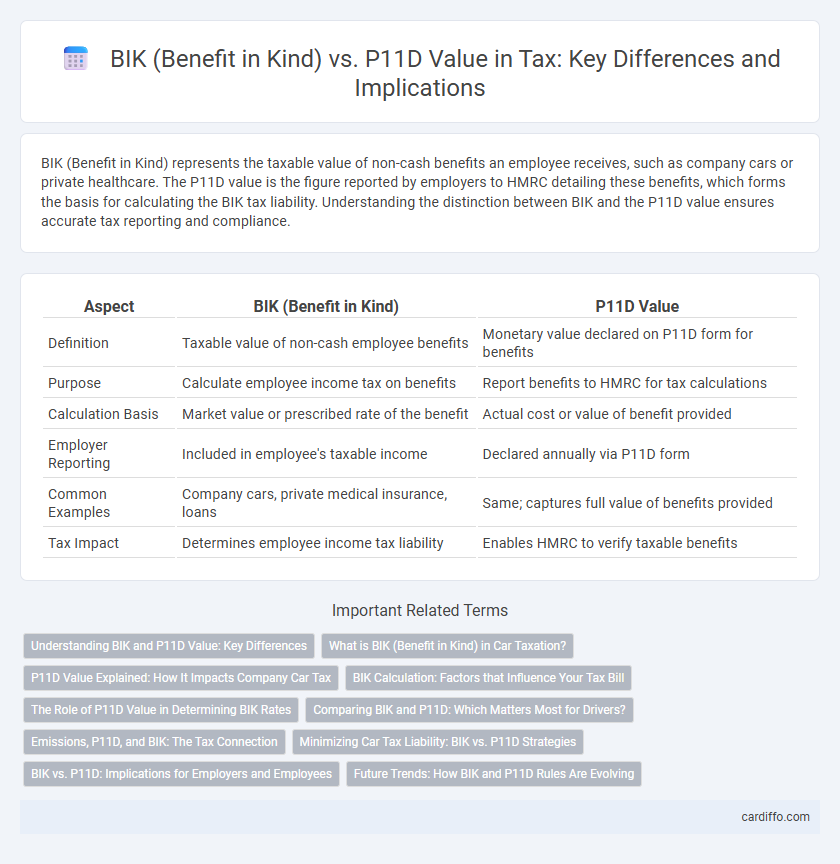

BIK (Benefit in Kind) represents the taxable value of non-cash benefits an employee receives, such as company cars or private healthcare. The P11D value is the figure reported by employers to HMRC detailing these benefits, which forms the basis for calculating the BIK tax liability. Understanding the distinction between BIK and the P11D value ensures accurate tax reporting and compliance.

Table of Comparison

| Aspect | BIK (Benefit in Kind) | P11D Value |

|---|---|---|

| Definition | Taxable value of non-cash employee benefits | Monetary value declared on P11D form for benefits |

| Purpose | Calculate employee income tax on benefits | Report benefits to HMRC for tax calculations |

| Calculation Basis | Market value or prescribed rate of the benefit | Actual cost or value of benefit provided |

| Employer Reporting | Included in employee's taxable income | Declared annually via P11D form |

| Common Examples | Company cars, private medical insurance, loans | Same; captures full value of benefits provided |

| Tax Impact | Determines employee income tax liability | Enables HMRC to verify taxable benefits |

Understanding BIK and P11D Value: Key Differences

BIK (Benefit in Kind) represents the taxable value of non-cash benefits provided to employees, such as company cars or private health insurance, while the P11D value is the official cost reported to HMRC on the P11D form. The P11D value often reflects the supplier's list price or market value used for calculating the BIK taxable amount but may exclude certain adjustments like employee contributions. Understanding the distinction ensures accurate tax calculations and compliance with HMRC regulations.

What is BIK (Benefit in Kind) in Car Taxation?

BIK (Benefit in Kind) in car taxation refers to a non-cash taxable benefit provided by employers to employees, such as company cars, which is subject to income tax. The P11D value represents the taxable cash equivalent of this benefit and is used to calculate the employee's tax liability. Understanding the distinction between BIK and the P11D value ensures accurate reporting and compliance with HMRC regulations.

P11D Value Explained: How It Impacts Company Car Tax

P11D Value refers to the list price of a company car including VAT, delivery charges, and optional extras, which forms the basis for calculating Benefit in Kind (BIK) tax liability. The BIK rate applied to the P11D Value determines the taxable benefit that employees must report, directly influencing the amount of company car tax payable. Accurate understanding of P11D valuations is crucial for both employers and employees to ensure correct tax compliance and avoid penalties.

BIK Calculation: Factors that Influence Your Tax Bill

BIK calculation is primarily influenced by the vehicle's list price, CO2 emissions, and fuel type, which determine the percentage rate applied to the P11D value for taxable benefit. Higher CO2 emissions result in increased BIK rates, significantly impacting the overall tax liability for company car users. Adjustments for optional extras and company contributions can further modify the taxable benefit, making accurate valuation essential for precise tax planning.

The Role of P11D Value in Determining BIK Rates

P11D value plays a crucial role in determining Benefit in Kind (BIK) rates by representing the taxable value of company-provided assets or benefits. It serves as the baseline for calculating the BIK charge, reflecting the market value of items such as company cars, private medical insurance, or other perks. Accurate P11D valuations ensure employees and employers correctly assess tax liabilities and comply with HMRC regulations.

Comparing BIK and P11D: Which Matters Most for Drivers?

BIK (Benefit in Kind) reflects the taxable value of non-cash benefits such as company cars, directly impacting the employee's tax liability, while the P11D value represents the car's list price used by HMRC to calculate BIK rates. Drivers should prioritize understanding the BIK rate, as it determines the actual tax payable based on factors like CO2 emissions and fuel type, whereas the P11D value serves as the baseline for this calculation. Comparing BIK and P11D values helps employees anticipate their tax responsibilities, making BIK the crucial figure for accurate tax planning and budgeting.

Emissions, P11D, and BIK: The Tax Connection

BIK (Benefit in Kind) tax liability heavily depends on a vehicle's CO2 emissions, with lower emissions resulting in reduced BIK rates. The P11D value reflects the car's list price including accessories and VAT, directly influencing the taxable BIK amount. Understanding the interplay between P11D value and emissions is crucial for accurately calculating tax obligations on company cars.

Minimizing Car Tax Liability: BIK vs. P11D Strategies

Minimizing car tax liability involves understanding the difference between Benefit in Kind (BIK) rates and P11D values, where BIK represents the taxable benefit calculated on the vehicle's CO2 emissions and list price, while the P11D value is the vehicle's list price including extras but excluding the first year's registration fee and road tax. Choosing low-emission vehicles reduces the BIK rate, directly lowering taxable benefits and tax payable. Employers and employees can optimize car benefit reporting by accurately assessing P11D values and leveraging company car tax bands to minimize overall tax liability.

BIK vs. P11D: Implications for Employers and Employees

BIK (Benefit in Kind) represents the taxable value of non-cash benefits provided to employees, directly impacting their personal tax liabilities based on the assessed monetary value of these perks. The P11D value is the reported figure employers submit to HMRC, detailing the benefits and expenses paid on behalf of employees, crucial for accurate tax calculations and National Insurance contributions. Employers must carefully manage BIK valuations and P11D disclosures to ensure compliance, avoid penalties, and maintain transparent employee benefit records, influencing both organizational tax responsibilities and employee take-home pay.

Future Trends: How BIK and P11D Rules Are Evolving

Future trends in BIK and P11D rules indicate a shift towards greater digital integration and real-time reporting, enhancing transparency and compliance efficiency. Tax authorities are increasingly leveraging data analytics to more accurately assess benefit valuations, prompting employers to adopt automated payroll systems for BIK management. Legislative updates are expected to refine valuation methods, particularly for emerging benefits like electric vehicles and remote work allowances, reflecting evolving workforce dynamics.

BIK (Benefit in Kind) vs P11D Value Infographic

cardiffo.com

cardiffo.com