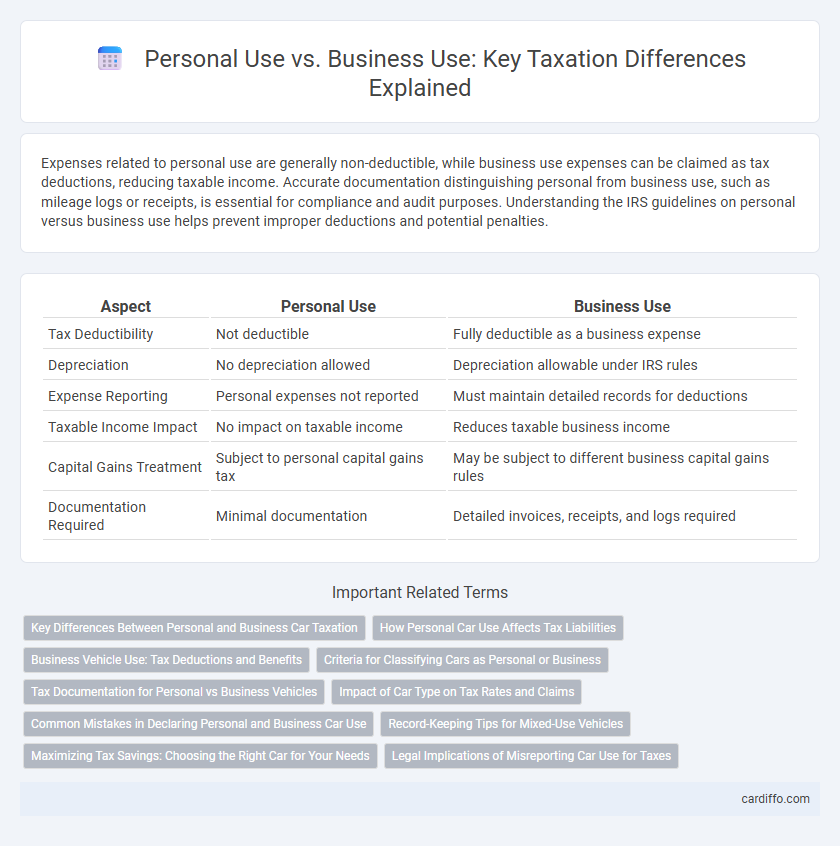

Expenses related to personal use are generally non-deductible, while business use expenses can be claimed as tax deductions, reducing taxable income. Accurate documentation distinguishing personal from business use, such as mileage logs or receipts, is essential for compliance and audit purposes. Understanding the IRS guidelines on personal versus business use helps prevent improper deductions and potential penalties.

Table of Comparison

| Aspect | Personal Use | Business Use |

|---|---|---|

| Tax Deductibility | Not deductible | Fully deductible as a business expense |

| Depreciation | No depreciation allowed | Depreciation allowable under IRS rules |

| Expense Reporting | Personal expenses not reported | Must maintain detailed records for deductions |

| Taxable Income Impact | No impact on taxable income | Reduces taxable business income |

| Capital Gains Treatment | Subject to personal capital gains tax | May be subject to different business capital gains rules |

| Documentation Required | Minimal documentation | Detailed invoices, receipts, and logs required |

Key Differences Between Personal and Business Car Taxation

Personal car use taxation is generally limited to deductible expenses such as mileage at the IRS standard rate or actual expenses documented for business purposes, with strict limitations on personal travel deductions. Business car taxation allows full deduction of expenses including depreciation, fuel, maintenance, insurance, and lease payments proportional to business use percentage. Accurate mileage logs and distinguishing personal versus business miles are critical to comply with IRS regulations and maximize tax benefits.

How Personal Car Use Affects Tax Liabilities

Personal car use directly impacts tax liabilities by reducing the deductible expenses available for business-related vehicle costs, as only the portion of miles driven for business purposes qualifies for tax deductions. The IRS requires detailed records distinguishing personal and business use, influencing the calculation of depreciation, fuel, and maintenance deductions. Misclassifying personal use can lead to increased taxable income and potential penalties during an audit.

Business Vehicle Use: Tax Deductions and Benefits

Business vehicle use qualifies for significant tax deductions, including depreciation, fuel, maintenance, and insurance expenses, which reduce taxable income. The IRS allows taxpayers to choose between the standard mileage rate or actual expense method to calculate deductible costs, ensuring flexibility based on vehicle usage patterns. Proper documentation, such as mileage logs and receipts, is essential to substantiate business use and maximize tax benefits while maintaining compliance.

Criteria for Classifying Cars as Personal or Business

Criteria for classifying cars as personal or business use primarily depend on the proportion of time the vehicle is used for business purposes, typically requiring detailed logbooks or mileage tracking to substantiate claims. Tax authorities often assess factors such as the regularity of use for business activities, parking arrangements, and whether the car's ownership is under a business entity or individual. Accurate classification impacts allowable deductions, depreciation, and potential tax liabilities under regulations set by agencies like the IRS or HMRC.

Tax Documentation for Personal vs Business Vehicles

Accurate tax documentation distinguishes personal from business vehicle use, affecting deductible expenses and tax liability. Business vehicle use requires detailed logs, receipts, and mileage records to validate tax deductions, whereas personal vehicle use typically lacks such documentation and is not deductible. Maintaining separate records ensures compliance with IRS regulations and maximizes allowable business expense claims.

Impact of Car Type on Tax Rates and Claims

Different car types significantly influence tax rates and allowable claims under personal use versus business use categories. Electric and hybrid vehicles often qualify for higher tax credits and lower deductible rates compared to gas-powered cars, impacting overall tax liability. Accurate classification of car use ensures compliance and optimizes tax benefits tied to vehicle type and usage percentage.

Common Mistakes in Declaring Personal and Business Car Use

Many taxpayers mistakenly mix personal and business car expenses, leading to inaccurate tax deductions and potential audits. Common errors include failing to keep detailed mileage logs, over-claiming business use percentages, and using personal vehicles without properly distinguishing expenses. Accurate record-keeping and clear separation of personal versus business use ensure compliance with IRS regulations and maximize legitimate tax benefits.

Record-Keeping Tips for Mixed-Use Vehicles

Maintaining detailed mileage logs separated by personal and business use is essential for accurate tax deductions on mixed-use vehicles. Use digital apps or traditional mileage books to record dates, destinations, and purposes of trips, ensuring compliance with IRS requirements. Retain receipts for fuel, maintenance, and repairs to support claimed business expenses and optimize tax benefits.

Maximizing Tax Savings: Choosing the Right Car for Your Needs

Selecting a vehicle primarily for business use allows for greater tax deductions such as depreciation, mileage, fuel, and maintenance expenses, directly reducing taxable income. Keeping detailed records that clearly separate personal use from business use ensures accurate allocation of expenses and maximizes allowable deductions. Leveraging IRS guidelines on qualifying vehicles and using methods like the standard mileage rate or actual expense method optimizes tax savings by aligning car expenses with legitimate business activities.

Legal Implications of Misreporting Car Use for Taxes

Misreporting car use for tax purposes can lead to severe legal consequences, including penalties, fines, and potential audits by tax authorities such as the IRS. Accurate documentation distinguishing personal use from business use is critical to comply with tax laws and avoid allegations of tax evasion or fraud. The IRS requires detailed mileage logs and proper substantiation to validate business use deductions and ensure lawful tax reporting.

Personal Use vs Business Use Taxation Infographic

cardiffo.com

cardiffo.com