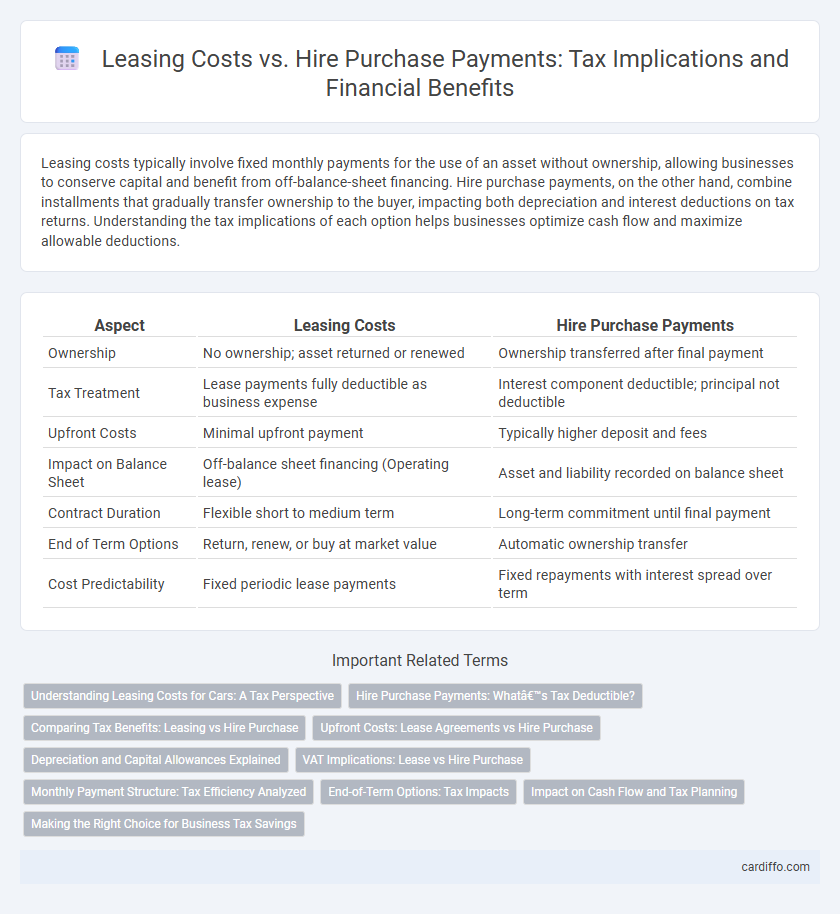

Leasing costs typically involve fixed monthly payments for the use of an asset without ownership, allowing businesses to conserve capital and benefit from off-balance-sheet financing. Hire purchase payments, on the other hand, combine installments that gradually transfer ownership to the buyer, impacting both depreciation and interest deductions on tax returns. Understanding the tax implications of each option helps businesses optimize cash flow and maximize allowable deductions.

Table of Comparison

| Aspect | Leasing Costs | Hire Purchase Payments |

|---|---|---|

| Ownership | No ownership; asset returned or renewed | Ownership transferred after final payment |

| Tax Treatment | Lease payments fully deductible as business expense | Interest component deductible; principal not deductible |

| Upfront Costs | Minimal upfront payment | Typically higher deposit and fees |

| Impact on Balance Sheet | Off-balance sheet financing (Operating lease) | Asset and liability recorded on balance sheet |

| Contract Duration | Flexible short to medium term | Long-term commitment until final payment |

| End of Term Options | Return, renew, or buy at market value | Automatic ownership transfer |

| Cost Predictability | Fixed periodic lease payments | Fixed repayments with interest spread over term |

Understanding Leasing Costs for Cars: A Tax Perspective

Leasing costs for cars are typically treated as allowable expenses for tax purposes, reducing taxable profits when the vehicle is used for business. Lease payments are deducted in the accounting period they relate to, unlike hire purchase payments where only the interest portion is deductible while the capital repayment is considered an asset purchase. Understanding the tax treatment of leasing costs helps businesses optimize cash flow and maximize allowable expense claims under current HMRC guidelines.

Hire Purchase Payments: What’s Tax Deductible?

Hire purchase payments allow businesses to claim tax deductions on the interest portion of each payment, reducing taxable income. The principal repayments are considered capital expenditure and are not tax-deductible but contribute to the asset's depreciation claims. Understanding the distinction between deductible interest and non-deductible capital repayment is essential for optimizing tax benefits under hire purchase agreements.

Comparing Tax Benefits: Leasing vs Hire Purchase

Leasing costs are generally fully deductible as a business expense, reducing taxable income in the year of payment, whereas hire purchase payments combine interest and principal, with only the interest component being tax-deductible. Lease agreements often offer VAT advantages, allowing businesses to reclaim VAT on lease payments, while hire purchase agreements treat VAT as recoverable upfront on the asset purchase. For tax efficiency, leasing provides consistent cash flow benefits through deductible expenses, while hire purchase enables asset ownership with potential capital allowances applied to the asset cost.

Upfront Costs: Lease Agreements vs Hire Purchase

Lease agreements typically require lower upfront costs compared to hire purchase agreements, as leases usually involve an initial deposit or first month's rent rather than a substantial down payment. Hire purchase contracts demand higher initial payments, often including a significant deposit that contributes to ownership acquisition. The difference in upfront costs impacts cash flow management and tax treatment under capital allowances and leasing expense deductions.

Depreciation and Capital Allowances Explained

Leasing costs are typically considered operating expenses and fully deductible against taxable income, while hire purchase payments include both interest and capital portions affecting tax treatment differently. Depreciation on leased assets is not claimed by the lessee, as ownership remains with the lessor, whereas hire purchase allows the purchaser to claim capital allowances based on the asset's depreciation. Capital allowances reduce taxable profits by accounting for the asset's wear and tear, providing tax relief on qualifying expenditure.

VAT Implications: Lease vs Hire Purchase

Leasing costs typically include VAT charged on monthly rental payments, allowing businesses to reclaim VAT if registered, whereas hire purchase payments involve VAT charged upfront on the asset's price, recoverable immediately. VAT on leasing is spread over the contract period, impacting cash flow differently than hire purchase, where VAT is paid and reclaimed promptly. Understanding these distinctions is crucial for tax planning and optimizing VAT recovery in asset acquisition strategies.

Monthly Payment Structure: Tax Efficiency Analyzed

Leasing costs typically offer predictable monthly payments that can be fully deductible as operating expenses, enhancing tax efficiency by reducing taxable income consistently. Hire purchase payments consist of principal and interest components, with only the interest portion usually deductible, impacting cash flow and tax benefits differently. Businesses should analyze monthly payment structures to optimize tax positions, balancing immediate expense recognition against asset ownership advantages.

End-of-Term Options: Tax Impacts

Leasing costs provide tax benefits by allowing businesses to deduct the full rental payments as operating expenses, reducing taxable income throughout the lease term. Hire purchase payments combine interest and capital repayment, where only the interest portion is tax-deductible, impacting cash flow and depreciation claims differently. At the end of the term, leasing offers options like returning or renewing the asset without additional tax liability, while hire purchase leads to ownership with potential capital allowances and differing tax consequences on asset disposal.

Impact on Cash Flow and Tax Planning

Leasing costs provide predictable monthly expenses that improve cash flow management by spreading payments over the asset's useful life, often allowing full deductibility against taxable income. Hire purchase payments typically involve a larger initial outlay or higher early installments, impacting short-term cash flow but enabling ownership and capital allowance claims for tax depreciation. Strategic tax planning considers the timing and deductibility of lease expenses versus interest and capital allowances in hire purchase agreements to optimize overall tax efficiency.

Making the Right Choice for Business Tax Savings

Leasing costs are typically treated as deductible business expenses, allowing for immediate tax relief on payments, while hire purchase payments combine interest and capital repayment, with only the interest portion being tax-deductible. Choosing leasing over hire purchase can enhance cash flow management and optimize tax savings by maximizing deductible expenses within financial reporting periods. An informed decision between leasing and hire purchase requires analyzing the impact on tax deductions, asset ownership, and long-term financial strategy to align with business tax optimization goals.

Leasing Costs vs Hire Purchase Payments Infographic

cardiffo.com

cardiffo.com