Fleet management tax offers businesses streamlined tax benefits by allowing bulk vehicle expense deductions and simplified reporting, contrasting with individual car tax which focuses on personal vehicle ownership and usage. Fleet taxes often include allowances for depreciation, maintenance, and operational costs, providing significant savings compared to individual car tax rates based on vehicle type and emissions. Understanding these differences helps optimize tax liabilities whether managing multiple vehicles for business or a single car for personal use.

Table of Comparison

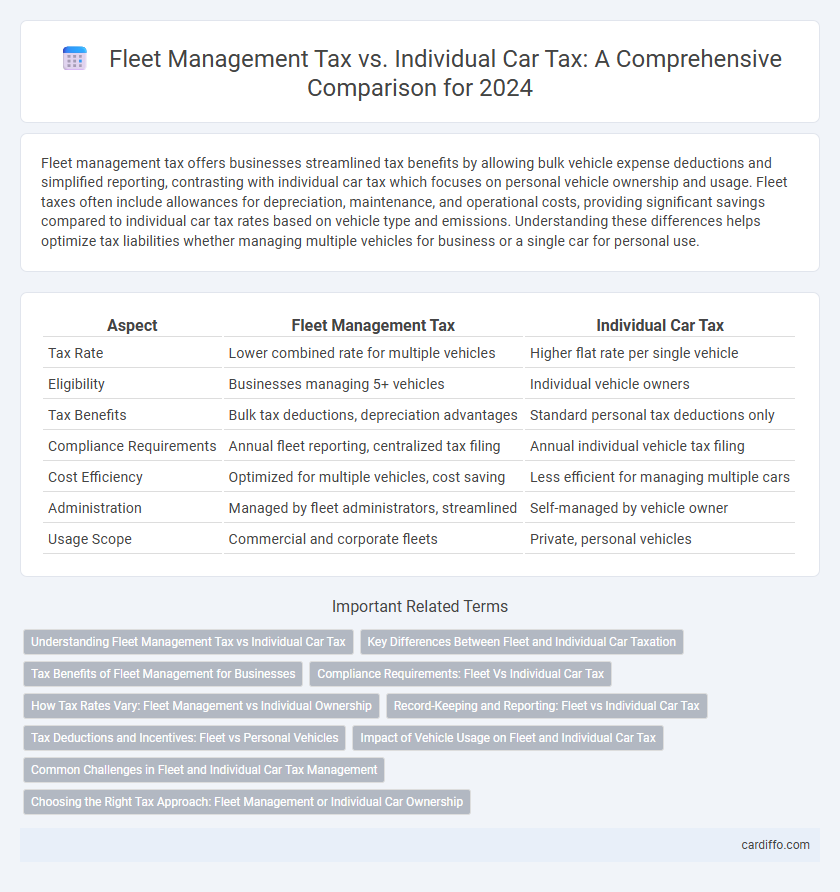

| Aspect | Fleet Management Tax | Individual Car Tax |

|---|---|---|

| Tax Rate | Lower combined rate for multiple vehicles | Higher flat rate per single vehicle |

| Eligibility | Businesses managing 5+ vehicles | Individual vehicle owners |

| Tax Benefits | Bulk tax deductions, depreciation advantages | Standard personal tax deductions only |

| Compliance Requirements | Annual fleet reporting, centralized tax filing | Annual individual vehicle tax filing |

| Cost Efficiency | Optimized for multiple vehicles, cost saving | Less efficient for managing multiple cars |

| Administration | Managed by fleet administrators, streamlined | Self-managed by vehicle owner |

| Usage Scope | Commercial and corporate fleets | Private, personal vehicles |

Understanding Fleet Management Tax vs Individual Car Tax

Fleet management tax typically offers cost efficiencies by consolidating multiple vehicles under a single tax scheme, reducing administrative burdens and often qualifying for bulk tax rate reductions. Individual car tax requires separate registration and payment for each vehicle, leading to potentially higher aggregate expenses and increased paperwork. Understanding the distinctions between fleet management tax and individual car tax helps businesses optimize tax liabilities and compliance strategies for their vehicle assets.

Key Differences Between Fleet and Individual Car Taxation

Fleet management tax simplifies administration by applying a consolidated tax rate to multiple vehicles owned by a single business, reducing paperwork and overall tax compliance costs. Individual car tax is calculated separately for each vehicle based on factors such as engine size, CO2 emissions, and registration date, often resulting in higher cumulative taxes for multiple cars. Differences in tax incentives and deductions also exist, with fleet taxes often providing more favorable depreciation and expense claims tailored for commercial use.

Tax Benefits of Fleet Management for Businesses

Fleet management tax offers significant benefits for businesses by enabling tax deductions on multiple vehicles used solely for commercial purposes, reducing overall taxable income. Unlike individual car tax, which applies to privately owned vehicles with limited deductions, fleet management allows for depreciation, maintenance, and fuel expenses to be fully accounted for as business costs. This tax structure improves cash flow and incentivizes companies to invest in operational efficiency through consolidated vehicle management.

Compliance Requirements: Fleet Vs Individual Car Tax

Fleet management tax compliance demands adherence to collective vehicle regulations, including aggregated mileage reporting, uniform tax filing deadlines, and consolidated payment processes, ensuring efficient oversight for multiple vehicles under one entity. Individual car tax compliance requires owners to manage separate registrations, submit individual tax returns, and maintain distinct proof of payment, leading to varied deadlines and personalized documentation. Understanding these divergent compliance requirements is essential for optimizing legal adherence and minimizing penalties in tax administration for fleet operators versus individual car owners.

How Tax Rates Vary: Fleet Management vs Individual Ownership

Tax rates for fleet management vehicles often benefit from bulk purchase discounts and specialized corporate tax incentives, leading to lower effective tax burdens compared to individual car ownership. Individual car owners face standard personal vehicle tax rates based on factors such as engine size, emissions, and vehicle age, typically resulting in higher per-vehicle tax costs. Fleet management tax structures emphasize operational efficiency and cost savings, leveraging tax credits and depreciation rules unavailable to individual owners.

Record-Keeping and Reporting: Fleet vs Individual Car Tax

Fleet management tax requires comprehensive record-keeping that tracks multiple vehicles' expenses, mileage, and usage patterns to optimize tax deductions and compliance. Individual car tax reporting typically involves simpler documentation focused on a single vehicle's registration, maintenance costs, and fuel consumption. Efficient digital record-keeping systems are essential for fleets to meet stringent tax reporting standards and reduce audit risks.

Tax Deductions and Incentives: Fleet vs Personal Vehicles

Fleet management tax offers substantial deductions and incentives, including accelerated depreciation and bulk fuel tax credits, which reduce overall taxable income significantly. Individual car tax benefits are generally limited to standard deductions like mileage or business use, often resulting in smaller tax savings. Companies managing fleets can leverage specialized incentives such as vehicle replacement allowances, emission-based credits, and maintenance cost write-offs not typically available to personal vehicle owners.

Impact of Vehicle Usage on Fleet and Individual Car Tax

Vehicle usage significantly influences tax calculations, where fleet management tax often benefits from bulk vehicle operation incentives and higher mileage thresholds, reducing the per-vehicle tax burden. In contrast, individual car tax is typically assessed based on personal usage patterns, engine size, and emissions, leading to potentially higher taxes for frequent or long-distance drivers. Efficient fleet utilization can optimize tax liabilities by leveraging governmental deductions or credits tied to commercial vehicle use and environmental impact.

Common Challenges in Fleet and Individual Car Tax Management

Fleet management tax and individual car tax both face challenges such as complex compliance requirements, varying regional tax regulations, and fluctuating tax rates. Fleet operators often deal with bulk tax calculations and reporting, making accuracy and record-keeping critical, while individual car owners must navigate personalized tax brackets and occasional exemptions. Both must address administrative burdens and potential penalties arising from incorrect filings or missed deadlines.

Choosing the Right Tax Approach: Fleet Management or Individual Car Ownership

Choosing the right tax approach depends on analyzing the total cost implications of fleet management tax versus individual car tax, including depreciation allowances, deductible expenses, and VAT recovery rules. Fleet management tax often provides enhanced tax benefits for businesses operating multiple vehicles by consolidating expenses and streamlining compliance. Individual car ownership tax may offer simpler administration but could result in higher overall taxable amounts due to limited deductions and reduced flexibility in expense allocation.

Fleet Management Tax vs Individual Car Tax Infographic

cardiffo.com

cardiffo.com