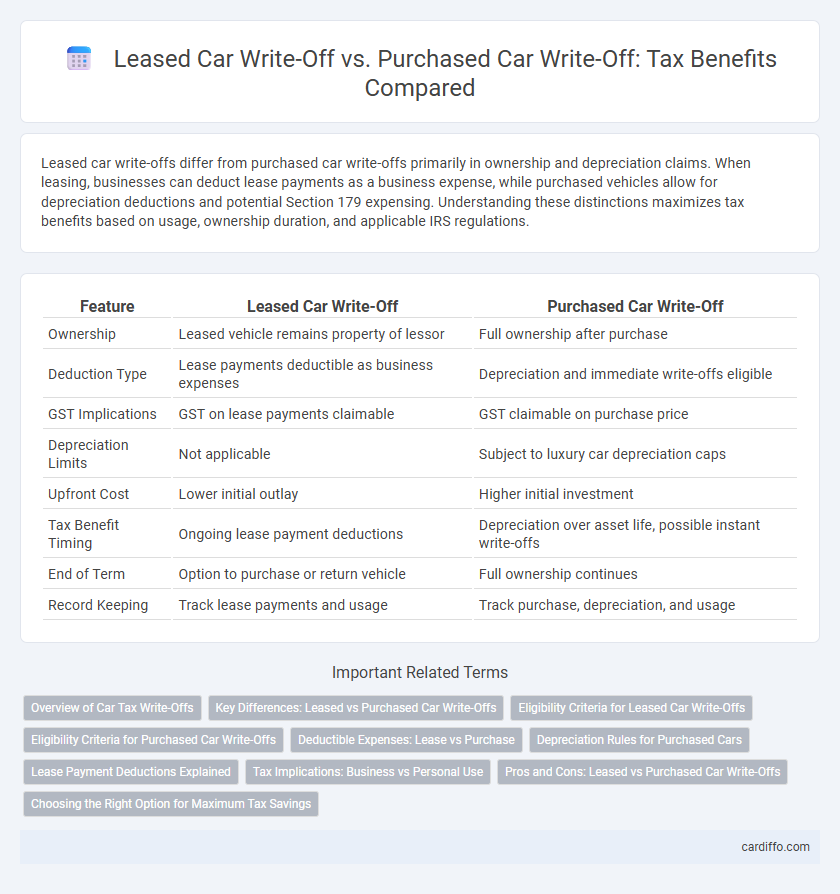

Leased car write-offs differ from purchased car write-offs primarily in ownership and depreciation claims. When leasing, businesses can deduct lease payments as a business expense, while purchased vehicles allow for depreciation deductions and potential Section 179 expensing. Understanding these distinctions maximizes tax benefits based on usage, ownership duration, and applicable IRS regulations.

Table of Comparison

| Feature | Leased Car Write-Off | Purchased Car Write-Off |

|---|---|---|

| Ownership | Leased vehicle remains property of lessor | Full ownership after purchase |

| Deduction Type | Lease payments deductible as business expenses | Depreciation and immediate write-offs eligible |

| GST Implications | GST on lease payments claimable | GST claimable on purchase price |

| Depreciation Limits | Not applicable | Subject to luxury car depreciation caps |

| Upfront Cost | Lower initial outlay | Higher initial investment |

| Tax Benefit Timing | Ongoing lease payment deductions | Depreciation over asset life, possible instant write-offs |

| End of Term | Option to purchase or return vehicle | Full ownership continues |

| Record Keeping | Track lease payments and usage | Track purchase, depreciation, and usage |

Overview of Car Tax Write-Offs

Car tax write-offs differentiate significantly between leased and purchased vehicles, impacting depreciation deductions and expense claims. Purchased cars allow for depreciation over time, including Section 179 expensing and bonus depreciation, while leased vehicles typically permit deducting lease payments as a business expense without claiming depreciation. Understanding IRS guidelines on business use percentage and record-keeping requirements is essential to maximize tax benefits related to vehicle write-offs.

Key Differences: Leased vs Purchased Car Write-Offs

Leased car write-offs typically allow businesses to deduct the full lease payments as a business expense, while purchased car write-offs involve depreciating the vehicle over several years using IRS depreciation methods such as Section 179 or bonus depreciation. Lease expenses provide immediate tax relief without asset ownership, whereas purchased cars offer capital asset deductions but require tracking the vehicle's depreciation schedule. Understanding these differences helps optimize tax benefits based on cash flow preferences and long-term business usage.

Eligibility Criteria for Leased Car Write-Offs

Eligibility criteria for leased car write-offs require the vehicle to be used primarily for business purposes, with clear documentation demonstrating business use percentage. Lease payments must be made under a formal lease agreement, and any personal use portion is not deductible. The lessee cannot claim depreciation, but lease expenses proportional to business use can be deducted under IRS guidelines.

Eligibility Criteria for Purchased Car Write-Offs

Purchased car write-offs require the vehicle to be owned outright or financed with clear ownership, used primarily for business purposes at least 50% of the time, and properly documented with purchase invoices and mileage logs. Eligibility also depends on adherence to the IRS guidelines regarding depreciation limits and the vehicle's classification as a business asset. Maintaining detailed records of expenses and usage ensures compliance and maximizes deductible amounts under tax law.

Deductible Expenses: Lease vs Purchase

Deductible expenses for leased cars typically include monthly lease payments, insurance, maintenance, and running costs, all of which can be claimed proportional to business use. Purchased car write-offs allow for depreciation through capital cost allowance (CCA) deductions and interest on any vehicle financing, along with operational expenses linked to business activities. Lease agreements often simplify expense tracking, while ownership provides the advantage of depreciating the asset over time for tax purposes.

Depreciation Rules for Purchased Cars

Purchased cars qualify for depreciation deductions under the Modified Accelerated Cost Recovery System (MACRS), allowing businesses to recover the vehicle's cost over a specified recovery period, typically five years for passenger vehicles. The IRS imposes luxury auto limits on annual depreciation deductions, capping the amount deductible for high-value vehicles, which must be accounted for in tax planning. Unlike leased cars, purchased vehicles offer the benefit of claiming both depreciation and potential Section 179 expensing, subject to eligibility and usage criteria.

Lease Payment Deductions Explained

Lease payment deductions for a leased car allow businesses to write off the monthly lease expenses as operating costs, typically limited to the portion used for business purposes and subject to IRS limits. In contrast, purchased car write-offs involve depreciating the vehicle's cost over several years, plus deducting actual expenses such as maintenance, fuel, and insurance. Understanding the tax treatment of lease payments versus depreciation is crucial for optimizing deductions and compliance under IRS guidelines.

Tax Implications: Business vs Personal Use

Leased car write-offs allow businesses to deduct lease payments proportionate to the vehicle's business use, offering flexibility but often limiting deductions to operating expenses. Purchased car write-offs provide depreciation benefits via Section 179 or bonus depreciation, allowing empreses to recover the vehicle's cost, but personal use requires careful mileage tracking to separate deductible expenses. Tax implications hinge on accurately allocating business versus personal use, ensuring compliance with IRS rules to maximize allowable deductions without triggering audit risks.

Pros and Cons: Leased vs Purchased Car Write-Offs

Leased car write-offs offer the advantage of deducting lease payments as a business expense, providing consistent tax benefits without the upfront capital investment required for purchased cars. Purchased car write-offs allow for depreciation deductions and potential Section 179 expensing, offering greater long-term tax relief but requiring higher initial expenditure and asset management. Choosing between leased and purchased car write-offs depends on cash flow priorities, tax strategy, and the intended duration of vehicle use in business operations.

Choosing the Right Option for Maximum Tax Savings

Choosing between a leased car write-off and a purchased car write-off depends on factors like annual mileage, depreciation rates, and business usage percentage. Leased cars often provide consistent, predictable deductions based on lease payments, while purchased vehicles allow for accelerated depreciation and potential Section 179 deductions. Maximizing tax savings requires analyzing cash flow, ownership duration, and the impact of standard mileage rates versus actual expenses.

Leased Car Write-off vs Purchased Car Write-off Infographic

cardiffo.com

cardiffo.com