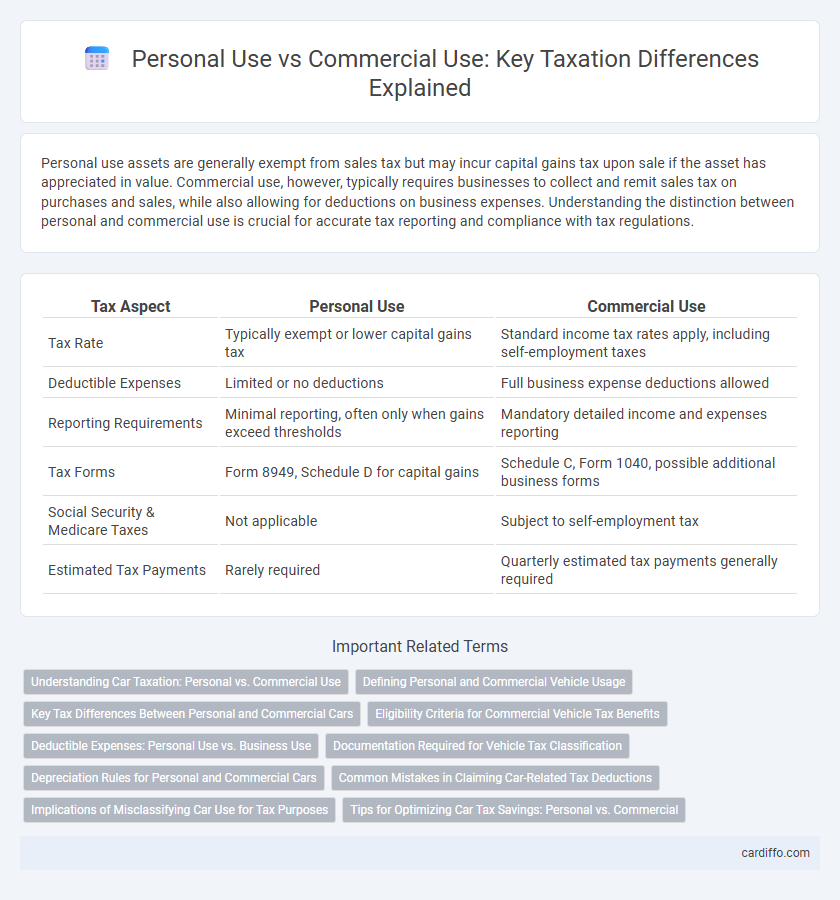

Personal use assets are generally exempt from sales tax but may incur capital gains tax upon sale if the asset has appreciated in value. Commercial use, however, typically requires businesses to collect and remit sales tax on purchases and sales, while also allowing for deductions on business expenses. Understanding the distinction between personal and commercial use is crucial for accurate tax reporting and compliance with tax regulations.

Table of Comparison

| Tax Aspect | Personal Use | Commercial Use |

|---|---|---|

| Tax Rate | Typically exempt or lower capital gains tax | Standard income tax rates apply, including self-employment taxes |

| Deductible Expenses | Limited or no deductions | Full business expense deductions allowed |

| Reporting Requirements | Minimal reporting, often only when gains exceed thresholds | Mandatory detailed income and expenses reporting |

| Tax Forms | Form 8949, Schedule D for capital gains | Schedule C, Form 1040, possible additional business forms |

| Social Security & Medicare Taxes | Not applicable | Subject to self-employment tax |

| Estimated Tax Payments | Rarely required | Quarterly estimated tax payments generally required |

Understanding Car Taxation: Personal vs. Commercial Use

Car taxation varies significantly between personal and commercial use, with commercial vehicles typically subject to higher tax rates and specific deductions. Personal use vehicles often qualify for standard tax rates and limited deductions, focusing on private consumption rather than business operations. Understanding the distinctions in mileage tracking, depreciation claims, and allowable expenses is crucial for accurate tax reporting and compliance.

Defining Personal and Commercial Vehicle Usage

Personal vehicle usage refers to driving a vehicle primarily for private purposes such as commuting, errands, or leisure, which typically qualifies for limited or no tax deductions. Commercial vehicle usage involves using a vehicle mainly for business activities like transporting goods, client visits, or job site travel, making expenses eligible for tax deductions or credits under IRS guidelines. Distinguishing between these uses is crucial for accurate tax reporting and maximizing deductible expenses related to vehicle operation.

Key Tax Differences Between Personal and Commercial Cars

Personal cars are typically subject to limited tax deductions, with expenses like fuel and maintenance only deductible under specific conditions or through standard mileage rates. Commercial vehicles allow for broader tax benefits, including full depreciation, business-related expenses, and potential Section 179 deductions that reduce taxable income. Understanding IRS guidelines and keeping accurate records is crucial for maximizing deductions and ensuring compliance in distinguishing personal use from commercial tax applications.

Eligibility Criteria for Commercial Vehicle Tax Benefits

Commercial vehicle tax benefits apply to vehicles primarily used for business activities, such as transporting goods or passengers for profit. Eligibility criteria typically require documented proof of commercial use, including vehicle registration under a business name, consistent revenue-generating operations, and maintenance of detailed mileage logs separating personal from commercial use. Tax authorities may also mandate compliance with specific industry regulations or licensing to qualify for tax deductions or credits on commercial vehicles.

Deductible Expenses: Personal Use vs. Business Use

Deductible expenses are typically limited to costs directly related to business use, with personal use expenses generally non-deductible under tax regulations. Accurate allocation between personal and business use is essential to comply with tax laws and maximize legitimate deductions, such as vehicle mileage, home office costs, and supplies. Proper documentation and clear separation of personal versus commercial use can prevent audits and penalties while optimizing tax benefits.

Documentation Required for Vehicle Tax Classification

Accurate documentation is essential for differentiating between personal use and commercial use vehicle tax classification, including proof of ownership, mileage logs, and business registration certificates. Commercial vehicles often require detailed records such as trip sheets, expense reports, and invoices to validate the business use percentage for tax deductions. Failure to provide thorough and compliant documentation can result in penalties, audits, or disqualification from commercial tax benefits.

Depreciation Rules for Personal and Commercial Cars

Depreciation rules differ significantly between personal and commercial car use for tax purposes, with commercial vehicles eligible for accelerated depreciation methods such as the Modified Accelerated Cost Recovery System (MACRS). Personal use vehicles typically follow stricter limits on depreciation deductions, often capped by IRS guidelines like the luxury car depreciation caps. Accurate classification of vehicle use is crucial to maximize allowable depreciation expenses and ensure compliance with tax regulations.

Common Mistakes in Claiming Car-Related Tax Deductions

Misclassifying personal use as commercial use is a frequent error that can lead to disallowed car-related tax deductions and potential IRS audits. Taxpayers often neglect detailed mileage logs, which are critical for substantiating business use percentages required by the IRS for vehicle expense claims. Overestimating business mileage or mixing personal trips without clear documentation distorts the actual deductible amount, increasing the risk of tax penalties.

Implications of Misclassifying Car Use for Tax Purposes

Misclassifying car use from personal to commercial or vice versa can lead to significant tax penalties and increased scrutiny from tax authorities. Businesses may lose eligible deductions or face back taxes and interest if expenses are incorrectly claimed, while individuals might underreport taxable benefits or fail to comply with documentation requirements. Proper classification ensures accurate reporting, compliance with IRS guidelines, and optimized tax liability management.

Tips for Optimizing Car Tax Savings: Personal vs. Commercial

Maximize car tax savings by accurately distinguishing between personal and commercial use, as commercial use often qualifies for higher deductions such as depreciation, fuel, and maintenance expenses. Maintain precise mileage logs and categorized receipts to support claims and comply with IRS requirements, reducing audit risks and ensuring all eligible expenses are captured. Consult IRS Publication 463 for detailed guidelines on vehicle expenses and consider leveraging Section 179 deductions if the vehicle is primarily used for business purposes.

personal use vs commercial use taxation Infographic

cardiffo.com

cardiffo.com