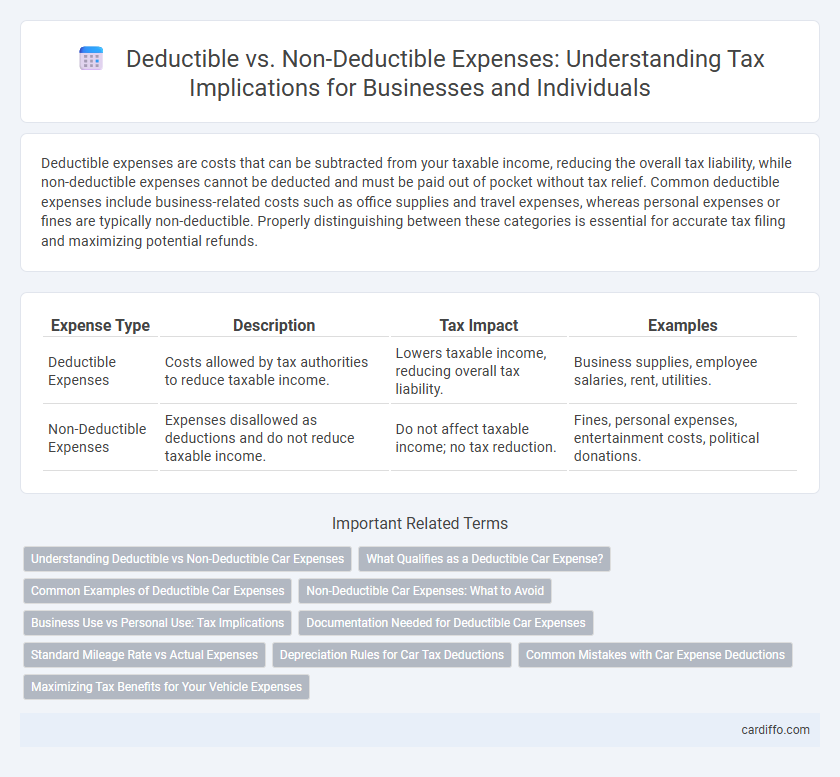

Deductible expenses are costs that can be subtracted from your taxable income, reducing the overall tax liability, while non-deductible expenses cannot be deducted and must be paid out of pocket without tax relief. Common deductible expenses include business-related costs such as office supplies and travel expenses, whereas personal expenses or fines are typically non-deductible. Properly distinguishing between these categories is essential for accurate tax filing and maximizing potential refunds.

Table of Comparison

| Expense Type | Description | Tax Impact | Examples |

|---|---|---|---|

| Deductible Expenses | Costs allowed by tax authorities to reduce taxable income. | Lowers taxable income, reducing overall tax liability. | Business supplies, employee salaries, rent, utilities. |

| Non-Deductible Expenses | Expenses disallowed as deductions and do not reduce taxable income. | Do not affect taxable income; no tax reduction. | Fines, personal expenses, entertainment costs, political donations. |

Understanding Deductible vs Non-Deductible Car Expenses

Deductible car expenses typically include costs directly related to business use, such as fuel, maintenance, insurance, and depreciation, while non-deductible expenses cover personal use or commuting costs. Accurate record-keeping of mileage and purpose of trips is essential to differentiate deductible business expenses from non-deductible personal expenses. Understanding IRS guidelines on vehicle expense deductions helps maximize tax benefits and ensures compliance with tax regulations.

What Qualifies as a Deductible Car Expense?

Deductible car expenses include costs directly related to business use, such as fuel, maintenance, repairs, insurance, depreciation, and lease payments. Expenses that are solely personal or commuting-related do not qualify as deductible. Accurate mileage tracking and proper documentation are essential to substantiate deductible car expenses for tax purposes.

Common Examples of Deductible Car Expenses

Common examples of deductible car expenses include fuel costs, maintenance and repairs, insurance premiums, and lease payments directly related to business use. Mileage driven for business purposes can also be deducted using the standard mileage rate set by the IRS. Non-deductible car expenses typically encompass personal use, commuting costs, and fines or penalties incurred while driving.

Non-Deductible Car Expenses: What to Avoid

Non-deductible car expenses include personal use, fines, and luxury vehicle costs exceeding IRS limits, which can increase taxable income if improperly claimed. Accurate record-keeping and distinguishing between business-related mileage and personal trips are critical to avoid audit issues. Avoid claiming expenses such as parking tickets, commuting costs, and lavish modifications, as these are specifically disallowed by tax regulations.

Business Use vs Personal Use: Tax Implications

Business use expenses are generally deductible, reducing taxable income and lowering overall tax liability, whereas personal use expenses are non-deductible and must be fully borne by the taxpayer. The IRS scrutinizes mixed-use assets, requiring accurate allocation between business and personal use to ensure proper deduction claims. Proper documentation and clear separation of expenses are critical to maximize tax benefits and avoid penalties during audits.

Documentation Needed for Deductible Car Expenses

To claim deductible car expenses, detailed documentation is essential, including mileage logs, receipts for fuel, maintenance, and repairs, and records of business-related travel dates and purposes. Keep copies of lease agreements or purchase documents if applicable, along with any reimbursement records from employers. Accurate and complete records ensure compliance with IRS requirements and maximize allowable deductions.

Standard Mileage Rate vs Actual Expenses

Deductible expenses for business vehicle use can be calculated using the Standard Mileage Rate, which simplifies record-keeping by applying a fixed per-mile rate set by the IRS, or by tracking Actual Expenses, including fuel, maintenance, depreciation, and insurance. The Standard Mileage Rate for 2024 is 65.5 cents per mile, offering a straightforward deduction method but potentially less accurate for vehicles with high operating costs. Choosing between the Standard Mileage Rate and Actual Expenses depends on the taxpayer's documentation capabilities and the total deductible costs to maximize tax benefits.

Depreciation Rules for Car Tax Deductions

Depreciation rules for car tax deductions determine how much of the vehicle's cost can be deducted as a business expense over its useful life. Generally, only the business-use portion of the vehicle's depreciation is deductible, while personal-use portions are non-deductible. Understanding the different methods, such as the Modified Accelerated Cost Recovery System (MACRS), is essential for accurately calculating deductible depreciation expenses versus non-deductible amounts on tax returns.

Common Mistakes with Car Expense Deductions

Many taxpayers incorrectly categorize personal car expenses as deductible business expenses, leading to potential IRS audits and penalties. Common mistakes include failing to maintain detailed mileage logs and mixing personal and business use without proper documentation. Accurate record-keeping and understanding IRS guidelines for deductible car expenses can prevent costly errors during tax filing.

Maximizing Tax Benefits for Your Vehicle Expenses

Maximizing tax benefits for your vehicle expenses requires distinguishing between deductible and non-deductible costs, such as fuel, maintenance, and depreciation, which typically qualify for deductions, versus personal use expenses, which do not. Keeping detailed records and mileage logs ensures accurate reporting of business-related travel, directly impacting deductible amounts and reducing taxable income. Leveraging IRS guidelines on vehicle expense methods, like the standard mileage rate or actual expense method, optimizes your tax savings by aligning deductions with your specific usage and expenditures.

Deductible expenses vs non-deductible expenses Infographic

cardiffo.com

cardiffo.com