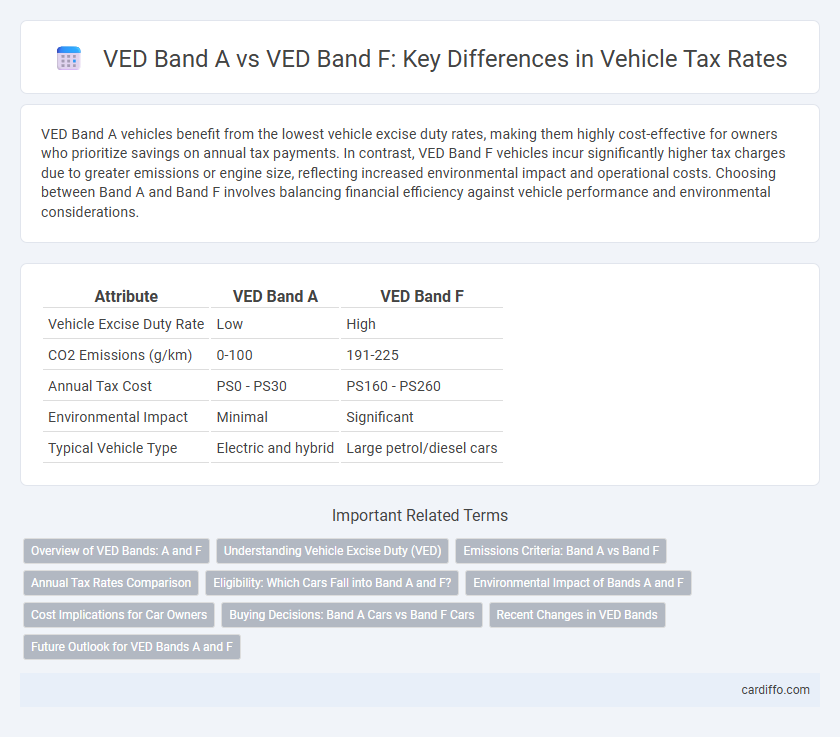

VED Band A vehicles benefit from the lowest vehicle excise duty rates, making them highly cost-effective for owners who prioritize savings on annual tax payments. In contrast, VED Band F vehicles incur significantly higher tax charges due to greater emissions or engine size, reflecting increased environmental impact and operational costs. Choosing between Band A and Band F involves balancing financial efficiency against vehicle performance and environmental considerations.

Table of Comparison

| Attribute | VED Band A | VED Band F |

|---|---|---|

| Vehicle Excise Duty Rate | Low | High |

| CO2 Emissions (g/km) | 0-100 | 191-225 |

| Annual Tax Cost | PS0 - PS30 | PS160 - PS260 |

| Environmental Impact | Minimal | Significant |

| Typical Vehicle Type | Electric and hybrid | Large petrol/diesel cars |

Overview of VED Bands: A and F

VED Band A applies to vehicles with the lowest CO2 emissions, typically under 100g/km, resulting in minimal or zero annual road tax fees. VED Band F covers cars emitting between 161g/km and 170g/km of CO2, attracting significantly higher road tax charges due to increased environmental impact. Understanding these VED Bands helps vehicle owners manage tax liabilities based on emissions levels and comply with government regulations aimed at reducing pollution.

Understanding Vehicle Excise Duty (VED)

Vehicle Excise Duty (VED) is a tax applied based on vehicle emissions and fuel type, with Band A representing the lowest emissions category and Band F indicating higher emissions, resulting in significantly different tax rates. Band A vehicles typically incur minimal or zero VED due to their environmentally friendly emissions, whereas Band F vehicles attract higher charges reflecting their greater environmental impact. Understanding these VED bands helps vehicle owners optimize costs and encourages the use of eco-friendly vehicles.

Emissions Criteria: Band A vs Band F

VED Band A applies to vehicles with ultra-low CO2 emissions, typically ranging from 0 to 50 g/km, reflecting the highest environmental standards and resulting in minimal or zero road tax liability. In contrast, VED Band F covers vehicles with considerably higher emissions, usually between 131 and 150 g/km CO2, leading to significantly higher tax rates due to their greater environmental impact. The emissions criteria directly influence tax obligations, incentivizing lower-emission vehicles to reduce environmental harm and combat climate change.

Annual Tax Rates Comparison

VED Band A vehicles incur the lowest annual tax rates, typically starting at PS0 to PS20, favoring low-emission cars and motorcycles. In contrast, VED Band F imposes significantly higher charges, often exceeding PS150 annually, reflecting higher CO2 emissions and environmental impact. The substantial tax difference between Band A and Band F incentivizes the adoption of cleaner, more fuel-efficient vehicles.

Eligibility: Which Cars Fall into Band A and F?

VED Band A includes cars with zero emissions, typically fully electric vehicles producing no CO2, while Band F covers vehicles emitting between 156 and 170 g/km of CO2. Eligibility for Band A requires a registered new car to have CO2 emissions of 0 g/km, often qualifying models such as Tesla Model 3 and Nissan Leaf. Band F includes higher-polluting petrol or diesel cars like certain sports cars or larger SUVs with emissions within the specified range.

Environmental Impact of Bands A and F

VED Band A vehicles emit the lowest level of CO2, typically under 100 g/km, resulting in minimal environmental impact and lower tax rates to encourage eco-friendly driving. In contrast, VED Band F vehicles produce significantly higher emissions, often between 150 and 170 g/km of CO2, leading to increased pollution and higher Vehicle Excise Duty charges aimed at discouraging high-emission vehicles. The stark difference in CO2 output between Bands A and F underscores the government's emphasis on reducing carbon footprints through graduated tax incentives.

Cost Implications for Car Owners

VED Band A vehicles incur the lowest Vehicle Excise Duty rates, typically starting from zero to minimal charges, making them highly cost-effective for budget-conscious car owners. In contrast, VED Band F vehicles face significantly higher tax rates, reflecting their greater emissions levels and resulting in increased annual expenses. This discrepancy in VED costs directly impacts overall car ownership affordability and long-term budget planning.

Buying Decisions: Band A Cars vs Band F Cars

VED Band A cars attract lower Vehicle Excise Duty rates, making them more cost-effective choices for budget-conscious buyers seeking fuel-efficient, low-emission vehicles. In contrast, Band F cars incur higher VED charges due to increased CO2 emissions, influencing buyers to consider long-term tax implications and running costs. Consumers prioritizing affordability and environmental impact are more inclined to select Band A vehicles over Band F models to minimize total cost of ownership.

Recent Changes in VED Bands

Recent changes to Vehicle Excise Duty (VED) bands have adjusted rates for Band A and Band F, reflecting stricter emissions standards. Band A, typically for zero-emission vehicles, now benefits from reduced or zero tax to incentivize environmental-friendly choices. Band F, which covers higher emission vehicles, faces increased charges aimed at discouraging the use of polluting cars and supporting green initiatives.

Future Outlook for VED Bands A and F

VED Band A vehicles, typically electric or ultra-low emission cars, are expected to benefit from increasingly favorable tax policies aimed at promoting environmental sustainability, resulting in reduced or zero Vehicle Excise Duty (VED) rates over the coming years. Conversely, VED Band F vehicles, generally featuring higher CO2 emissions, are predicted to face progressively higher tax burdens as governments reinforce climate policies and incentivize cleaner transportation alternatives. Future outlook for VED Bands A and F clearly reflects a strategic shift towards rewarding low-emission vehicles while penalizing higher-polluting cars through escalating excise duties.

VED Band A vs VED Band F Infographic

cardiffo.com

cardiffo.com