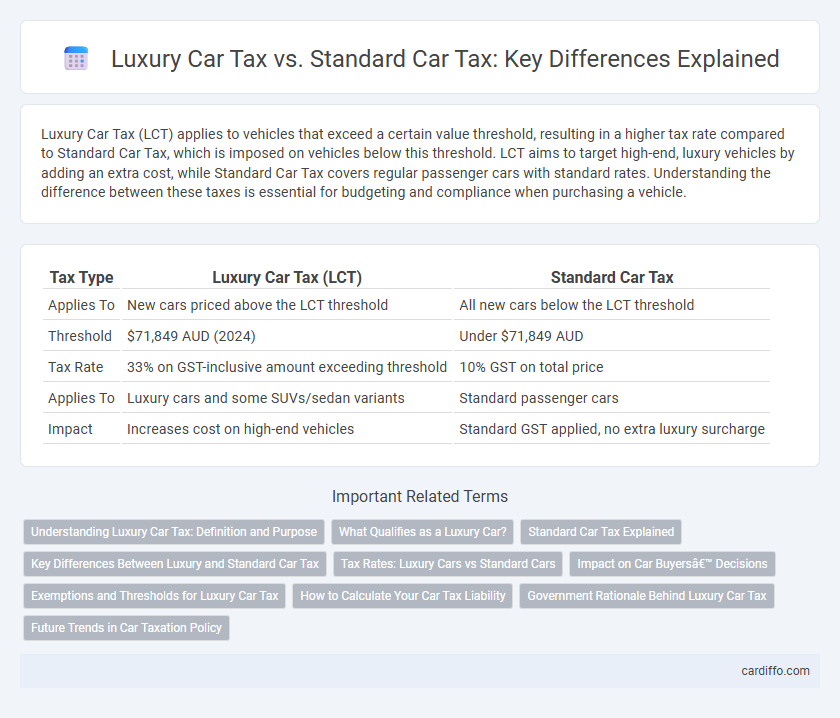

Luxury Car Tax (LCT) applies to vehicles that exceed a certain value threshold, resulting in a higher tax rate compared to Standard Car Tax, which is imposed on vehicles below this threshold. LCT aims to target high-end, luxury vehicles by adding an extra cost, while Standard Car Tax covers regular passenger cars with standard rates. Understanding the difference between these taxes is essential for budgeting and compliance when purchasing a vehicle.

Table of Comparison

| Tax Type | Luxury Car Tax (LCT) | Standard Car Tax |

|---|---|---|

| Applies To | New cars priced above the LCT threshold | All new cars below the LCT threshold |

| Threshold | $71,849 AUD (2024) | Under $71,849 AUD |

| Tax Rate | 33% on GST-inclusive amount exceeding threshold | 10% GST on total price |

| Applies To | Luxury cars and some SUVs/sedan variants | Standard passenger cars |

| Impact | Increases cost on high-end vehicles | Standard GST applied, no extra luxury surcharge |

Understanding Luxury Car Tax: Definition and Purpose

Luxury Car Tax (LCT) is a specific tax applied to vehicles that exceed a set value threshold, designed to target high-value automobiles rather than standard passenger cars. This tax aims to generate revenue from luxury vehicle purchases while encouraging affordability and accessibility by exempting standard cars priced below the threshold. Understanding LCT involves recognizing its role in distinguishing luxury vehicles from regular cars and its impact on consumer purchasing decisions within the automotive market.

What Qualifies as a Luxury Car?

A luxury car is typically defined by its price threshold, which for Luxury Car Tax (LCT) purposes in Australia is a vehicle with a value exceeding the LCT threshold, currently set at $71,849 for fuel-efficient vehicles and $84,916 for non-fuel-efficient vehicles. These vehicles often feature high-end specifications, advanced technology, superior performance, and premium materials, distinguishing them from standard cars that fall below the threshold. The LCT is designed to apply to vehicles exceeding these prices to ensure tax equity while standard car tax rates apply to vehicles below these thresholds.

Standard Car Tax Explained

Standard Car Tax applies to vehicles that do not meet the luxury car criteria set by tax authorities, typically based on price thresholds and specific features. It involves a fixed rate or percentage applied to the vehicle's taxable value, often lower than the Luxury Car Tax, ensuring affordability for average consumers. This tax structure promotes budget-friendly vehicle ownership while ensuring government revenue without the premium surcharges levied on high-end luxury cars.

Key Differences Between Luxury and Standard Car Tax

Luxury Car Tax (LCT) applies to vehicles with a value exceeding the luxury car threshold, currently set at $71,849 (for fuel-efficient cars) or $84,916 (for other vehicles) in Australia, while standard car tax applies to all vehicles below these thresholds. LCT is calculated at 33% on the amount above the threshold, whereas standard car tax follows the standard Goods and Services Tax (GST) rate of 10%. The key difference lies in the additional tax burden imposed by LCT on high-value cars to discourage luxury vehicle consumption and generate revenue, unlike the uniform taxation under standard car tax.

Tax Rates: Luxury Cars vs Standard Cars

Luxury Car Tax (LCT) applies to vehicles exceeding a specific price threshold, typically set around $71,849, with rates currently at 33% on the amount above the threshold. Standard car tax for vehicles below this threshold follows the Goods and Services Tax (GST) of 10%, without the additional LCT surcharge. This significant difference in tax rates incentivizes consumers to consider price points relative to LCT thresholds when purchasing vehicles.

Impact on Car Buyers’ Decisions

Luxury Car Tax (LCT) applies to vehicles priced above a set threshold, significantly increasing the purchase cost compared to Standard Car Tax rates for lower-priced cars. This tax difference heavily influences car buyers' decisions, often deterring purchases of high-end models due to the increased upfront expenses. As a result, many consumers opt for mid-range vehicles to avoid the additional financial burden imposed by LCT.

Exemptions and Thresholds for Luxury Car Tax

Luxury Car Tax (LCT) applies to vehicles with a value exceeding the set threshold, which is indexed annually and varies based on fuel type; for instance, the LCT threshold for fuel-efficient cars is higher compared to standard vehicles. Exemptions from LCT include certain environmentally friendly cars and vehicles used for primary production or charitable purposes, reducing the tax burden on eligible buyers. Understanding the differences in thresholds and exemptions is crucial for consumers and dealers to accurately calculate tax liabilities and optimize purchasing decisions under Australian tax law.

How to Calculate Your Car Tax Liability

Calculating your car tax liability involves understanding the Luxury Car Tax (LCT) threshold and the applicable rates for both standard and luxury vehicles. The LCT applies to cars priced above the threshold, currently set at $71,849 for fuel-efficient vehicles and $84,916 for others, with the tax rate at 33% on the amount exceeding the threshold. To determine your total car tax liability, first calculate the base GST on the vehicle's purchase price, then add the LCT if the price exceeds the threshold, ensuring accurate reporting to comply with Australian Tax Office regulations.

Government Rationale Behind Luxury Car Tax

The Government implements Luxury Car Tax (LCT) to target high-end vehicles exceeding the luxury car threshold, aiming to promote affordability and equity within the automotive market. By imposing a higher tax rate on luxury cars, the policy discourages extravagant consumption and helps generate revenue for public services and infrastructure. The Standard Car Tax applies to all vehicles but at a lower rate, ensuring basic taxation while maintaining accessibility for average consumers.

Future Trends in Car Taxation Policy

Future trends in car taxation policy indicate a shift towards increasing taxes on luxury vehicles, driven by environmental concerns and efforts to curb emissions. Standard car tax rates are expected to be adjusted based on fuel efficiency and electric vehicle adoption incentives, promoting greener transportation choices. Policymakers are likely to implement stricter regulations and higher luxury car tax thresholds to encourage the transition to sustainable automotive technologies.

Luxury Car Tax vs Standard Car Tax Infographic

cardiffo.com

cardiffo.com