Personal car usage tax typically applies to individual car owners based on factors like mileage and fuel consumption, aimed at encouraging efficient and eco-friendly driving habits. Fleet car usage tax is designed for businesses managing multiple vehicles, often incorporating elements such as total fleet size, vehicle types, and emissions to regulate commercial transportation impact. Understanding the distinctions between these taxes helps optimize compliance and leverage potential deductions for both personal and corporate vehicle use.

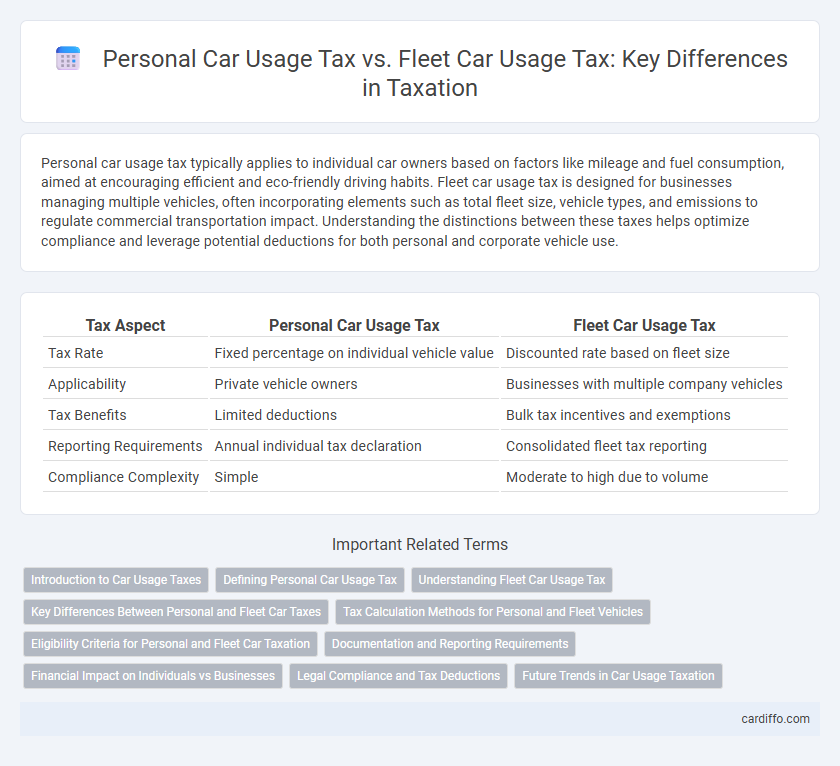

Table of Comparison

| Tax Aspect | Personal Car Usage Tax | Fleet Car Usage Tax |

|---|---|---|

| Tax Rate | Fixed percentage on individual vehicle value | Discounted rate based on fleet size |

| Applicability | Private vehicle owners | Businesses with multiple company vehicles |

| Tax Benefits | Limited deductions | Bulk tax incentives and exemptions |

| Reporting Requirements | Annual individual tax declaration | Consolidated fleet tax reporting |

| Compliance Complexity | Simple | Moderate to high due to volume |

Introduction to Car Usage Taxes

Personal Car Usage Tax applies to individual vehicle owners and is based on factors such as engine size, fuel type, and annual mileage, ensuring a fair contribution to road maintenance. Fleet Car Usage Tax targets businesses operating multiple vehicles, often offering differential rates or incentives based on fleet size, vehicle efficiency, and commercial usage patterns. Understanding these distinctions helps taxpayers optimize compliance and manage overall transportation costs effectively.

Defining Personal Car Usage Tax

Personal Car Usage Tax is a levy imposed on individuals who use their personal vehicles for activities related to business or commercial purposes. This tax is calculated based on factors such as mileage, vehicle type, and the proportion of business versus personal use, ensuring compliance with tax regulations. Unlike Fleet Car Usage Tax, which applies to multiple vehicles owned by a company, Personal Car Usage Tax specifically targets single, privately owned vehicles utilized for work-related tasks.

Understanding Fleet Car Usage Tax

Fleet Car Usage Tax applies to vehicles owned and operated by businesses for commercial purposes, often calculated based on mileage, vehicle type, and usage intensity. Unlike Personal Car Usage Tax, which is assessed on individual vehicle ownership and private use, fleet taxes encompass a broader range of vehicles contributing to business operations, requiring detailed record-keeping and compliance with specific tax regulations. Understanding the nuances of fleet taxes ensures accurate reporting, tax deductions, and optimized financial management for companies managing multiple vehicles.

Key Differences Between Personal and Fleet Car Taxes

Personal car usage tax typically involves individual vehicle ownership, with tax rates based on factors like engine size, fuel type, and annual mileage, reflecting private usage patterns. Fleet car usage tax applies to multiple vehicles owned by businesses, often calculated on aggregated usage metrics, offering potential bulk rate discounts and compliance requirements specific to commercial operations. Tax deductions and reporting obligations also differ, as fleet taxes frequently incorporate maintenance and operational cost considerations unlike personal car taxes.

Tax Calculation Methods for Personal and Fleet Vehicles

Personal car usage tax is typically calculated based on factors such as engine displacement, vehicle value, and annual mileage, with progressive rates applied to encourage fuel efficiency. Fleet car usage tax often depends on aggregate fleet data, including total vehicle count, average emissions, and overall mileage, allowing for bulk tax assessments and potential discounts for standardized vehicle types. Tax authorities may also implement different tax brackets or incentives to promote environmentally friendly fleets compared to individual car ownership.

Eligibility Criteria for Personal and Fleet Car Taxation

Eligibility for personal car usage tax typically applies to individual vehicle owners using cars primarily for non-commercial purposes, whereas fleet car usage tax targets businesses or organizations managing multiple vehicles for commercial activities. Personal car tax computation often depends on factors like engine capacity, fuel type, and annual mileage, while fleet taxation eligibility is influenced by the number of vehicles, fleet size, and operational scope. Compliance with local tax regulations mandates accurate documentation of vehicle usage to differentiate between personal and fleet taxation categories.

Documentation and Reporting Requirements

Personal car usage tax requires detailed logs documenting mileage, purpose of trips, and fuel consumption, with reports submitted to tax authorities on a regular basis, often monthly or quarterly. Fleet car usage tax mandates comprehensive records for each vehicle in the fleet, including maintenance, driver assignments, and route details, alongside aggregated usage reports for accurate tax calculations and compliance. Both tax regimes emphasize stringent documentation to support claims and avoid penalties during audits.

Financial Impact on Individuals vs Businesses

Personal car usage tax directly affects individuals by increasing their out-of-pocket expenses for fuel, maintenance, and depreciation, leading to reduced disposable income. Fleet car usage tax imposes a financial burden on businesses by raising operational costs, which can affect profit margins and potentially lead to higher prices for consumers. Tax strategies and deductions available for businesses often mitigate the impact, whereas individuals face more straightforward and less flexible tax liabilities.

Legal Compliance and Tax Deductions

Personal car usage tax requires strict adherence to regulatory documentation and mileage reporting to ensure legal compliance, often limiting deductible expenses to fuel and maintenance costs. Fleet car usage tax compliance involves more complex record-keeping, including detailed logs of individual vehicle usage and business purposes, enabling broader tax deductions such as depreciation, insurance, and vehicle leasing expenses. Proper differentiation between personal and fleet car usage is crucial for maximizing allowable tax deductions under current tax laws and avoiding penalties.

Future Trends in Car Usage Taxation

Future trends in car usage taxation emphasize the shift from traditional personal car usage tax to more dynamic fleet car usage tax models, reflecting the rise of shared mobility and electric vehicle adoption. Governments are increasingly leveraging telematics and real-time data analytics to implement mileage-based and emissions-based taxation for fleets, optimizing revenue while promoting sustainability. Advancements in AI-driven tax compliance systems are expected to enhance accuracy and fairness in tax assessments, driving a more efficient regulatory environment for both personal and fleet car usage.

Personal Car Usage Tax vs Fleet Car Usage Tax Infographic

cardiffo.com

cardiffo.com