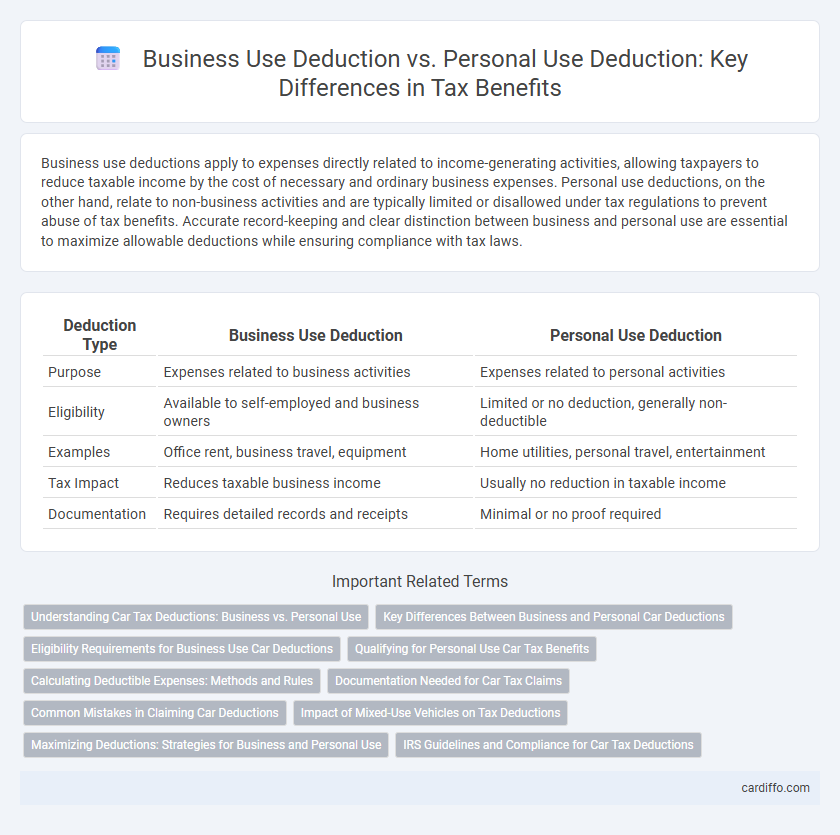

Business use deductions apply to expenses directly related to income-generating activities, allowing taxpayers to reduce taxable income by the cost of necessary and ordinary business expenses. Personal use deductions, on the other hand, relate to non-business activities and are typically limited or disallowed under tax regulations to prevent abuse of tax benefits. Accurate record-keeping and clear distinction between business and personal use are essential to maximize allowable deductions while ensuring compliance with tax laws.

Table of Comparison

| Deduction Type | Business Use Deduction | Personal Use Deduction |

|---|---|---|

| Purpose | Expenses related to business activities | Expenses related to personal activities |

| Eligibility | Available to self-employed and business owners | Limited or no deduction, generally non-deductible |

| Examples | Office rent, business travel, equipment | Home utilities, personal travel, entertainment |

| Tax Impact | Reduces taxable business income | Usually no reduction in taxable income |

| Documentation | Requires detailed records and receipts | Minimal or no proof required |

Understanding Car Tax Deductions: Business vs. Personal Use

Car tax deductions vary significantly between business use and personal use, with the IRS allowing businesses to deduct expenses directly related to vehicle operation for business purposes, such as fuel, maintenance, and depreciation. Personal use of a vehicle does not qualify for tax deductions, except for limited exceptions like medical or charitable driving mileage, which require detailed mileage logs to substantiate. Accurate tracking and documentation of business versus personal mileage are crucial to maximizing deductible expenses and ensuring compliance with IRS regulations.

Key Differences Between Business and Personal Car Deductions

Business use deductions allow taxpayers to deduct vehicle expenses related directly to business activities, including mileage, repairs, and depreciation, whereas personal use deductions are limited and generally not deductible except in specific cases such as medical or charitable purposes. The IRS requires meticulous records and substantiation of mileage and expenses for business use deductions to qualify, while personal use expenses cannot be claimed unless they meet strict criteria. Key differences include the proportion of use attributed to business versus personal, documentation requirements, and the scope of allowable expenses under tax law.

Eligibility Requirements for Business Use Car Deductions

Eligibility for business use car deductions requires that the vehicle be used primarily for business activities, with clear documentation of mileage and purpose. Taxpayers must separate business miles from personal miles, maintaining detailed logs to substantiate the deduction. Vehicles used exclusively for personal reasons do not qualify, while mixed-use requires prorating expenses based on actual business use percentage.

Qualifying for Personal Use Car Tax Benefits

Qualifying for personal use car tax benefits requires meeting specific IRS criteria, including maintaining detailed mileage logs that separate business and personal use. Personal use deductions are limited and often non-deductible unless the vehicle is exclusively used for business purposes, whereas business use deductions allow for depreciation, lease payments, and operational expenses. Accurate documentation ensures proper allocation of expenses and maximizes potential tax benefits related to vehicle use.

Calculating Deductible Expenses: Methods and Rules

Calculating deductible expenses for business use involves allocating costs based on the actual business usage percentage, often determined by mileage logs, time tracking, or square footage measurements. Personal use deductions require excluding non-business portions to ensure only expenses directly related to income generation are deducted, following IRS guidelines and specific depreciation rules. Accurate record-keeping and adherence to the chosen method, such as the simplified or actual expense method, are essential for compliant and optimized tax reporting.

Documentation Needed for Car Tax Claims

Accurate documentation is essential for car tax claims when differentiating between business use deduction and personal use deduction. Detailed mileage logs, including dates, destinations, and purpose of travel, are required to substantiate business-related expenses, while personal use must be clearly segregated. Receipts for fuel, maintenance, and insurance support the total expenses but must be proportional to the percentage of business use to ensure compliance with IRS regulations.

Common Mistakes in Claiming Car Deductions

Many taxpayers mistakenly claim personal expenses as business use deductions on their car expenses, leading to potential IRS audits and penalties. Incorrectly estimating mileage or failing to maintain detailed records of business-related trips often results in overstated deductions. Ensuring accurate logbooks and distinguishing personal from business use are essential to avoid disallowed expenses and maximize legitimate car deduction claims.

Impact of Mixed-Use Vehicles on Tax Deductions

Mixed-use vehicles, used for both business and personal purposes, require precise allocation of expenses to maximize tax deductions. Only the portion of vehicle expenses directly related to business use is deductible, necessitating detailed mileage tracking and documentation. Failure to accurately separate business and personal use can lead to reduced deductions and increased audit risk from tax authorities.

Maximizing Deductions: Strategies for Business and Personal Use

Maximizing deductions requires distinguishing between business use and personal use of assets, as only expenses directly related to business activities qualify for business use deductions under IRS guidelines. Accurate record-keeping through mileage logs, time tracking, and expense documentation supports claiming the highest allowable deduction without triggering audits. Leveraging depreciation schedules for business property and carefully allocating mixed-use costs ensures optimal tax benefits while maintaining compliance with tax regulations.

IRS Guidelines and Compliance for Car Tax Deductions

IRS guidelines distinguish between business use and personal use deductions for vehicles, allowing taxpayers to deduct expenses proportional to the miles driven for business purposes. Compliance requires detailed mileage logs and proper documentation to substantiate business use, as personal use miles are non-deductible under tax regulations. Accurate record-keeping and adherence to IRS standards ensure legitimate car tax deductions without risking audits or penalties.

Business Use Deduction vs Personal Use Deduction Infographic

cardiffo.com

cardiffo.com