Mileage allowance payments provide a simplified method for reimbursing employees for business travel by covering fixed rates per mile, reducing the need for detailed record-keeping. Actual cost reimbursement requires employees to submit precise receipts for expenses like fuel, maintenance, and depreciation, ensuring exact compensation but increasing administrative workload. Choosing between mileage allowance payments and actual cost reimbursement depends on the balance between ease of processing and accuracy in tax deductions.

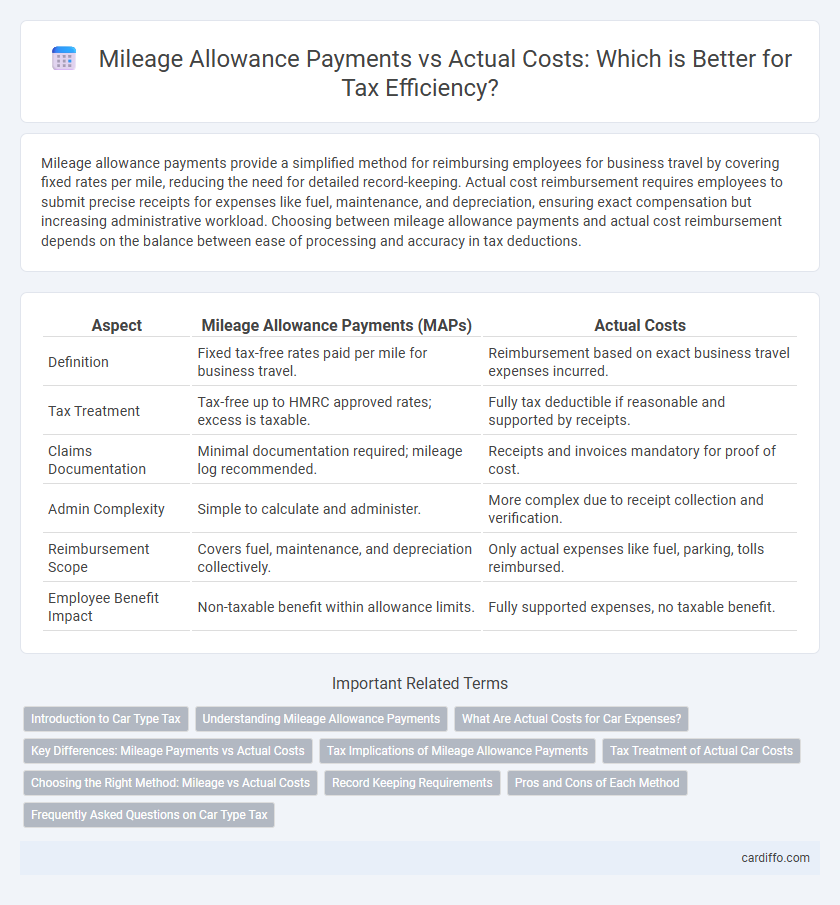

Table of Comparison

| Aspect | Mileage Allowance Payments (MAPs) | Actual Costs |

|---|---|---|

| Definition | Fixed tax-free rates paid per mile for business travel. | Reimbursement based on exact business travel expenses incurred. |

| Tax Treatment | Tax-free up to HMRC approved rates; excess is taxable. | Fully tax deductible if reasonable and supported by receipts. |

| Claims Documentation | Minimal documentation required; mileage log recommended. | Receipts and invoices mandatory for proof of cost. |

| Admin Complexity | Simple to calculate and administer. | More complex due to receipt collection and verification. |

| Reimbursement Scope | Covers fuel, maintenance, and depreciation collectively. | Only actual expenses like fuel, parking, tolls reimbursed. |

| Employee Benefit Impact | Non-taxable benefit within allowance limits. | Fully supported expenses, no taxable benefit. |

Introduction to Car Type Tax

Mileage Allowance Payments (MAPs) provide a fixed rate to reimburse employees for business travel in personal vehicles, simplifying expense tracking by avoiding detailed cost analysis. Actual Costs reimbursement requires detailed records of all vehicle-related expenses, including fuel, maintenance, and insurance, which can be more complex but potentially more accurate for tax deduction purposes. Different car types, such as electric, petrol, or diesel vehicles, influence tax treatment and allowable rates under both MAPs and Actual Costs methods.

Understanding Mileage Allowance Payments

Mileage Allowance Payments (MAPs) provide a fixed rate per mile to reimburse employees for business travel expenses without requiring detailed receipts. Understanding MAPs helps employers comply with HMRC guidelines by offering tax-free reimbursements up to approved mileage rates, which vary by vehicle type and usage. Choosing MAPs over actual cost claims simplifies record-keeping and prevents taxable benefit complications, streamlining expense management for both employer and employee.

What Are Actual Costs for Car Expenses?

Actual costs for car expenses include all the tangible expenditures incurred while using a vehicle for business purposes, such as fuel, oil, repairs, insurance, depreciation, car tax, and MOT fees. These expenses must be accurately recorded and claimed to ensure compliance with tax regulations and to maximize allowable deductions. Detailed receipts and logbooks are essential for substantiating actual costs when submitting tax returns or mileage allowance claims.

Key Differences: Mileage Payments vs Actual Costs

Mileage Allowance Payments (MAPs) provide a fixed rate per mile to employees for business travel, simplifying expense reporting by covering fuel, maintenance, and depreciation without requiring detailed receipts. Actual Costs involve reimbursing employees for exact expenses incurred, including fuel receipts, parking fees, and vehicle repairs, necessitating comprehensive documentation. The key difference lies in MAPs offering a streamlined, lump-sum approach, while Actual Costs demand precise tracking and validation of each expenditure.

Tax Implications of Mileage Allowance Payments

Mileage Allowance Payments (MAPs) provide a tax-efficient way for employers to reimburse employees for business travel without incurring tax liabilities, as HMRC-approved rates up to 45p per mile for cars are exempt from income tax and National Insurance contributions. If the MAP exceeds the approved rates, the excess is treated as taxable income, requiring the employee to pay income tax and NICs on the difference. Employees opting to claim actual vehicle costs must maintain detailed records and can deduct allowable expenses such as fuel, maintenance, and depreciation, but this requires more complex calculations and record-keeping compared to receiving MAPs.

Tax Treatment of Actual Car Costs

Tax treatment of actual car costs allows employees to claim deductions on expenses such as fuel, maintenance, insurance, and depreciation when business use is documented. Unlike mileage allowance payments, which apply a fixed rate for business mileage, actual cost claims require detailed records and receipts to substantiate the tax relief. HMRC permits only the proportion of expenses attributable to business mileage to be deducted, ensuring accurate and eligible tax relief on vehicle-related expenditures.

Choosing the Right Method: Mileage vs Actual Costs

Choosing between Mileage Allowance Payments (MAPs) and Actual Costs for business vehicle expenses requires a clear understanding of tax efficiency and record-keeping obligations. Mileage Allowance Payments offer a simplified, fixed-rate method based on distance traveled, minimizing administrative burdens and reducing HMRC scrutiny risk, while Actual Costs involve detailed tracking of fuel, maintenance, insurance, and depreciation, enabling precise tax deductions but demanding comprehensive receipts and documentation. Businesses should evaluate vehicle usage patterns, expense variability, and record-keeping capacity to select the optimal approach that maximizes allowable tax relief under current HMRC guidelines.

Record Keeping Requirements

Maintaining accurate records for Mileage Allowance Payments (MAPs) and Actual Costs is essential for tax compliance and reimbursement claims. Taxpayers must keep detailed logs of date, purpose, distance traveled, vehicle type, and expenses incurred to substantiate claims. HMRC requires supporting evidence such as fuel receipts and maintenance invoices to differentiate between allowable map rates and actual vehicle costs.

Pros and Cons of Each Method

Mileage Allowance Payments offer a simplified way to claim vehicle expenses by using a fixed rate per mile, reducing record-keeping and administrative burden but possibly resulting in under- or over-compensation compared to actual costs. Actual Costs reimbursement allows precise deduction of fuel, maintenance, insurance, and depreciation expenses, providing accuracy but requiring detailed receipts and comprehensive tracking of all spending. Choosing between methods impacts tax efficiency and compliance, depending on the taxpayer's vehicle usage, record-keeping capacity, and preference for simplicity versus accuracy.

Frequently Asked Questions on Car Type Tax

Mileage Allowance Payments (MAPs) provide a tax-free rate per mile based on car engine size, with HMRC setting specific rates for petrol, diesel, and electric vehicles to cover fuel, insurance, and maintenance costs. Tax relief on Actual Costs requires detailed records of all car-related expenses, including fuel, servicing, insurance, and depreciation, allowing deductions based on the business-use percentage of the vehicle. For company cars, the taxable benefit depends on CO2 emissions and car list price, influencing the suitability of MAPs versus actual cost claims for maximum tax efficiency.

Mileage Allowance Payments vs Actual Costs Infographic

cardiffo.com

cardiffo.com