Green vehicle tax incentives significantly reduce the overall cost of ownership by offering lower rates and exemptions compared to standard vehicle tax. Standard vehicle tax rates are generally higher due to increased emissions, encouraging consumers to shift toward environmentally friendly options. Governments implement these tax policies to promote sustainability and reduce carbon footprints in the transportation sector.

Table of Comparison

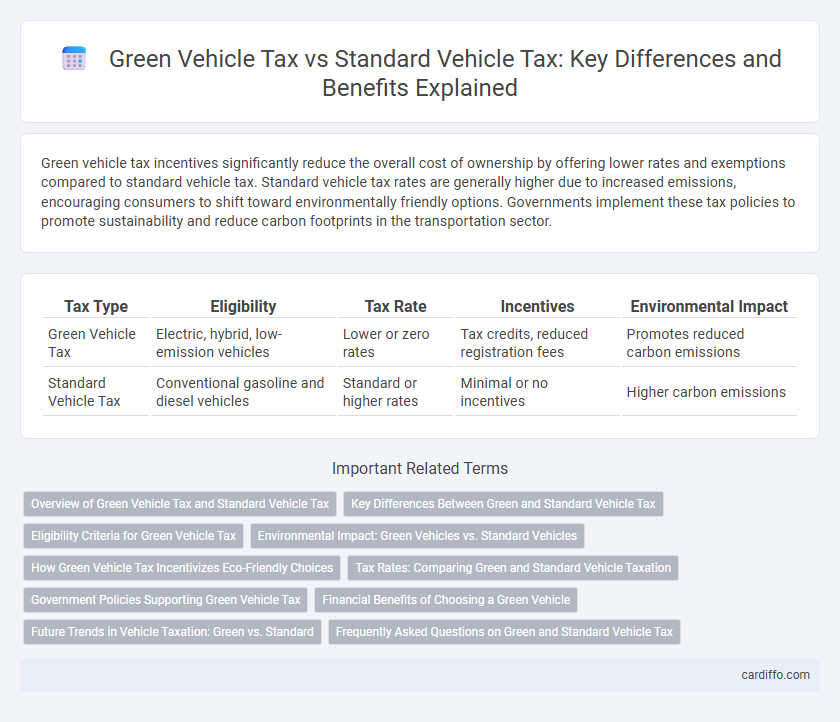

| Tax Type | Eligibility | Tax Rate | Incentives | Environmental Impact |

|---|---|---|---|---|

| Green Vehicle Tax | Electric, hybrid, low-emission vehicles | Lower or zero rates | Tax credits, reduced registration fees | Promotes reduced carbon emissions |

| Standard Vehicle Tax | Conventional gasoline and diesel vehicles | Standard or higher rates | Minimal or no incentives | Higher carbon emissions |

Overview of Green Vehicle Tax and Standard Vehicle Tax

Green Vehicle Tax incentivizes environmentally-friendly transportation by imposing lower tax rates on electric, hybrid, and low-emission vehicles, promoting reduced carbon footprints and energy consumption. Standard Vehicle Tax applies higher rates based on factors such as engine size, fuel type, and emissions level, reflecting the greater environmental impact of conventional vehicles. This tax differentiation aims to encourage the adoption of greener technologies while generating revenue through established taxation models.

Key Differences Between Green and Standard Vehicle Tax

Green vehicle tax rates are significantly lower than standard vehicle tax due to incentives aimed at reducing carbon emissions and promoting eco-friendly transportation. Standard vehicle tax is typically calculated based on engine size or CO2 emissions, resulting in higher fees for vehicles with greater environmental impact. Green vehicle tax structures prioritize electric and hybrid models, offering exemptions or reduced charges to encourage sustainable vehicle adoption.

Eligibility Criteria for Green Vehicle Tax

Eligibility criteria for Green Vehicle Tax include vehicle classification as electric, hybrid, or hydrogen-fueled, with emissions below specified thresholds typically set by government environmental agencies. Applicants must provide proof of vehicle registration, emissions certification, and in some cases, residency or usage within designated low-emission zones. Tax benefits vary based on vehicle weight, battery capacity, and overall environmental impact, aligning with national sustainability goals and legislation.

Environmental Impact: Green Vehicles vs. Standard Vehicles

Green vehicles generate significantly lower carbon emissions compared to standard vehicles, contributing to reduced air pollution and improved public health. Tax incentives for green vehicles encourage adoption by offsetting higher initial costs, promoting sustainable transportation solutions. Standard vehicle tax rates typically reflect greater environmental externalities, penalizing higher fuel consumption and greenhouse gas emissions.

How Green Vehicle Tax Incentivizes Eco-Friendly Choices

Green vehicle tax structures offer significant financial incentives such as reduced registration fees and lower annual taxes, encouraging consumers to choose eco-friendly alternatives over traditional gasoline-powered cars. These tax benefits directly correlate with reduced carbon emissions, promoting environmental sustainability and supporting national goals for cleaner air quality. By lowering the ownership cost of electric and hybrid vehicles, green vehicle tax policies accelerate the adoption of sustainable transportation options and drive innovation in green automotive technologies.

Tax Rates: Comparing Green and Standard Vehicle Taxation

Green vehicle tax rates are generally lower than standard vehicle tax rates to incentivize eco-friendly transportation and reduce carbon emissions. Standard vehicle taxes often involve higher rates due to increased environmental impact and fuel consumption associated with traditional combustion engines. Governments implement these differential tax rates to promote sustainable vehicle choices and support environmental policies.

Government Policies Supporting Green Vehicle Tax

Government policies increasingly favor green vehicle tax incentives to promote environmental sustainability and reduce carbon emissions. Subsidies, reduced tax rates, and exemptions for electric and hybrid vehicles encourage consumers to choose eco-friendly transportation options. These measures align with national climate goals by accelerating the adoption of cleaner, energy-efficient vehicles while discouraging reliance on traditional gasoline-powered cars.

Financial Benefits of Choosing a Green Vehicle

Choosing a green vehicle offers substantial financial benefits through reduced tax rates and eligibility for government incentives, significantly lowering overall ownership costs. Green vehicle tax policies often include exemptions or credits that directly decrease annual tax liabilities compared to standard vehicles. These fiscal advantages encourage environmentally friendly transportation while promoting long-term savings for consumers.

Future Trends in Vehicle Taxation: Green vs. Standard

Future trends in vehicle taxation increasingly favor green vehicles through reduced tax rates, incentives, and exemptions designed to promote electric and hybrid adoption. Standard vehicle tax structures are expected to become more stringent with higher levies on fossil fuel emissions, reflecting global carbon reduction targets. Governments are likely to integrate dynamic tax models based on real-time emissions data to encourage sustainable transportation choices.

Frequently Asked Questions on Green and Standard Vehicle Tax

Green Vehicle Tax typically offers reduced rates or exemptions to promote environmentally friendly transportation, applying to electric and hybrid vehicles with low emissions. Standard Vehicle Tax is imposed on conventional gasoline or diesel vehicles based on factors like engine size, fuel type, and CO2 emissions, often resulting in higher fees for less eco-friendly cars. Frequently asked questions address eligibility criteria, tax calculation methods, applicable discounts, and the benefits of choosing green vehicles for tax savings and environmental impact reduction.

Green Vehicle Tax vs Standard Vehicle Tax Infographic

cardiffo.com

cardiffo.com