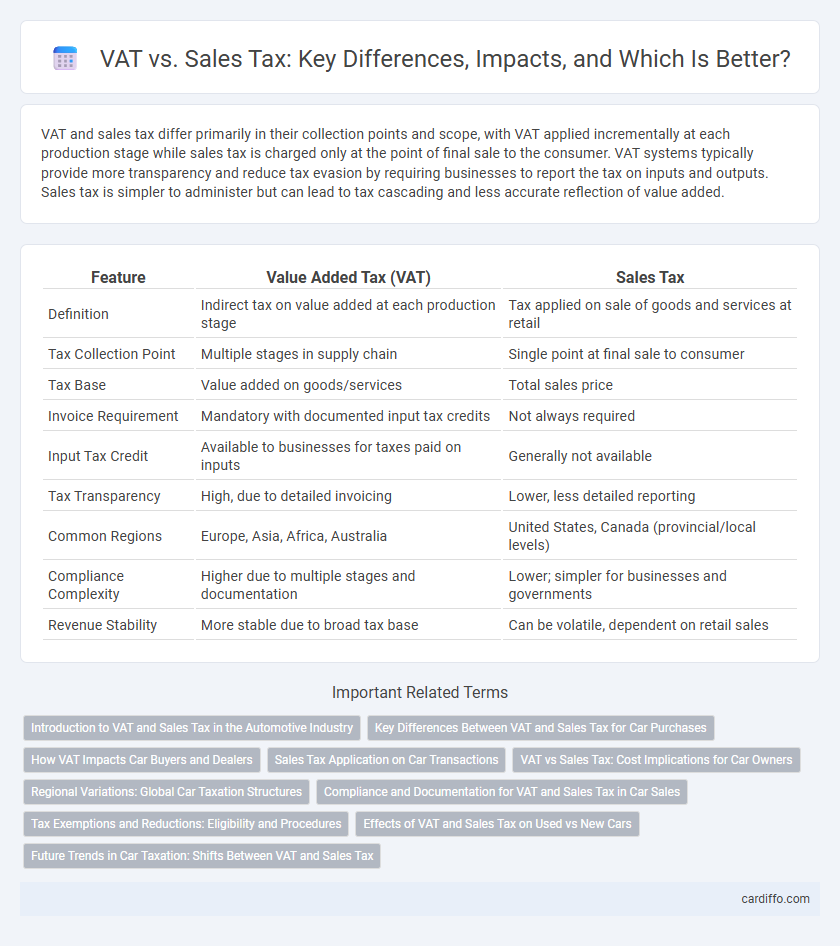

VAT and sales tax differ primarily in their collection points and scope, with VAT applied incrementally at each production stage while sales tax is charged only at the point of final sale to the consumer. VAT systems typically provide more transparency and reduce tax evasion by requiring businesses to report the tax on inputs and outputs. Sales tax is simpler to administer but can lead to tax cascading and less accurate reflection of value added.

Table of Comparison

| Feature | Value Added Tax (VAT) | Sales Tax |

|---|---|---|

| Definition | Indirect tax on value added at each production stage | Tax applied on sale of goods and services at retail |

| Tax Collection Point | Multiple stages in supply chain | Single point at final sale to consumer |

| Tax Base | Value added on goods/services | Total sales price |

| Invoice Requirement | Mandatory with documented input tax credits | Not always required |

| Input Tax Credit | Available to businesses for taxes paid on inputs | Generally not available |

| Tax Transparency | High, due to detailed invoicing | Lower, less detailed reporting |

| Common Regions | Europe, Asia, Africa, Australia | United States, Canada (provincial/local levels) |

| Compliance Complexity | Higher due to multiple stages and documentation | Lower; simpler for businesses and governments |

| Revenue Stability | More stable due to broad tax base | Can be volatile, dependent on retail sales |

Introduction to VAT and Sales Tax in the Automotive Industry

VAT (Value-Added Tax) in the automotive industry is a multi-stage tax imposed on the value added at each production and distribution phase, ensuring tax is collected incrementally from manufacturer to retailer. Sales tax, however, is levied as a single-stage tax on the final sale of vehicles to consumers, typically calculated as a percentage of the purchase price. Understanding the distinction between VAT and sales tax is essential for automotive businesses to comply with tax regulations and optimize pricing strategies across different markets.

Key Differences Between VAT and Sales Tax for Car Purchases

VAT on car purchases is applied at each stage of the supply chain, allowing businesses to reclaim the tax paid on inputs, while sales tax is charged only once at the final point of sale to the consumer. VAT rates often vary by country but typically range from 5% to 25%, whereas sales tax rates differ by state or locality within a country, usually between 2% and 10%. Car buyers benefit from VAT if the vehicle is used for business, as the input tax can be deducted, whereas sales tax is generally a flat cost with no recovery options.

How VAT Impacts Car Buyers and Dealers

VAT impacts car buyers and dealers by increasing the purchase price due to a percentage-based tax applied at each stage of the supply chain, which dealers can reclaim as input tax, unlike sales tax that is only charged at the final sale. Car buyers face higher upfront costs under VAT because the tax is embedded in the vehicle price, while dealers benefit from VAT credits on business-related expenses, reducing their overall tax burden. This system encourages transparency in transactions and reduces tax evasion compared to sales tax regimes.

Sales Tax Application on Car Transactions

Sales tax on car transactions applies as a percentage of the vehicle's purchase price, varying by state and often collected at the point of sale or registration. Unlike VAT, which is a multi-stage tax applied at each production level, sales tax is typically a single-stage tax targeted at the final consumer purchase. States may also impose additional fees for titles and registrations, increasing the total amount payable when buying a car.

VAT vs Sales Tax: Cost Implications for Car Owners

VAT on cars is charged at each stage of production and distribution, which can increase the overall cost reflected in the final price paid by car owners. Sales tax is a one-time charge applied only at the point of purchase, often resulting in a lower immediate cost but no recovery mechanism for businesses. Car owners face higher initial expenses under VAT systems, while sales tax may lead to less transparent pricing but simpler tax calculations.

Regional Variations: Global Car Taxation Structures

Value-Added Tax (VAT) and Sales Tax differ significantly across global regions, with VAT commonly applied in Europe, Asia, and Latin America, while Sales Tax is prevalent in the United States and Canada. VAT is a multi-stage tax levied at each production and distribution point, enabling reclaim of input tax, whereas Sales Tax is a single-stage tax collected at the final sale to consumers. Regional variations influence tax rates, compliance mechanisms, and exemptions, reflecting localized economic policies and administrative capacities within car taxation frameworks.

Compliance and Documentation for VAT and Sales Tax in Car Sales

VAT compliance in car sales requires detailed invoicing that clearly separates VAT amounts, maintaining accurate records for input VAT credits and output VAT liabilities, ensuring adherence to tax authority regulations. Sales tax compliance mandates precise calculation based on the sales price, retention of sales receipts, and reporting to state tax agencies, often lacking input tax credit mechanisms. Proper documentation for VAT involves standardized tax invoices, while sales tax relies on proof of payment and exemption certificates when applicable.

Tax Exemptions and Reductions: Eligibility and Procedures

Tax exemptions and reductions for VAT and sales tax vary based on jurisdiction, product type, and buyer status, often including categories like essential goods, healthcare products, and nonprofit organizations. Eligibility typically requires submitting specific documentation to tax authorities and adhering to formal application procedures, which may involve detailed invoices and exemption certificates. Businesses should maintain compliance by regularly reviewing applicable laws and updating records to ensure accurate tax reporting and benefit utilization.

Effects of VAT and Sales Tax on Used vs New Cars

VAT applies to the value added at each stage of the supply chain, impacting both new and used cars by taxing the difference in resale value, which can increase the final cost of used vehicles. Sales tax is typically levied only on the final retail price, often resulting in a higher relative tax burden on new cars compared to used cars, as used car sales may not always be taxed in some jurisdictions. The choice between VAT and sales tax systems influences consumer behavior, market prices, and dealer incentives differently for new versus used cars.

Future Trends in Car Taxation: Shifts Between VAT and Sales Tax

Future trends in car taxation indicate a growing preference for VAT over sales tax due to its ability to capture value addition throughout the supply chain, enhancing revenue accuracy and reducing tax evasion. Innovations in digital invoicing and blockchain technology are expected to streamline VAT collection, making it more efficient than traditional point-of-sale sales tax systems. Policymakers are increasingly considering VAT adjustments aligned with electric vehicle incentives, reflecting broader environmental goals integrated into tax frameworks.

VAT vs Sales Tax Infographic

cardiffo.com

cardiffo.com