CO2 emissions bands directly influence vehicle tax rates, with higher emissions bands typically incurring increased tax liabilities. List price value also plays a significant role in determining the taxable amount, as many tax systems base charges on vehicle price brackets combined with emission categories. Understanding the correlation between CO2 emissions bands and list price value is essential for accurate tax calculation and cost optimization.

Table of Comparison

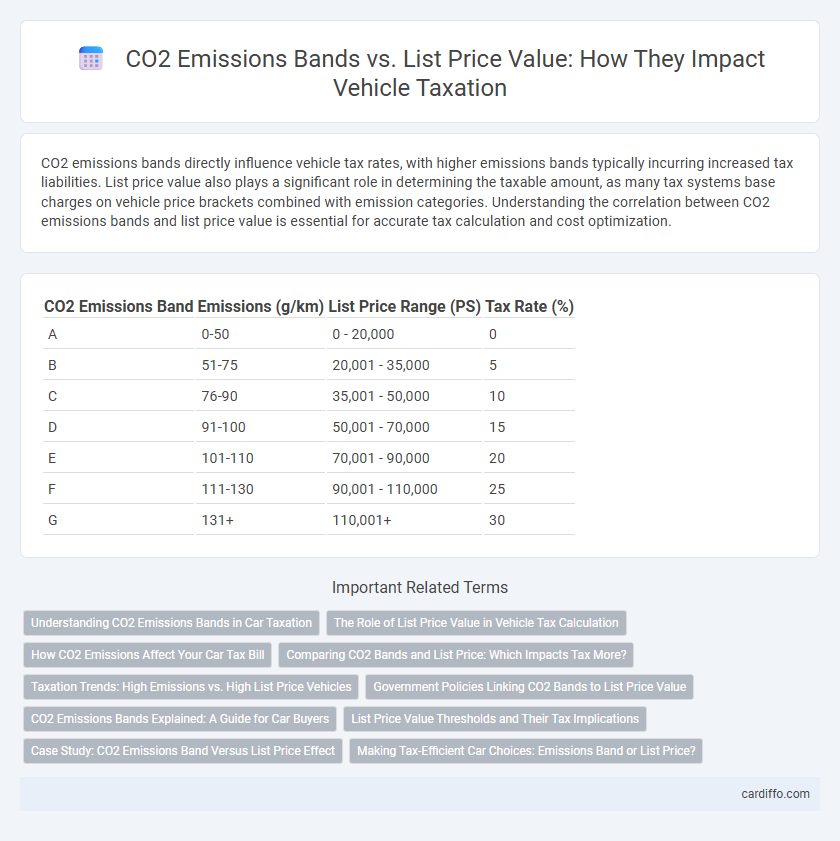

| CO2 Emissions Band | Emissions (g/km) | List Price Range (PS) | Tax Rate (%) |

|---|---|---|---|

| A | 0-50 | 0 - 20,000 | 0 |

| B | 51-75 | 20,001 - 35,000 | 5 |

| C | 76-90 | 35,001 - 50,000 | 10 |

| D | 91-100 | 50,001 - 70,000 | 15 |

| E | 101-110 | 70,001 - 90,000 | 20 |

| F | 111-130 | 90,001 - 110,000 | 25 |

| G | 131+ | 110,001+ | 30 |

Understanding CO2 Emissions Bands in Car Taxation

CO2 emissions bands categorize vehicles based on their carbon dioxide output, directly impacting car taxation rates by aligning tax liabilities with environmental impact. Lower CO2 bands correspond to reduced list price values in tax calculations, incentivizing the purchase of environmentally friendly vehicles. Understanding the correlation between CO2 emissions bands and list price values is essential for optimizing tax efficiency and compliance in vehicle ownership.

The Role of List Price Value in Vehicle Tax Calculation

List Price Value plays a crucial role in vehicle tax calculation by directly influencing the CO2 emissions band assigned to a vehicle, which determines the tax rate applied. Higher list prices often correspond with vehicles emitting more CO2, placing them in higher tax bands and increasing the overall tax liability. Accurate assessment of the list price ensures fair tax distribution based on environmental impact and vehicle valuation.

How CO2 Emissions Affect Your Car Tax Bill

CO2 emissions directly impact your car tax bill by determining the emissions band your vehicle falls into, with higher emissions bands incurring greater tax rates. Cars with lower CO2 emissions benefit from reduced annual vehicle excise duty (VED) fees, incentivizing environmentally-friendly choices. Understanding the correlation between CO2 emissions bands and list price values helps optimize tax savings by selecting vehicles that minimize tax liabilities based on emission thresholds.

Comparing CO2 Bands and List Price: Which Impacts Tax More?

CO2 emissions bands and list price both significantly influence vehicle tax calculations, with CO2 emissions bands primarily determining environmental tax rates through emission-based levies. Higher list prices often incur additional luxury tax surcharges, but the CO2 emissions band directly affects annual vehicle tax costs tied to environmental regulations. Tax policies typically prioritize CO2 emissions bands for ongoing tax liabilities, reflecting government efforts to incentivize low-emission vehicles over merely high list price valuation.

Taxation Trends: High Emissions vs. High List Price Vehicles

Vehicles with high CO2 emissions consistently face steeper tax rates compared to lower-emission counterparts, reflecting stringent environmental policies aimed at reducing carbon footprints. Taxation frameworks often impose higher levies on luxury vehicles with elevated list prices, especially when coupled with excessive emissions, to discourage consumption of less eco-friendly models. This dual focus on emissions bands and list price value drives manufacturers toward producing cleaner, more affordable vehicles while influencing consumer choices through fiscal incentives and penalties.

Government Policies Linking CO2 Bands to List Price Value

Government policies increasingly link CO2 emissions bands to vehicle list price values to incentivize lower emissions and promote environmental sustainability. By imposing higher taxes or levies on vehicles with higher CO2 emissions bands relative to their list prices, authorities encourage consumers to choose eco-friendly models with lower carbon footprints. This dynamic pricing strategy aligns fiscal measures with climate goals, reducing overall emissions in the transportation sector.

CO2 Emissions Bands Explained: A Guide for Car Buyers

CO2 emissions bands categorize vehicles based on their carbon dioxide output, influencing tax rates and environmental impact assessments. Each band corresponds to a specific range of gram-per-kilometer emissions, with lower bands indicating more eco-friendly cars and reduced tax liabilities. Understanding these bands helps car buyers make informed decisions by balancing vehicle cost, fuel efficiency, and potential tax benefits.

List Price Value Thresholds and Their Tax Implications

List price value thresholds play a critical role in determining the tax rates applied to vehicles based on their CO2 emissions bands, directly influencing the total tax liability. Vehicles with higher list prices often face steeper tax brackets, especially if they fall into elevated CO2 emissions bands, making price thresholds a key factor in automotive taxation. Understanding these thresholds helps businesses and consumers optimize tax payments by selecting vehicles that balance list price and environmental impact within favorable tax categories.

Case Study: CO2 Emissions Band Versus List Price Effect

The case study on CO2 emissions bands versus list price reveals a direct correlation between vehicle emissions categories and pricing strategies in the automotive market. Vehicles falling into lower emissions bands generally command higher list prices due to advanced technology and eco-friendly features, influencing consumer purchasing decisions and tax incentives. Understanding this relationship assists policymakers in designing effective tax frameworks that promote environmental sustainability while balancing economic impacts.

Making Tax-Efficient Car Choices: Emissions Band or List Price?

Choosing a tax-efficient car involves analyzing the CO2 emissions band alongside the vehicle's list price value to minimize tax liabilities. Vehicles in lower emissions bands often benefit from reduced road tax rates, while higher list price values can increase Vehicle Excise Duty and Benefit-in-Kind tax for company cars. Balancing a low CO2 emissions band with a moderate list price creates optimal savings in annual tax costs and total cost of ownership.

CO2 Emissions Band vs List Price Value Infographic

cardiffo.com

cardiffo.com