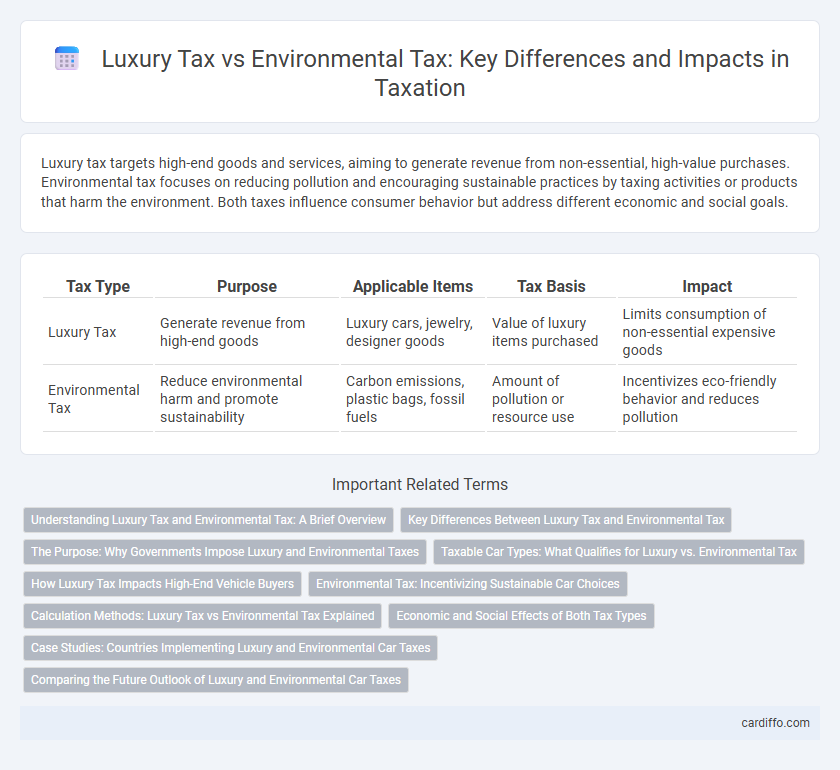

Luxury tax targets high-end goods and services, aiming to generate revenue from non-essential, high-value purchases. Environmental tax focuses on reducing pollution and encouraging sustainable practices by taxing activities or products that harm the environment. Both taxes influence consumer behavior but address different economic and social goals.

Table of Comparison

| Tax Type | Purpose | Applicable Items | Tax Basis | Impact |

|---|---|---|---|---|

| Luxury Tax | Generate revenue from high-end goods | Luxury cars, jewelry, designer goods | Value of luxury items purchased | Limits consumption of non-essential expensive goods |

| Environmental Tax | Reduce environmental harm and promote sustainability | Carbon emissions, plastic bags, fossil fuels | Amount of pollution or resource use | Incentivizes eco-friendly behavior and reduces pollution |

Understanding Luxury Tax and Environmental Tax: A Brief Overview

Luxury tax targets high-value goods such as expensive cars, jewelry, and yachts to generate revenue from affluent consumers, often aiming to reduce economic inequality. Environmental tax imposes charges on activities or products harmful to the environment, including carbon emissions, plastic usage, or fossil fuel consumption, to incentivize sustainable practices. Both taxes serve policy objectives by influencing consumer behavior and funding public initiatives but differ fundamentally in their focus--luxury tax addresses wealth distribution while environmental tax promotes ecological responsibility.

Key Differences Between Luxury Tax and Environmental Tax

Luxury tax targets high-end goods and services, aiming to generate revenue from discretionary spending on items such as luxury cars, jewelry, and designer clothing. Environmental tax, also known as eco-tax or green tax, is designed to reduce environmental harm by imposing costs on activities that generate pollution or deplete natural resources, like carbon emissions or plastic usage. The key difference lies in their objectives: luxury tax primarily focuses on wealth redistribution through taxing non-essential luxury consumption, whereas environmental tax emphasizes incentivizing sustainable behavior and reducing ecological impact.

The Purpose: Why Governments Impose Luxury and Environmental Taxes

Governments impose luxury taxes to discourage conspicuous consumption and generate revenue from non-essential, high-value goods, aiming to reduce economic inequality. Environmental taxes target activities and products that harm the environment, incentivizing sustainable behavior and funding eco-friendly initiatives. Both types of taxes serve to influence consumer decisions while addressing broader social and environmental goals.

Taxable Car Types: What Qualifies for Luxury vs. Environmental Tax

Taxable car types under luxury tax typically include high-value vehicles such as sports cars, luxury sedans, and SUVs exceeding specific price thresholds, often above $50,000 or more. Environmental tax applies primarily to vehicles with poor fuel efficiency, high emissions, or non-compliance with environmental standards, including gas-guzzlers and older model trucks. Hybrid and electric vehicles often qualify for exemptions or reduced environmental taxes, reflecting their lower ecological impact compared to traditional luxury models.

How Luxury Tax Impacts High-End Vehicle Buyers

Luxury tax on high-end vehicles increases the overall purchase price, making premium models less accessible to affluent buyers. This tax targets non-essential luxury goods, thereby discouraging excessive spending on expensive cars and generating additional government revenue. Unlike environmental tax, which aims to reduce carbon emissions by penalizing fuel-inefficient vehicles, luxury tax primarily affects buyer behavior in the luxury market segment.

Environmental Tax: Incentivizing Sustainable Car Choices

Environmental tax targets emissions from vehicles, encouraging consumers to choose low-emission or electric cars by imposing higher taxes on gas-guzzling luxury vehicles. This tax structure not only reduces carbon footprints but also drives automotive innovation toward sustainable technologies. Unlike luxury tax, which is based primarily on the vehicle's price, environmental tax directly links tax rates to environmental impact, promoting greener transportation options.

Calculation Methods: Luxury Tax vs Environmental Tax Explained

Luxury tax calculation typically involves applying a fixed percentage to the sale price of high-value items, such as jewelry, yachts, or luxury cars, targeting non-essential goods to generate revenue. Environmental tax, also known as eco-tax or green tax, is calculated based on the environmental impact or carbon emissions associated with products or activities, encouraging sustainable practices by imposing costs proportional to pollution levels. These distinct methods reflect their differing objectives: luxury taxes aim to tax affluence and indulgence, while environmental taxes incentivize reductions in environmental harm through measurable metrics like carbon output or resource consumption.

Economic and Social Effects of Both Tax Types

Luxury tax primarily targets high-value goods, redistributing wealth and potentially reducing excessive consumption among affluent consumers, which can lead to increased government revenue and funding for social programs. Environmental tax focuses on internalizing the external costs of pollution, incentivizing green practices, reducing environmental damage, and fostering sustainable economic growth. Both taxes affect social equity differently: luxury tax may decrease income inequality, while environmental tax promotes public health and long-term ecological benefits, though it may disproportionately impact low-income populations unless designed with rebates or subsidies.

Case Studies: Countries Implementing Luxury and Environmental Car Taxes

Countries like Norway and Singapore have implemented environmental car taxes to reduce carbon emissions by imposing higher fees on vehicles with poor fuel efficiency. In contrast, France and Italy apply luxury taxes on high-end cars, targeting wealthier consumers to increase revenue and discourage conspicuous consumption. These case studies demonstrate the effectiveness of tailored tax policies in promoting environmental sustainability and addressing social equity through car taxation.

Comparing the Future Outlook of Luxury and Environmental Car Taxes

Luxury car taxes are expected to face increasing scrutiny as governments aim to curb excessive consumption and generate revenue from high-value vehicles, with potential hikes in rates and stricter eligibility criteria. Environmental car taxes will likely expand, driven by global climate commitments and advances in emissions measurement, incentivizing low-emission and electric vehicles through rebates and reduced levies. The future landscape of car taxation will blend punitive luxury charges with progressive environmental incentives, shaping consumer behavior toward sustainability and social equity.

luxury tax vs environmental tax Infographic

cardiffo.com

cardiffo.com