The first-year tax rate often includes accelerated deductions or bonuses that reduce taxable income more significantly compared to the standard rate, which applies uniformly over the asset's useful life. Understanding the differences between these rates helps businesses maximize tax savings and optimize cash flow in the initial years of an investment. Selecting the appropriate tax rate influences depreciation schedules and overall tax liabilities.

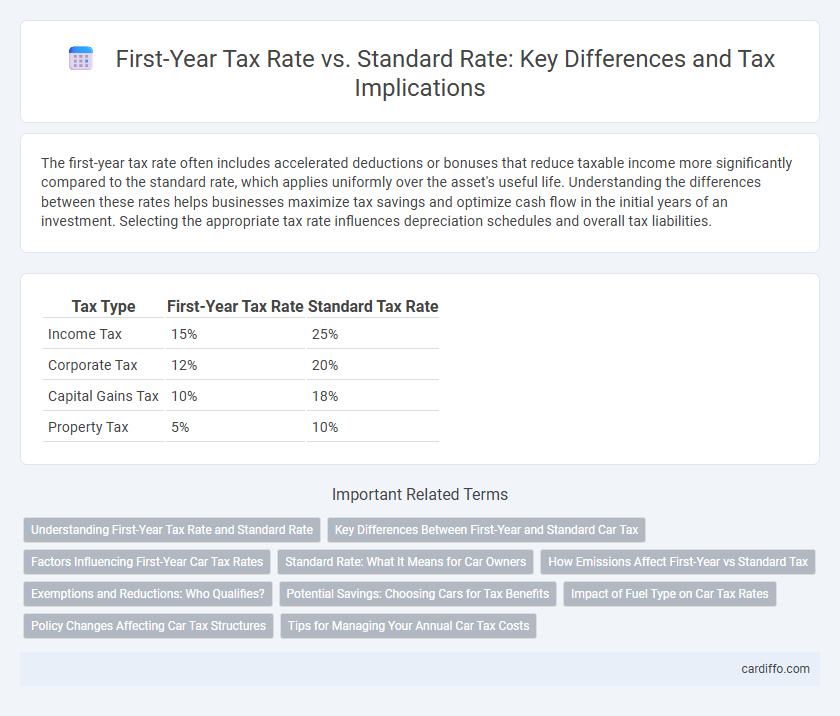

Table of Comparison

| Tax Type | First-Year Tax Rate | Standard Tax Rate |

|---|---|---|

| Income Tax | 15% | 25% |

| Corporate Tax | 12% | 20% |

| Capital Gains Tax | 10% | 18% |

| Property Tax | 5% | 10% |

Understanding First-Year Tax Rate and Standard Rate

The first-year tax rate applies to income or profits generated during the initial period of an asset's use, often offering accelerated deductions or credits to encourage investment. The standard tax rate is the regular rate imposed on income or profits in subsequent years after the first year, reflecting the typical tax burden without special incentives. Understanding the differences between these rates is essential for accurate tax planning and maximizing allowable deductions in the first year of asset acquisition.

Key Differences Between First-Year and Standard Car Tax

The first-year tax rate for vehicles is typically higher than the standard rate to account for initial depreciation and emissions impact, often set at a percentage reflecting the car's CO2 emissions. Standard car tax applies annually after the first year, generally at a lower fixed rate depending on the vehicle's fuel type and engine size. Key differences include the calculation basis--CO2 emissions for the first year versus a consistent band or flat rate for subsequent years--impacting overall tax liabilities for new vehicle owners.

Factors Influencing First-Year Car Tax Rates

First-year car tax rates are primarily influenced by the vehicle's CO2 emissions, fuel type, and list price, with higher emissions resulting in increased tax liabilities. Electric and low-emission vehicles benefit from reduced rates or exemptions under many tax systems, reflecting government incentives for greener transportation. Additionally, the vehicle's engine size and weight may impact the first-year tax rate, aligning taxation more closely with environmental impact and road wear considerations.

Standard Rate: What It Means for Car Owners

The standard tax rate for car owners refers to the fixed percentage applied to the taxable value of a vehicle, influencing annual tax liabilities. Unlike the first-year tax rate, which may include higher or accelerated charges typically used for new vehicles, the standard rate provides a consistent baseline for ongoing taxation. Understanding this rate helps car owners accurately calculate their expected tax expenses and comply with local tax regulations.

How Emissions Affect First-Year vs Standard Tax

Emissions levels directly impact the first-year tax rate by incentivizing lower emissions through reduced tax percentages, unlike the standard rate which remains fixed regardless of emission output. Companies with higher emissions face increased first-year tax rates, encouraging investments in cleaner technologies to minimize costs. This differentiated approach aligns fiscal policy with environmental goals, promoting sustainable business practices through tax incentives.

Exemptions and Reductions: Who Qualifies?

First-year tax rates often come with specific exemptions and reductions aimed at new taxpayers or businesses, targeting those with limited income or investment levels to ease initial financial burdens. Standard tax rates apply broadly but allow certain deductions and credits based on income thresholds, dependents, and other qualifying factors like age or disability. Eligibility for exemptions typically considers filing status, income sources, and compliance with local tax codes, making precise qualification criteria essential for optimal tax liability management.

Potential Savings: Choosing Cars for Tax Benefits

Selecting vehicles that qualify for the First-Year Tax Rate can lead to significant upfront savings by allowing accelerated depreciation deductions compared to the Standard Rate. For instance, passenger cars eligible for the First-Year Tax Rate may yield higher immediate write-offs, reducing taxable income more quickly in the initial purchase year. Businesses optimizing fleet purchases based on these tax rates can enhance cash flow and maximize tax efficiency through strategic asset selection.

Impact of Fuel Type on Car Tax Rates

Fuel type significantly influences first-year tax rates compared to the standard vehicle tax rates, with electric vehicles often attracting lower initial charges due to zero emissions. Diesel and petrol cars typically face higher first-year tax rates reflecting their environmental impact, incentivizing greener choices. This differentiation aims to promote cleaner fuel use by adjusting tax burdens according to emissions, affecting overall vehicle ownership costs.

Policy Changes Affecting Car Tax Structures

Recent policy changes have introduced differentiated first-year tax rates and standard rates to incentivize low-emission vehicles and discourage high-polluting cars. The first-year tax rate often reflects the vehicle's CO2 emissions, resulting in higher charges for gas guzzlers, while the standard rate applies in subsequent years, generally lower and more uniform. These adjustments aim to promote environmentally friendly transportation by gradually shifting tax burdens based on emission levels and vehicle type.

Tips for Managing Your Annual Car Tax Costs

Understanding the first-year tax rate is crucial for new car owners, as it often includes higher initial charges compared to the standard rate applied in subsequent years. To manage your annual car tax costs effectively, consider factors such as vehicle emissions, engine size, and fuel type, which significantly influence tax rates and eligibility for discounts. Regularly reviewing government tax guidelines and utilizing online calculators can help you predict and budget your expenses more accurately.

First-Year Tax Rate vs Standard Rate Infographic

cardiffo.com

cardiffo.com