Gross Vehicle Weight (GVW) represents the total weight of a vehicle including its maximum payload, passengers, and cargo, which is crucial for tax classification and regulatory compliance. Passenger Car Weight typically refers to the curb weight, excluding additional load, affecting the vehicle's registration fees and tax brackets differently. Understanding the difference between GVW and passenger car weight ensures accurate tax assessments and adherence to transportation regulations.

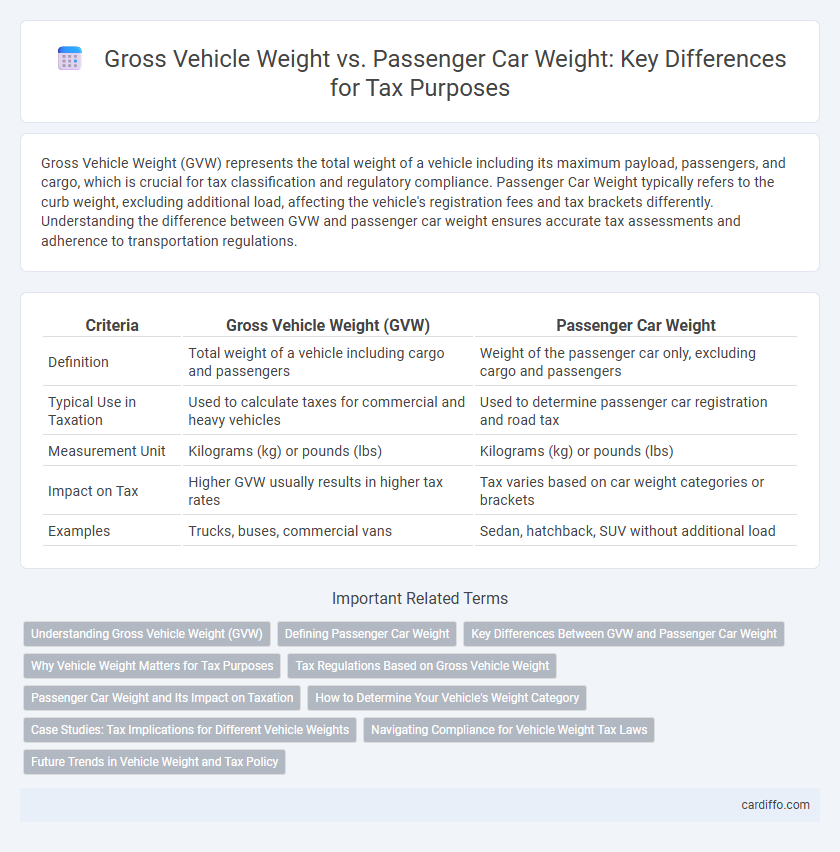

Table of Comparison

| Criteria | Gross Vehicle Weight (GVW) | Passenger Car Weight |

|---|---|---|

| Definition | Total weight of a vehicle including cargo and passengers | Weight of the passenger car only, excluding cargo and passengers |

| Typical Use in Taxation | Used to calculate taxes for commercial and heavy vehicles | Used to determine passenger car registration and road tax |

| Measurement Unit | Kilograms (kg) or pounds (lbs) | Kilograms (kg) or pounds (lbs) |

| Impact on Tax | Higher GVW usually results in higher tax rates | Tax varies based on car weight categories or brackets |

| Examples | Trucks, buses, commercial vans | Sedan, hatchback, SUV without additional load |

Understanding Gross Vehicle Weight (GVW)

Gross Vehicle Weight (GVW) represents the total weight of a vehicle, including its chassis, body, engine, fuel, passengers, cargo, and any additional load. Tax regulations often utilize GVW to determine vehicle classification, affecting registration fees and road taxes. Understanding GVW is crucial for accurate tax compliance, distinguishing it from passenger car weight, which only accounts for the vehicle without payload.

Defining Passenger Car Weight

Passenger car weight refers to the actual weight of a vehicle designed primarily for the transportation of passengers and their belongings, excluding commercial or cargo considerations. This weight is critical for tax assessments, insurance classifications, and regulatory compliance, often defined by manufacturers and regulatory bodies. Understanding passenger car weight aids in accurately distinguishing between personal vehicles and heavier commercial trucks subject to different tax rates and regulations.

Key Differences Between GVW and Passenger Car Weight

Gross Vehicle Weight (GVW) represents the maximum loaded weight of a vehicle, including passengers, cargo, and fuel, while Passenger Car Weight typically refers to the curb weight or unladen weight without occupants or cargo. GVW is crucial for tax calculations, compliance with road regulations, and determining toll fees, as it impacts vehicle classification and allowable load limits. Passenger Car Weight influences fuel efficiency ratings and insurance costs but does not account for the total operational weight affecting taxation.

Why Vehicle Weight Matters for Tax Purposes

Vehicle weight plays a crucial role in tax calculations because heavier vehicles typically cause more road wear, leading to higher road maintenance costs that are reflected in registration fees and taxes. Gross Vehicle Weight (GVW) includes the total allowable weight of the vehicle and its cargo, making it a key factor for commercial vehicle tax rates, while Passenger Car Weight, representing the base vehicle mass, generally influences personal vehicle taxation. Accurate classification between GVW and passenger car weight ensures fair taxation aligned with infrastructure impact and vehicle usage.

Tax Regulations Based on Gross Vehicle Weight

Tax regulations based on Gross Vehicle Weight (GVW) often impose higher rates compared to Passenger Car Weight due to the increased wear and tear heavy vehicles inflict on infrastructure. GVW classifications determine eligibility for specific tax brackets, surcharges, or exemptions under national and regional tax codes. Accurate GVW measurement is vital for compliance, as misclassification can lead to substantial penalties or audit liabilities.

Passenger Car Weight and Its Impact on Taxation

Passenger car weight plays a crucial role in vehicle taxation, as heavier cars often incur higher taxes due to increased road wear and environmental impact. Tax authorities use passenger car weight metrics to calculate registration fees, fuel levies, and emission-related taxes, influencing consumer vehicle choices. Understanding the specific weight categories and their corresponding tax brackets helps owners optimize their tax obligations and comply with regulatory standards.

How to Determine Your Vehicle's Weight Category

To determine your vehicle's weight category for tax purposes, locate the Gross Vehicle Weight Rating (GVWR) on the manufacturer's label inside the driver's door jamb, which includes the vehicle's maximum safe operating weight. If the vehicle is a passenger car, differentiate its weight category by referencing the curb weight, representing the vehicle's weight without passengers or cargo. Understanding whether your vehicle falls under passenger car weight or gross vehicle weight classifications impacts taxable rates and compliance with local vehicle tax regulations.

Case Studies: Tax Implications for Different Vehicle Weights

Case studies reveal that gross vehicle weight (GVW) significantly impacts tax liabilities, with heavier vehicles often incurring higher road use taxes and environmental levies compared to passenger cars. Tax codes in many jurisdictions categorize vehicles by weight thresholds, resulting in distinct fuel duty rates and registration fees that disproportionately affect commercial trucks versus lighter passenger cars. Understanding these weight-based tax implications helps businesses optimize fleet expenses and comply with regional tax regulations effectively.

Navigating Compliance for Vehicle Weight Tax Laws

Navigating compliance for vehicle weight tax laws requires understanding the distinctions between Gross Vehicle Weight (GVW) and Passenger Car Weight (PCW). GVW encompasses the total weight of a vehicle including cargo and passengers, directly impacting tax brackets and fee calculations, while PCW refers specifically to the weight of the car without additional load. Accurate classification under respective state or federal tax codes ensures proper tax liability and avoids penalties associated with misreporting vehicle weight.

Future Trends in Vehicle Weight and Tax Policy

Future trends in vehicle weight indicate a shift towards heavier electric vehicles due to battery integration, impacting gross vehicle weight (GVW) regulations and tax assessments. Tax policies are adapting to account for increased GVW, balancing environmental incentives with road infrastructure wear and fuel consumption metrics. Governments are increasingly considering GVW thresholds in tax brackets to promote eco-friendly vehicle adoption while ensuring fair road usage taxation.

Gross Vehicle Weight vs Passenger Car Weight Infographic

cardiffo.com

cardiffo.com