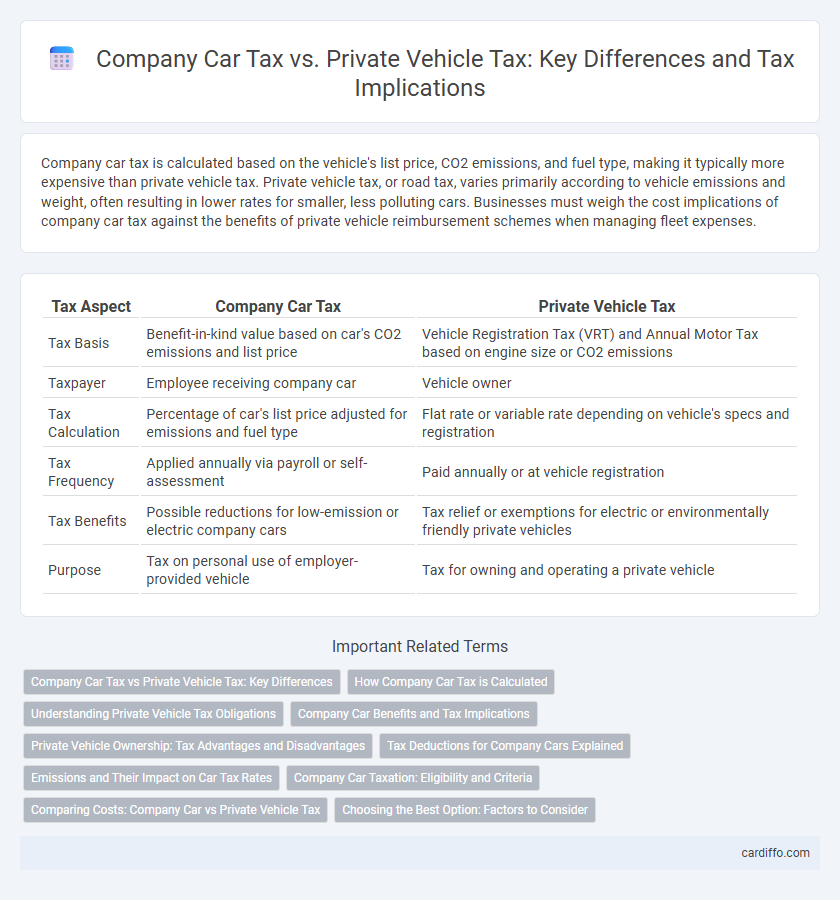

Company car tax is calculated based on the vehicle's list price, CO2 emissions, and fuel type, making it typically more expensive than private vehicle tax. Private vehicle tax, or road tax, varies primarily according to vehicle emissions and weight, often resulting in lower rates for smaller, less polluting cars. Businesses must weigh the cost implications of company car tax against the benefits of private vehicle reimbursement schemes when managing fleet expenses.

Table of Comparison

| Tax Aspect | Company Car Tax | Private Vehicle Tax |

|---|---|---|

| Tax Basis | Benefit-in-kind value based on car's CO2 emissions and list price | Vehicle Registration Tax (VRT) and Annual Motor Tax based on engine size or CO2 emissions |

| Taxpayer | Employee receiving company car | Vehicle owner |

| Tax Calculation | Percentage of car's list price adjusted for emissions and fuel type | Flat rate or variable rate depending on vehicle's specs and registration |

| Tax Frequency | Applied annually via payroll or self-assessment | Paid annually or at vehicle registration |

| Tax Benefits | Possible reductions for low-emission or electric company cars | Tax relief or exemptions for electric or environmentally friendly private vehicles |

| Purpose | Tax on personal use of employer-provided vehicle | Tax for owning and operating a private vehicle |

Company Car Tax vs Private Vehicle Tax: Key Differences

Company Car Tax applies when an employer provides a vehicle for an employee's personal use, calculated based on the car's list price and CO2 emissions, whereas Private Vehicle Tax involves personal ownership with costs primarily from fuel and maintenance expenses. Company Car Tax often results in higher taxable benefits due to its inclusion in income tax calculations, while Private Vehicle Tax does not impact income tax directly but relies on road tax rates and fuel duties. Understanding these distinctions helps businesses and employees optimize tax liabilities and compliance efficiently.

How Company Car Tax is Calculated

Company car tax is calculated based on the vehicle's list price, including VAT and any optional extras, multiplied by a percentage rate determined by its CO2 emissions. The percentage rate varies according to the car's fuel type and emission levels, incentivizing lower-emission vehicles through reduced tax liability. This calculated benefit is added to the employee's taxable income, influencing their overall tax bracket and resulting income tax payment.

Understanding Private Vehicle Tax Obligations

Private vehicle tax obligations require owners to pay Vehicle Excise Duty (VED) based on emissions and vehicle type, differing significantly from company car tax which involves Benefit-in-Kind (BiK) charges linked to the employee's taxable income. Understanding CO2 emissions thresholds and engine size is essential for accurately calculating private vehicle tax liabilities and avoiding penalties. Staying informed about annual VED rates and exemptions ensures compliance and efficient tax planning for private vehicle owners.

Company Car Benefits and Tax Implications

Company car tax offers significant benefits including reduced personal expense and simplified tax reporting compared to private vehicle tax, which often requires detailed record-keeping of mileage for business use. Employers typically cover maintenance, insurance, and fuel, lowering overall costs for employees while company car tax rates are generally based on the vehicle's CO2 emissions and list price, incentivizing environmentally friendly choices. Private vehicle tax involves claiming mileage allowances subject to HMRC rates, potentially resulting in higher taxable income and less predictable expenses.

Private Vehicle Ownership: Tax Advantages and Disadvantages

Private vehicle ownership offers tax advantages such as eligibility for certain deductions on mileage and fuel costs, which can reduce overall taxable income. However, disadvantages include the inability to claim full business-related expenses and potential higher personal tax liability compared to company cars. Understanding local tax regulations is essential to optimize benefits and minimize tax burdens associated with private vehicle use.

Tax Deductions for Company Cars Explained

Tax deductions for company cars often include allowances for depreciation, fuel expenses, and maintenance costs, reducing taxable income significantly. In contrast, private vehicle expenses are generally not deductible unless the vehicle is used strictly for business purposes, with detailed mileage logs required for validation. Understanding these distinctions helps businesses optimize tax savings by accurately reporting company car usage and related expenses.

Emissions and Their Impact on Car Tax Rates

Company car tax rates are heavily influenced by CO2 emissions, with higher-emission vehicles attracting increased tax burdens due to their environmental impact. Private vehicle tax, commonly known as road tax or Vehicle Excise Duty (VED), also depends on emissions, where lower-emission cars benefit from reduced rates or exemptions. This emissions-based tax system encourages the adoption of eco-friendly vehicles by linking car tax costs directly to carbon footprint.

Company Car Taxation: Eligibility and Criteria

Company car taxation applies when an employer provides a vehicle for an employee's personal and business use, with tax liability based on the vehicle's taxable value, CO2 emissions, and fuel type. Eligibility criteria include the vehicle being available for private use and owned or leased by the company, with specific rules governing electric and low-emission vehicles that can reduce the taxable benefit. Employers must report the company car benefit on employee tax returns, ensuring compliance with HMRC guidelines to avoid penalties.

Comparing Costs: Company Car vs Private Vehicle Tax

Company car tax is typically calculated based on the vehicle's list price, CO2 emissions, and the employee's income tax bracket, often resulting in higher taxable benefits than private vehicle tax, which relies mainly on fuel usage and mileage claims. Private vehicle tax expenses can be more manageable due to mileage reimbursement rates set by tax authorities, reducing overall taxable income impact. Comparing costs reveals that company car tax often carries higher fixed expenses while private vehicle tax allows for variable claims, making the latter more cost-efficient for infrequent or low-mileage users.

Choosing the Best Option: Factors to Consider

Company car tax is based on the vehicle's list price and CO2 emissions, while private vehicle tax depends on fuel type and engine size, influencing overall cost-effectiveness. Consider annual mileage, tax implications, and employee benefits when selecting between a company car or private vehicle to optimize tax savings. Evaluating depreciation rates, maintenance expenses, and personal usage patterns can further guide the best tax-efficient choice.

Company Car Tax vs Private Vehicle Tax Infographic

cardiffo.com

cardiffo.com