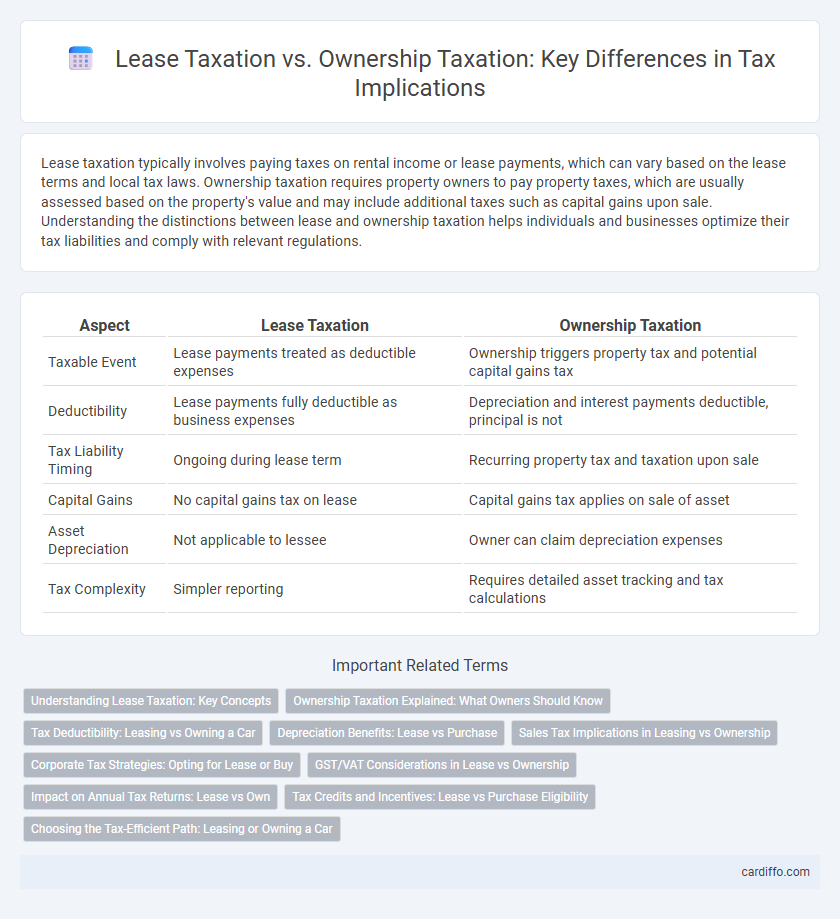

Lease taxation typically involves paying taxes on rental income or lease payments, which can vary based on the lease terms and local tax laws. Ownership taxation requires property owners to pay property taxes, which are usually assessed based on the property's value and may include additional taxes such as capital gains upon sale. Understanding the distinctions between lease and ownership taxation helps individuals and businesses optimize their tax liabilities and comply with relevant regulations.

Table of Comparison

| Aspect | Lease Taxation | Ownership Taxation |

|---|---|---|

| Taxable Event | Lease payments treated as deductible expenses | Ownership triggers property tax and potential capital gains tax |

| Deductibility | Lease payments fully deductible as business expenses | Depreciation and interest payments deductible, principal is not |

| Tax Liability Timing | Ongoing during lease term | Recurring property tax and taxation upon sale |

| Capital Gains | No capital gains tax on lease | Capital gains tax applies on sale of asset |

| Asset Depreciation | Not applicable to lessee | Owner can claim depreciation expenses |

| Tax Complexity | Simpler reporting | Requires detailed asset tracking and tax calculations |

Understanding Lease Taxation: Key Concepts

Lease taxation primarily focuses on the tax implications related to the use and occupancy of property without transferring ownership rights, involving terms such as leasehold improvements, rental income, and deductible expenses. Key concepts include distinguishing between operating and capital leases for tax purposes, as well as how lease payments are treated as deductible expenses for lessees, reducing taxable income. Understanding the differences in tax treatment between lessees and lessors is essential for compliance, accurate reporting, and optimizing tax benefits associated with leasing arrangements.

Ownership Taxation Explained: What Owners Should Know

Ownership taxation involves property taxes levied on real estate by local governments based on the assessed value of the property, impacting owners annually regardless of income or usage. Owners benefit from potential tax deductions such as mortgage interest and property tax payments, which can reduce taxable income on federal returns. Understanding capital gains tax implications upon sale and depreciation rules is crucial for maximizing tax efficiency and compliance in property ownership.

Tax Deductibility: Leasing vs Owning a Car

Lease payments are typically fully tax-deductible as a business expense, allowing companies to reduce taxable income more effectively compared to ownership. In contrast, owning a car offers tax deductions primarily through depreciation and interest expenses, which may be subject to limits and require record-keeping. The tax impact of leasing versus owning depends on factors such as vehicle use percentage, lease terms, and applicable tax regulations.

Depreciation Benefits: Lease vs Purchase

Depreciation benefits differ significantly between lease taxation and ownership taxation, with ownership allowing direct depreciation deductions on the asset's cost basis, thereby reducing taxable income over time. Lease payments are generally treated as operating expenses and fully deductible in the tax year they are paid, offering immediate expense recognition but no capital asset depreciation benefits. This distinction impacts long-term tax planning, where ownership offers accumulation of depreciation tax shields while leasing optimizes short-term cash flow through expense deductibility.

Sales Tax Implications in Leasing vs Ownership

Sales tax implications differ significantly between lease taxation and ownership taxation, impacting the overall cost structure for businesses and consumers. In leasing, sales tax is typically applied to each lease payment rather than the full purchase price, spreading the tax liability over time, whereas ownership requires a lump sum sales tax payment upfront on the total purchase price. This distinction can affect cash flow management and total tax expenses, with lease agreements sometimes qualifying for tax deductions on payments, while ownership offers depreciation benefits and potential sales tax credits upon resale.

Corporate Tax Strategies: Opting for Lease or Buy

Corporate tax strategies often weigh lease taxation against ownership taxation to optimize financial outcomes and cash flow management. Leasing allows companies to deduct lease payments as operating expenses, potentially reducing taxable income without increasing asset depreciation schedules. Ownership taxation provides benefits such as asset depreciation deductions and interest expense deductions on financed purchases, but involves capital investment and impacts balance sheet leverage ratios.

GST/VAT Considerations in Lease vs Ownership

GST/VAT treatment differs significantly between lease taxation and ownership taxation, primarily impacting cash flow and input tax credits. In lease agreements, lessees often claim input VAT on rental payments, enhancing liquidity, whereas ownership taxation involves VAT on asset acquisition, leading to a substantial upfront tax burden. Understanding these distinctions is crucial for businesses to optimize tax efficiency and compliance under GST/VAT regimes.

Impact on Annual Tax Returns: Lease vs Own

Lease taxation impacts annual tax returns primarily through deductible lease payments, which can reduce taxable income without affecting asset depreciation schedules. Ownership taxation requires accounting for property depreciation, interest deductions, and potential capital gains, influencing both current tax liabilities and future tax positions. Choosing between leasing and owning affects cash flow management and tax planning strategies, with ownership potentially offering long-term tax benefits through asset depreciation and equity build-up.

Tax Credits and Incentives: Lease vs Purchase Eligibility

Tax credits and incentives for lease agreements often differ from those available to property owners, with ownership typically qualifying for a broader range of deductions such as mortgage interest and property tax credits. Lease agreements may limit eligibility to specific credits related to energy-efficient improvements or business equipment leasing, lacking benefits tied to property ownership. Understanding the precise tax treatment in lease versus purchase scenarios is crucial for maximizing available tax advantages and minimizing overall tax liability.

Choosing the Tax-Efficient Path: Leasing or Owning a Car

Choosing between lease taxation and ownership taxation involves analyzing deductible expenses, depreciation allowances, and potential tax credits associated with each option. Leasing often allows for higher immediate deductions through lease payments, while ownership provides long-term benefits via asset depreciation and possible capital gains treatment upon sale. Evaluating individual tax brackets, usage needs, and state-specific tax laws ensures selecting the most tax-efficient path for vehicle acquisition.

Lease Taxation vs Ownership Taxation Infographic

cardiffo.com

cardiffo.com