Tax depreciation refers to the systematic allocation of an asset's cost over its useful life for tax reporting purposes, often following specific IRS guidelines. Market depreciation reflects the actual decrease in an asset's value over time based on market conditions and demand. Understanding the difference between tax depreciation and market depreciation is crucial for accurate financial reporting and strategic investment decisions.

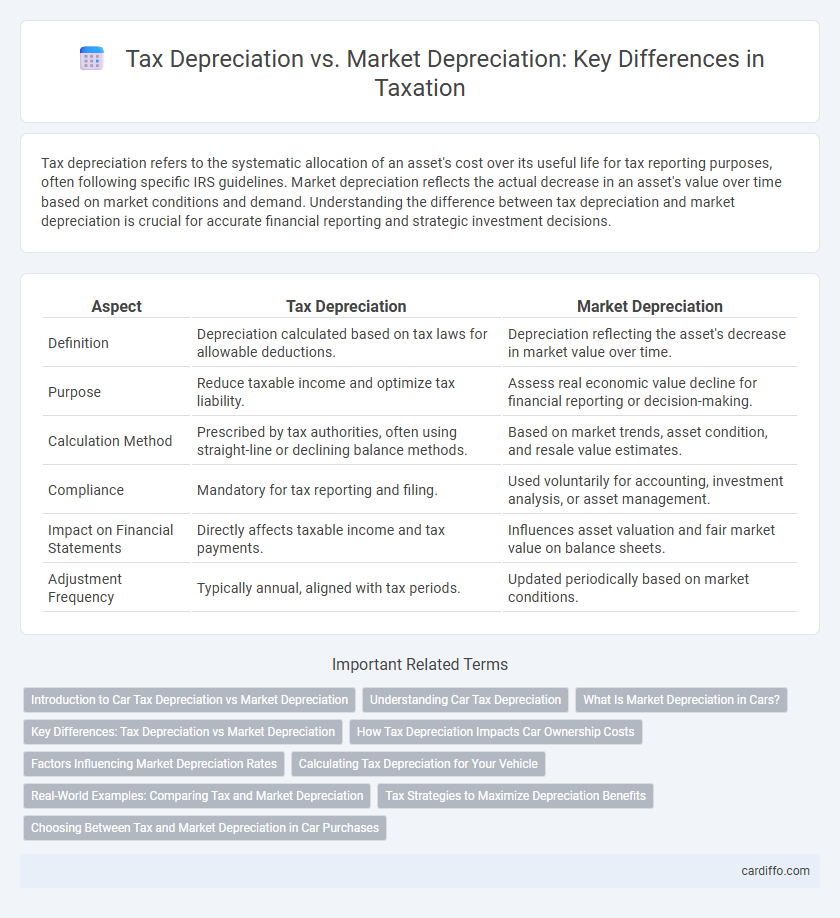

Table of Comparison

| Aspect | Tax Depreciation | Market Depreciation |

|---|---|---|

| Definition | Depreciation calculated based on tax laws for allowable deductions. | Depreciation reflecting the asset's decrease in market value over time. |

| Purpose | Reduce taxable income and optimize tax liability. | Assess real economic value decline for financial reporting or decision-making. |

| Calculation Method | Prescribed by tax authorities, often using straight-line or declining balance methods. | Based on market trends, asset condition, and resale value estimates. |

| Compliance | Mandatory for tax reporting and filing. | Used voluntarily for accounting, investment analysis, or asset management. |

| Impact on Financial Statements | Directly affects taxable income and tax payments. | Influences asset valuation and fair market value on balance sheets. |

| Adjustment Frequency | Typically annual, aligned with tax periods. | Updated periodically based on market conditions. |

Introduction to Car Tax Depreciation vs Market Depreciation

Tax depreciation allows businesses to deduct the cost of a vehicle over its useful life according to tax regulations, reducing taxable income. Market depreciation reflects the actual decline in the car's resale value due to factors like mileage, wear, and market demand. Understanding the distinction between tax depreciation and market depreciation helps optimize financial planning and tax strategy for vehicle assets.

Understanding Car Tax Depreciation

Car tax depreciation refers to the allowable deduction for a vehicle's loss in value as recognized by tax authorities, which often follows specific schedules or percentage rates set by tax codes. Market depreciation reflects the actual decline in a car's resale value determined by factors like age, condition, and demand, usually fluctuating more rapidly than tax depreciation. Understanding the distinction between tax depreciation and market depreciation helps optimize taxable income deductions while accurately assessing a car's true financial worth.

What Is Market Depreciation in Cars?

Market depreciation in cars refers to the decline in a vehicle's resale value over time due to factors like age, mileage, condition, and demand. Unlike tax depreciation, which follows IRS guidelines for deducting a vehicle's cost over its useful life, market depreciation reflects actual fluctuations in the open market. Understanding market depreciation is crucial for accurate car valuation, insurance claims, and private sales negotiations.

Key Differences: Tax Depreciation vs Market Depreciation

Tax depreciation calculates asset value reduction based on government tax codes and predetermined schedules, enabling businesses to deduct expenses and reduce taxable income. Market depreciation reflects the actual decline in an asset's value due to market conditions, usage, and wear, which may differ significantly from tax depreciation figures. The key difference lies in tax depreciation being a regulatory accounting method for tax benefits, while market depreciation represents real economic loss or gain in asset worth.

How Tax Depreciation Impacts Car Ownership Costs

Tax depreciation reduces taxable income by allowing vehicle owners to deduct a portion of the car's value each year, lowering overall tax liability and effectively decreasing the true cost of ownership. Unlike market depreciation, which reflects the actual decline in a car's resale value over time, tax depreciation follows predetermined schedules set by tax authorities, often accelerating deductions in early years. This tax benefit can improve cash flow and financial planning for businesses and individuals using vehicles for income-generating purposes.

Factors Influencing Market Depreciation Rates

Market depreciation rates are influenced by factors such as asset condition, technological advancements, and shifting consumer preferences, which directly impact the asset's resale value and useful life. Economic conditions and industry-specific trends also play critical roles, as they can accelerate obsolescence or increase demand for certain assets. Unlike tax depreciation, which follows standardized schedules set by tax authorities, market depreciation reflects real-time fluctuations in asset value driven by external market forces.

Calculating Tax Depreciation for Your Vehicle

Calculating tax depreciation for your vehicle involves using the IRS-approved methods such as the Modified Accelerated Cost Recovery System (MACRS) or Section 179 deduction, which determines the annual deductible amount based on the vehicle's purchase price and applicable recovery period. Market depreciation, reflecting the vehicle's actual loss in value due to wear and market conditions, typically differs from tax depreciation as it does not follow standardized schedules or tax guidelines. Accurate tax depreciation calculation maximizes deductible expenses, reducing taxable income and improving cash flow for businesses or vehicle owners.

Real-World Examples: Comparing Tax and Market Depreciation

Tax depreciation utilizes predefined schedules and allowable rates set by tax authorities, enabling businesses to deduct asset costs systematically over time, often resulting in accelerated expense recognition. Market depreciation reflects the actual decline in an asset's value due to factors such as wear and tear, technological obsolescence, and market demand fluctuations, which can diverge significantly from tax depreciation figures. For instance, commercial real estate may experience slower market depreciation compared to faster tax depreciation deductions allowed under IRS guidelines, impacting financial statements and tax liabilities differently.

Tax Strategies to Maximize Depreciation Benefits

Tax depreciation allows businesses to deduct the cost of assets over time using methods like the Modified Accelerated Cost Recovery System (MACRS), maximizing immediate tax savings. Market depreciation reflects the actual loss in asset value, which may differ from tax records but is not deductible for tax purposes. Strategic use of accelerated tax depreciation and bonus depreciation provisions can optimize cash flow by reducing taxable income sooner than market depreciation would indicate.

Choosing Between Tax and Market Depreciation in Car Purchases

Choosing between tax depreciation and market depreciation in car purchases hinges on the intended financial strategy and tax benefits. Tax depreciation allows businesses to deduct the vehicle's cost over its useful life for tax purposes, often using accelerated methods like the Modified Accelerated Cost Recovery System (MACRS), which can reduce taxable income more rapidly. Conversely, market depreciation reflects the actual decline in the car's resale value, influencing decisions for asset management but not directly impacting tax deductions.

Tax Depreciation vs Market Depreciation Infographic

cardiffo.com

cardiffo.com