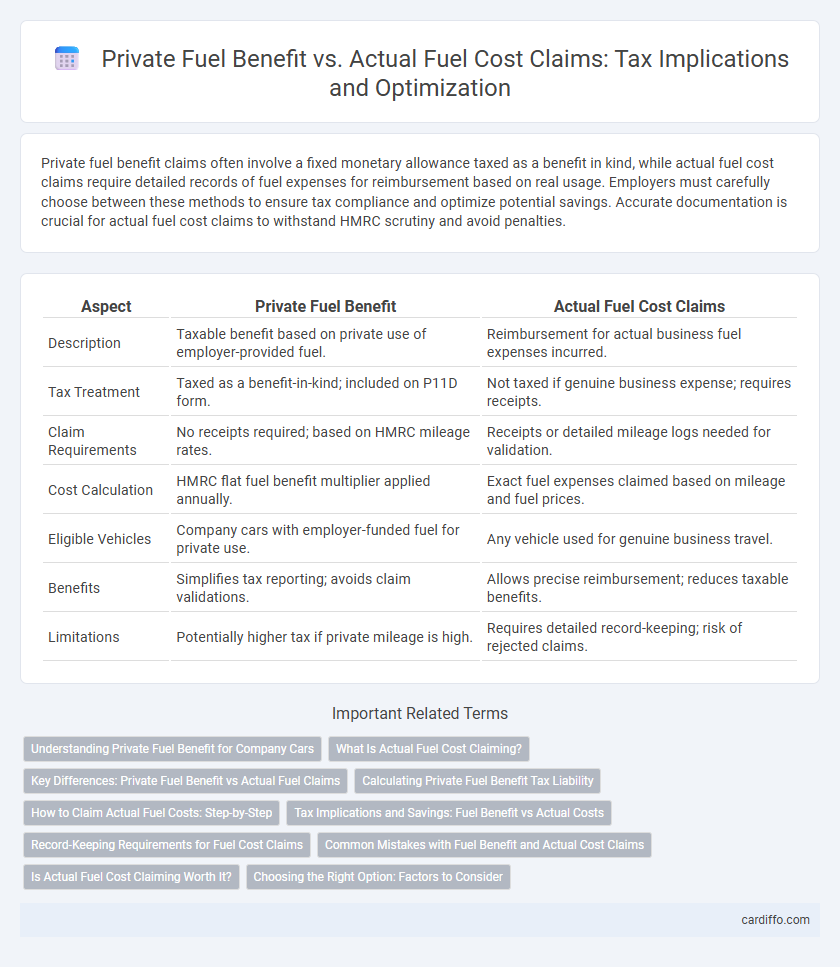

Private fuel benefit claims often involve a fixed monetary allowance taxed as a benefit in kind, while actual fuel cost claims require detailed records of fuel expenses for reimbursement based on real usage. Employers must carefully choose between these methods to ensure tax compliance and optimize potential savings. Accurate documentation is crucial for actual fuel cost claims to withstand HMRC scrutiny and avoid penalties.

Table of Comparison

| Aspect | Private Fuel Benefit | Actual Fuel Cost Claims |

|---|---|---|

| Description | Taxable benefit based on private use of employer-provided fuel. | Reimbursement for actual business fuel expenses incurred. |

| Tax Treatment | Taxed as a benefit-in-kind; included on P11D form. | Not taxed if genuine business expense; requires receipts. |

| Claim Requirements | No receipts required; based on HMRC mileage rates. | Receipts or detailed mileage logs needed for validation. |

| Cost Calculation | HMRC flat fuel benefit multiplier applied annually. | Exact fuel expenses claimed based on mileage and fuel prices. |

| Eligible Vehicles | Company cars with employer-funded fuel for private use. | Any vehicle used for genuine business travel. |

| Benefits | Simplifies tax reporting; avoids claim validations. | Allows precise reimbursement; reduces taxable benefits. |

| Limitations | Potentially higher tax if private mileage is high. | Requires detailed record-keeping; risk of rejected claims. |

Understanding Private Fuel Benefit for Company Cars

Private Fuel Benefit for company cars is a taxable benefit calculated based on the vehicle's list price and fuel provided by the employer for personal use. Employees must report this benefit on their tax returns, and it is separate from actual fuel cost claims, which require precise records of mileage and expenses for business use reimbursement. Understanding the distinction helps ensure compliance with HMRC regulations and optimizes tax liabilities related to company car fuel expenses.

What Is Actual Fuel Cost Claiming?

Actual Fuel Cost Claiming allows employees to recover the precise expenses incurred for business mileage, supported by accurate records of fuel purchases and vehicle usage. Unlike Private Fuel Benefit calculations that use a standardized method, actual cost claims require detailed documentation, such as receipts and mileage logs, to substantiate reimbursement. This approach minimizes taxable benefits by ensuring that only fuel costs directly related to business travel are claimed.

Key Differences: Private Fuel Benefit vs Actual Fuel Claims

Private Fuel Benefit involves calculating a taxable benefit based on the Vehicle Benefit Charge and an approved mileage rate, whereas Actual Fuel Cost Claims require submission of detailed receipts to claim reimbursement for business-related fuel expenses. The Private Fuel Benefit is typically a fixed amount assessed by HMRC rules, while Actual Fuel Cost Claims fluctuate according to real expenditure backed by evidence. Employers and employees must carefully distinguish between these methods to ensure accurate tax reporting and compliance with HMRC guidelines.

Calculating Private Fuel Benefit Tax Liability

Calculating private fuel benefit tax liability requires understanding the annual fuel benefit charge, which is based on the car's list price and the applicable fuel multiplier set by HMRC. Employers must add the cash equivalent of private fuel to the employee's taxable income, considering actual fuel cost claims where fuel is used solely for business purposes. Accurate record-keeping of mileage and fuel expenses is essential to ensure precise reporting and avoid overpayment or penalties on the taxable benefit.

How to Claim Actual Fuel Costs: Step-by-Step

To claim actual fuel costs for tax purposes, employees must maintain detailed mileage records, including business miles, fuel receipts, and vehicle logbooks. Submit an accurate mileage claim form or expense report to the employer or tax authority, supporting the claim with all relevant documentation. Ensure compliance with HMRC guidelines by distinguishing business use fuel expenses from private use to accurately calculate allowable deductions.

Tax Implications and Savings: Fuel Benefit vs Actual Costs

Private fuel benefit charges apply when employers provide fuel for personal use in company vehicles, resulting in taxable benefits calculated based on the car's list price and CO2 emissions. Claiming actual fuel costs instead requires detailed mileage records separating business and personal use, potentially reducing taxable benefits if personal fuel consumption is low. Careful comparison between the fixed fuel benefit charge and actual costs claims can result in significant tax savings by minimizing the reported fuel benefit value subject to income tax.

Record-Keeping Requirements for Fuel Cost Claims

For fuel cost claims, meticulous record-keeping is mandatory, including detailed logs of mileage, fuel receipts, and vehicle usage to substantiate actual expenses incurred. HMRC requires employees to maintain these documents to validate claims against the Private Fuel Benefit, ensuring compliance and preventing penalties. Proper documentation supports accurate tax reporting and facilitates efficient audits or reviews by tax authorities.

Common Mistakes with Fuel Benefit and Actual Cost Claims

Common mistakes with private fuel benefit and actual cost claims include incorrect calculation of taxable benefits, failure to maintain accurate mileage records, and misunderstanding the distinction between business and private use. Claimants often overlook the requirement to substantiate actual fuel expenses with detailed receipts, leading to disallowed deductions or additional tax liabilities. Misclassification of fuel usage and improper application of HMRC guidelines frequently result in compliance issues and penalties.

Is Actual Fuel Cost Claiming Worth It?

Claiming actual fuel costs for tax purposes often requires detailed record-keeping of every trip and fuel purchase, which can be time-consuming but may result in greater tax relief compared to the private fuel benefit charge. Assessing the total annual mileage and fuel expenditure versus the fixed private fuel benefit rate is crucial to determine whether the additional effort in tracking actual costs yields significant tax savings. For high-mileage drivers or those with fluctuating fuel prices, actual fuel cost claims can be more advantageous, but for low or moderate private use, the private fuel benefit might simplify tax calculations without losing value.

Choosing the Right Option: Factors to Consider

When deciding between Private Fuel Benefit and Actual Fuel Cost Claims, consider factors such as the frequency of business travel, the accuracy of mileage records, and the potential tax implications of each method. Private Fuel Benefit provides a fixed taxable benefit based on vehicle type and fuel usage, while Actual Fuel Cost Claims require detailed documentation but may result in more precise reimbursement. Evaluating the consistency of fuel expenses and administrative ease helps determine the most tax-efficient and compliant option for your situation.

Private Fuel Benefit vs Actual Fuel Cost Claims Infographic

cardiffo.com

cardiffo.com