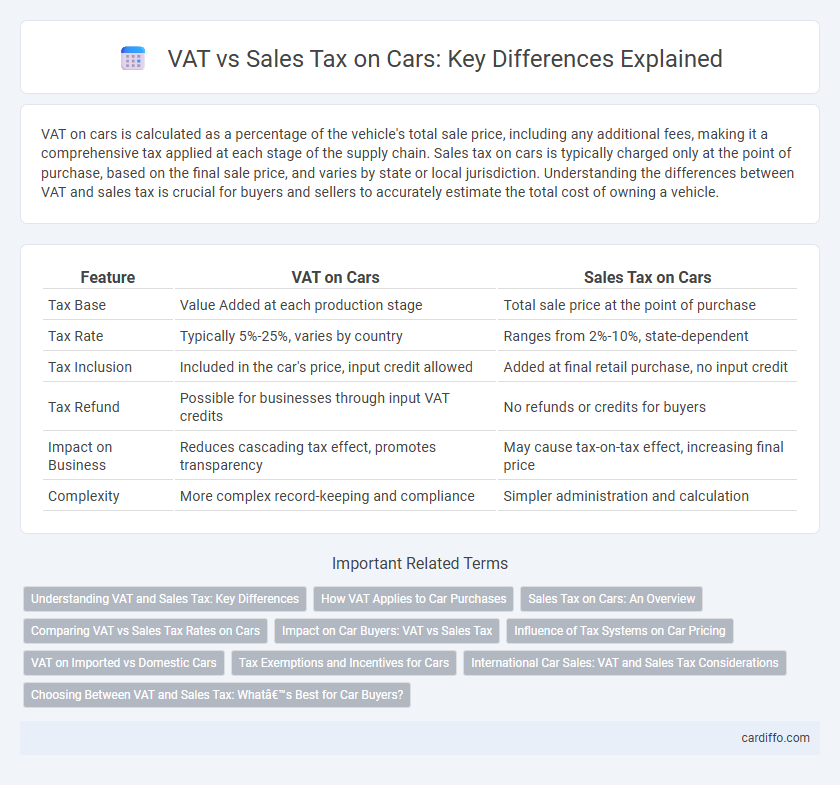

VAT on cars is calculated as a percentage of the vehicle's total sale price, including any additional fees, making it a comprehensive tax applied at each stage of the supply chain. Sales tax on cars is typically charged only at the point of purchase, based on the final sale price, and varies by state or local jurisdiction. Understanding the differences between VAT and sales tax is crucial for buyers and sellers to accurately estimate the total cost of owning a vehicle.

Table of Comparison

| Feature | VAT on Cars | Sales Tax on Cars |

|---|---|---|

| Tax Base | Value Added at each production stage | Total sale price at the point of purchase |

| Tax Rate | Typically 5%-25%, varies by country | Ranges from 2%-10%, state-dependent |

| Tax Inclusion | Included in the car's price, input credit allowed | Added at final retail purchase, no input credit |

| Tax Refund | Possible for businesses through input VAT credits | No refunds or credits for buyers |

| Impact on Business | Reduces cascading tax effect, promotes transparency | May cause tax-on-tax effect, increasing final price |

| Complexity | More complex record-keeping and compliance | Simpler administration and calculation |

Understanding VAT and Sales Tax: Key Differences

VAT on cars is a consumption tax levied at each stage of the supply chain based on the value added, allowing businesses to reclaim VAT paid on purchases, thereby reducing the effective tax burden. Sales tax on cars is a direct tax applied only at the point of sale to the end consumer, calculated as a percentage of the final sale price without input tax credits. Understanding these key differences is crucial for consumers and dealers to navigate pricing, tax compliance, and potential cost savings effectively.

How VAT Applies to Car Purchases

Value-Added Tax (VAT) on car purchases is applied as a percentage of the vehicle's sale price at each stage of the supply chain, ensuring tax is paid on the value added rather than the total price alone. Unlike sales tax, which is levied only at the final retail sale to the consumer, VAT is collected incrementally from manufacturers, wholesalers, and retailers, allowing for input tax credits and reducing tax cascading. This system impacts the final cost of cars differently depending on the country's VAT rate and the eligibility for VAT refunds or exemptions, making purchase cost analysis essential for buyers and dealers.

Sales Tax on Cars: An Overview

Sales tax on cars is a percentage-based tax levied at the point of purchase, varying by state and local jurisdictions in the United States. Unlike VAT, which is applied at each stage of production, sales tax is typically charged only once when the vehicle is sold to the end consumer. Rates can range from 2.9% to over 10%, impacting the final purchase price significantly depending on regional tax policies.

Comparing VAT vs Sales Tax Rates on Cars

VAT on cars typically ranges from 5% to 20% depending on the country, reflecting a consumption-based tax included in the sale price, while sales tax on cars varies widely, often between 2% and 10%, and is applied at the point of sale separately. VAT rates are generally uniform across goods and services within a jurisdiction, providing consistency in taxation, whereas sales tax rates can differ by state or municipality, creating variability in the final cost of a vehicle. Comparing these rates reveals that VAT tends to result in a higher effective tax burden on car purchases in regions where it is applied at standard or elevated rates compared to sales tax systems with lower, localized percentages.

Impact on Car Buyers: VAT vs Sales Tax

VAT on cars increases the upfront cost by a percentage of the vehicle's total price, including optional add-ons, making the final purchase price higher for buyers. Sales tax is typically applied only to the sale price, potentially resulting in a lower tax burden compared to VAT, especially on used cars or vehicles with dealer incentives. Buyers must consider how each tax type affects the total cost of ownership, as VAT can be integrated into the price while sales tax often appears as a separate additional charge at purchase.

Influence of Tax Systems on Car Pricing

Value-added tax (VAT) on cars is typically included at each stage of production and distribution, leading to a cumulative impact on the final car price, while sales tax is applied only once at the point of purchase, affecting consumer pricing directly. Countries implementing VAT tend to have more transparent and traceable tax flows, which can influence manufacturer pricing strategies and dealer markups. Sales tax systems often result in higher upfront costs for consumers but simpler accounting for businesses, shaping the overall cost structure and demand elasticity in car markets.

VAT on Imported vs Domestic Cars

VAT on imported cars is typically calculated based on the total customs value, including shipping and insurance, resulting in a higher taxable amount compared to domestic vehicles. Domestic cars are subject to VAT calculated on the factory price or dealer invoice, often benefiting from reduced logistics costs, which lowers the overall VAT liability. This distinction affects pricing strategies, with imported cars generally carrying a higher VAT cost due to cumulative import duties and value-added tax on the full landed cost.

Tax Exemptions and Incentives for Cars

VAT on cars often includes specific tax exemptions and incentives for electric and hybrid vehicles, reducing the overall purchase cost to promote environmentally friendly options. Sales tax exemptions typically apply to certain categories such as government vehicles, charitable organizations, or agricultural vehicles, helping to lower the tax burden for qualifying buyers. Incentive programs may also offer rebates or credits that offset either VAT or sales tax, encouraging the adoption of cleaner technologies and easing the financial impact on consumers.

International Car Sales: VAT and Sales Tax Considerations

International car sales involve careful consideration of VAT (Value-Added Tax) and sales tax, which vary significantly by country and impact the final purchase price. VAT is typically applied as a percentage of the vehicle's value at each stage of the supply chain, offering input tax credits, whereas sales tax is usually a one-time charge at the point of sale without such credits. Understanding the destination country's tax regulations is crucial for dealers and buyers to accurately calculate costs and ensure compliance in cross-border car transactions.

Choosing Between VAT and Sales Tax: What’s Best for Car Buyers?

Car buyers benefit from understanding the key differences between VAT and sales tax, as VAT applies uniformly to the value added at each stage of production, often included in the price, while sales tax is typically a one-time charge at the point of purchase. Choosing VAT can offer more transparency in the pricing structure and potential credits for businesses, whereas sales tax might result in higher upfront costs due to lack of input tax credits. Evaluating factors like the total purchase price, tax recovery possibilities, and regional tax rates helps optimize cost efficiency when deciding between VAT and sales tax on cars.

VAT on Cars vs Sales Tax on Cars Infographic

cardiffo.com

cardiffo.com