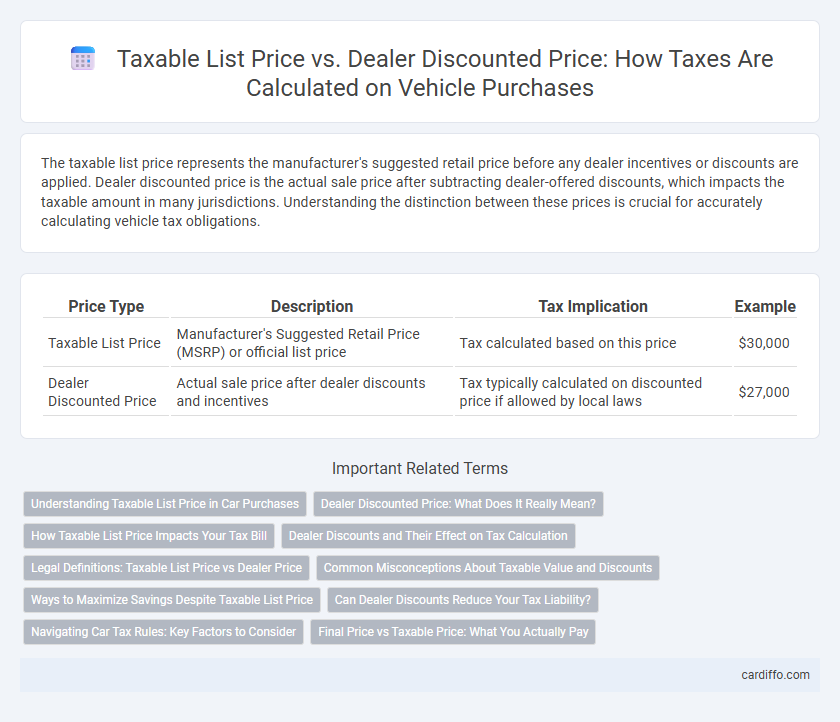

The taxable list price represents the manufacturer's suggested retail price before any dealer incentives or discounts are applied. Dealer discounted price is the actual sale price after subtracting dealer-offered discounts, which impacts the taxable amount in many jurisdictions. Understanding the distinction between these prices is crucial for accurately calculating vehicle tax obligations.

Table of Comparison

| Price Type | Description | Tax Implication | Example |

|---|---|---|---|

| Taxable List Price | Manufacturer's Suggested Retail Price (MSRP) or official list price | Tax calculated based on this price | $30,000 |

| Dealer Discounted Price | Actual sale price after dealer discounts and incentives | Tax typically calculated on discounted price if allowed by local laws | $27,000 |

Understanding Taxable List Price in Car Purchases

Taxable List Price refers to the manufacturer's suggested retail price (MSRP) used by tax authorities to calculate sales tax on car purchases, regardless of dealer discounts or negotiated prices. While the dealer discounted price reflects the actual transaction amount paid by the buyer, many states base sales tax on the higher taxable list price to maximize tax revenue. Understanding this distinction is crucial for accurate tax liability assessment and budgeting when buying a vehicle.

Dealer Discounted Price: What Does It Really Mean?

Dealer Discounted Price represents the actual transaction amount after the dealer reduces the Manufacturer's Suggested Retail Price (MSRP) through incentives, rebates, or negotiations, impacting the taxable amount for sales tax calculations. Unlike the Taxable List Price, which is the MSRP or the vehicle's fair market value used by tax authorities, the Dealer Discounted Price reflects the final sale price paid by the buyer. Understanding this distinction is critical for accurately assessing tax liabilities and ensuring compliance with state-specific taxation rules.

How Taxable List Price Impacts Your Tax Bill

The Taxable List Price determines the base amount on which sales tax is calculated, directly impacting your overall tax bill. Even if you negotiate a Dealer Discounted Price, the tax authorities typically assess taxes based on the higher Taxable List Price, leading to a potentially higher tax liability. Understanding this distinction is crucial for accurately forecasting your total vehicle purchase cost and managing your tax obligations.

Dealer Discounts and Their Effect on Tax Calculation

Dealer discounts directly reduce the taxable list price, which in turn lowers the amount of sales tax owed on a vehicle purchase. Tax authorities typically calculate tax based on the dealer discounted price rather than the sticker price, making these discounts critical in determining final tax liability. Understanding how dealer incentives and rebates affect the taxable amount ensures precise tax reporting and compliance.

Legal Definitions: Taxable List Price vs Dealer Price

The Taxable List Price generally refers to the manufacturer's suggested retail price (MSRP) that serves as the legal benchmark for calculating sales tax on vehicles, distinct from the dealer discounted price, which is the negotiated amount a buyer pays after dealer incentives. Legal definitions typically mandate that taxes are assessed based on the Taxable List Price regardless of discounts to ensure consistent tax revenue and prevent evasion through arbitrary price reductions. Understanding the distinction between these prices is crucial for compliance with state taxation laws and accurate tax reporting.

Common Misconceptions About Taxable Value and Discounts

Taxable list price is often misunderstood as the amount on which sales tax is calculated, but most jurisdictions require tax to be paid on the dealer discounted price, reflecting the actual sale transaction value. Many taxpayers incorrectly assume that pre-discount prices determine tax liability, leading to overpayment or disputes during audits. Clarifying that sales tax is based on the final negotiated price ensures accurate tax reporting and compliance with state and local tax regulations.

Ways to Maximize Savings Despite Taxable List Price

Maximizing savings despite a high taxable list price involves negotiating dealer discounts, leveraging manufacturer incentives, and exploring trade-in values to reduce the overall taxable amount. Understanding state-specific tax regulations and utilizing tax credits or deductions related to the purchase can further lower the effective tax burden. Carefully structuring the transaction to separate taxable and non-taxable fees ensures minimizing taxes on ancillary costs.

Can Dealer Discounts Reduce Your Tax Liability?

Dealer discounts lower the purchase price of a vehicle, but tax liability is typically based on the taxable list price or the vehicle's fair market value as determined by tax authorities. Most tax jurisdictions calculate sales tax on the manufacturer's suggested retail price (MSRP) or the vehicle's invoice price before dealer discounts are applied. Therefore, while dealer discounts reduce your out-of-pocket expense, they usually do not reduce your taxable amount for state or local sales taxes.

Navigating Car Tax Rules: Key Factors to Consider

Understanding the distinctions between the taxable list price and the dealer discounted price is crucial for accurately calculating vehicle tax obligations. Tax authorities often base sales tax on the manufacturer's suggested retail price (MSRP) rather than the final transaction price after dealer discounts, impacting the total tax liability. Buyers should verify local tax regulations and consult with dealerships to ensure compliance and optimize tax benefits when purchasing a car.

Final Price vs Taxable Price: What You Actually Pay

The Taxable List Price is the official manufacturer's suggested retail price used to calculate the sales tax, while the Dealer Discounted Price reflects the negotiated amount the buyer actually pays. Although the dealer discount reduces the final purchase price, sales tax is generally applied to the higher Taxable List Price, influencing the total cost. Understanding the distinction between these two prices clarifies why your final payment can exceed the apparent discounted price due to tax implications.

Taxable List Price vs Dealer Discounted Price Infographic

cardiffo.com

cardiffo.com