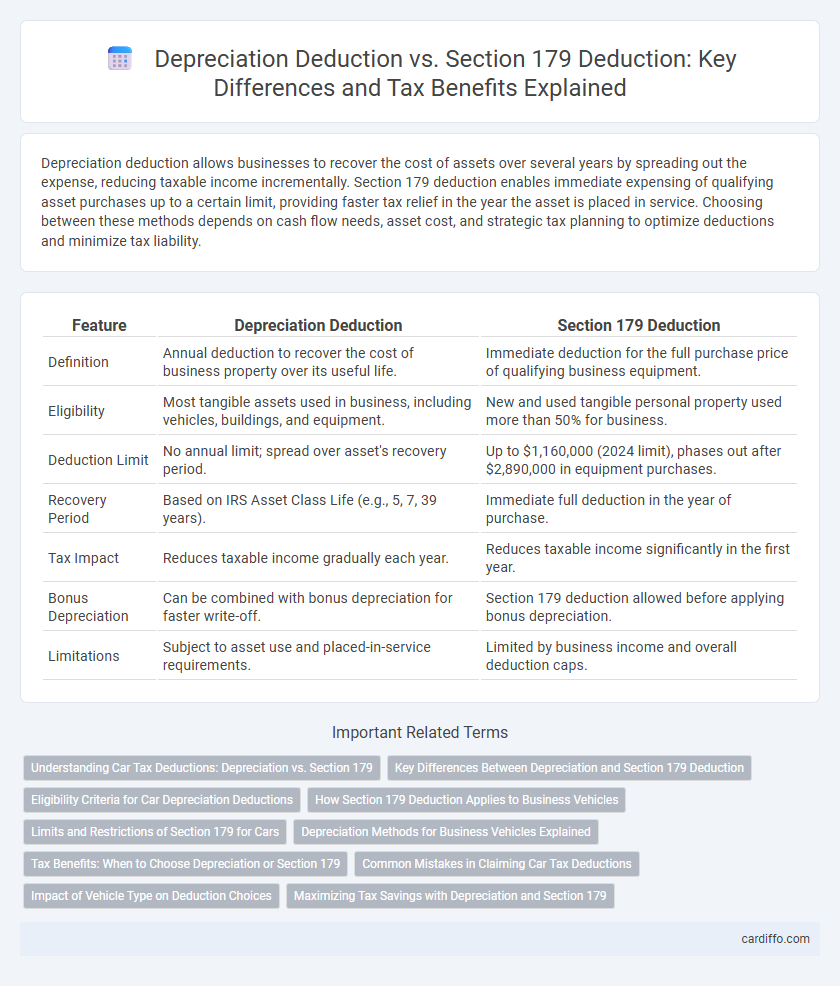

Depreciation deduction allows businesses to recover the cost of assets over several years by spreading out the expense, reducing taxable income incrementally. Section 179 deduction enables immediate expensing of qualifying asset purchases up to a certain limit, providing faster tax relief in the year the asset is placed in service. Choosing between these methods depends on cash flow needs, asset cost, and strategic tax planning to optimize deductions and minimize tax liability.

Table of Comparison

| Feature | Depreciation Deduction | Section 179 Deduction |

|---|---|---|

| Definition | Annual deduction to recover the cost of business property over its useful life. | Immediate deduction for the full purchase price of qualifying business equipment. |

| Eligibility | Most tangible assets used in business, including vehicles, buildings, and equipment. | New and used tangible personal property used more than 50% for business. |

| Deduction Limit | No annual limit; spread over asset's recovery period. | Up to $1,160,000 (2024 limit), phases out after $2,890,000 in equipment purchases. |

| Recovery Period | Based on IRS Asset Class Life (e.g., 5, 7, 39 years). | Immediate full deduction in the year of purchase. |

| Tax Impact | Reduces taxable income gradually each year. | Reduces taxable income significantly in the first year. |

| Bonus Depreciation | Can be combined with bonus depreciation for faster write-off. | Section 179 deduction allowed before applying bonus depreciation. |

| Limitations | Subject to asset use and placed-in-service requirements. | Limited by business income and overall deduction caps. |

Understanding Car Tax Deductions: Depreciation vs. Section 179

Car tax deductions allow businesses to recover vehicle costs through depreciation or Section 179 deductions, each impacting tax liability differently. Depreciation spreads the expense over several years according to IRS schedules, while Section 179 enables immediate full deduction of qualifying vehicle costs up to set limits. Understanding the difference helps optimize tax benefits, especially for vehicles used more than 50% for business purposes.

Key Differences Between Depreciation and Section 179 Deduction

Depreciation deduction allows businesses to recover the cost of an asset over its useful life through annual deductions, while Section 179 deduction enables immediate expensing of the entire cost of qualifying property in the year of purchase. Unlike depreciation, Section 179 has an annual maximum deduction limit and applies only to certain tangible property used for business purposes. Depreciation deductions continue over several years regardless of the asset's total purchase price, making Section 179 more advantageous for accelerating tax benefits on eligible assets.

Eligibility Criteria for Car Depreciation Deductions

Eligible vehicles for depreciation deduction must be used more than 50% for business purposes and meet IRS weight and usage classifications. Section 179 Deduction requires the vehicle to be purchased, placed in service during the tax year, and meet limits on gross vehicle weight, typically under 6,000 pounds for passenger vehicles. Luxury auto limits and strict business use percentage rules apply differently to each deduction, impacting the eligibility and calculation of car depreciation benefits.

How Section 179 Deduction Applies to Business Vehicles

Section 179 deduction allows businesses to immediately expense the cost of qualifying business vehicles up to a specified limit, providing significant tax savings in the year of purchase. This deduction is particularly beneficial for SUVs, trucks, and vans with a gross vehicle weight rating (GVWR) over 6,000 pounds, which may qualify for higher expense limits compared to standard vehicles. Unlike regular depreciation deductions, which spread the cost over several years, Section 179 accelerates tax relief, improving cash flow for business owners investing in eligible vehicles.

Limits and Restrictions of Section 179 for Cars

Section 179 deduction for cars is subject to strict limits, with a maximum expense deduction capped at $11,160 for passenger vehicles and $11,560 for trucks and SUVs in the 2024 tax year. Luxury auto limits restrict the amount that can be expensed, contrasting with standard depreciation deductions that allow gradual cost recovery over several years. Taxpayers must also consider business-use percentage requirements and total equipment purchase caps, as Section 179 cannot exceed the taxable income from the active business.

Depreciation Methods for Business Vehicles Explained

Business vehicles can be depreciated using several methods, including the Modified Accelerated Cost Recovery System (MACRS) which spreads the cost over a set number of years, typically five for vehicles. The Section 179 deduction allows businesses to immediately expense the full purchase price of qualifying vehicles up to a limit, providing faster tax relief compared to MACRS. Understanding the choice between depreciation methods impacts cash flow and tax strategy, with MACRS offering gradual deductions and Section 179 enabling upfront expense recognition.

Tax Benefits: When to Choose Depreciation or Section 179

Depreciation deduction spreads the cost of an asset over its useful life, offering gradual tax benefits and reducing taxable income each year. Section 179 deduction allows businesses to immediately expense the full cost of qualifying assets up to a specified limit, providing significant upfront tax relief. Choosing between them depends on current year profitability and cash flow needs, with Section 179 preferred for immediate tax savings and depreciation for long-term tax planning.

Common Mistakes in Claiming Car Tax Deductions

Taxpayers often confuse depreciation deduction with Section 179 deduction when claiming car expenses, mistakenly applying full Section 179 limits to vehicles that do not qualify. Common errors include neglecting the passenger vehicle limits imposed by the IRS, leading to improper deduction amounts and potential audits. Accurately distinguishing between these deductions and adhering to annual mileage and cost thresholds is essential to avoid penalties and maximize tax benefits.

Impact of Vehicle Type on Deduction Choices

Depreciation deduction and Section 179 deduction vary significantly based on the type of vehicle used for business purposes, with heavier vehicles like SUVs and trucks often qualifying for higher immediate expensing under Section 179. Passenger cars face stricter limits on annual depreciation and Section 179 deductions, making depreciation methods more beneficial over time. The choice between these deductions depends on vehicle weight, IRS classifications, and overall tax strategy to maximize write-offs.

Maximizing Tax Savings with Depreciation and Section 179

Maximizing tax savings involves strategically leveraging both depreciation deduction and Section 179 deduction to reduce taxable income. Depreciation spreads the cost of an asset over its useful life, while Section 179 allows immediate expensing of qualifying property up to a specified limit, accelerating tax benefits. Combining these methods optimizes cash flow by balancing immediate deductions with long-term asset cost recovery.

Depreciation Deduction vs Section 179 Deduction Infographic

cardiffo.com

cardiffo.com