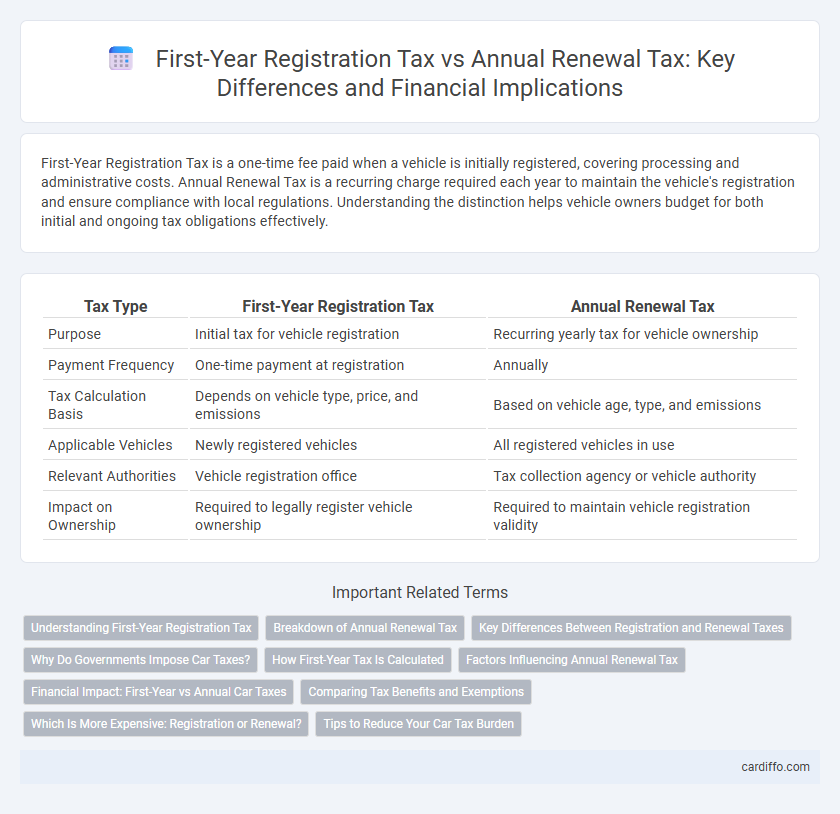

First-Year Registration Tax is a one-time fee paid when a vehicle is initially registered, covering processing and administrative costs. Annual Renewal Tax is a recurring charge required each year to maintain the vehicle's registration and ensure compliance with local regulations. Understanding the distinction helps vehicle owners budget for both initial and ongoing tax obligations effectively.

Table of Comparison

| Tax Type | First-Year Registration Tax | Annual Renewal Tax |

|---|---|---|

| Purpose | Initial tax for vehicle registration | Recurring yearly tax for vehicle ownership |

| Payment Frequency | One-time payment at registration | Annually |

| Tax Calculation Basis | Depends on vehicle type, price, and emissions | Based on vehicle age, type, and emissions |

| Applicable Vehicles | Newly registered vehicles | All registered vehicles in use |

| Relevant Authorities | Vehicle registration office | Tax collection agency or vehicle authority |

| Impact on Ownership | Required to legally register vehicle ownership | Required to maintain vehicle registration validity |

Understanding First-Year Registration Tax

First-Year Registration Tax is a mandatory fee imposed when a vehicle is registered for the first time, reflecting factors like vehicle type, engine capacity, and emissions. This tax is typically higher than the Annual Renewal Tax, which is a recurring fee paid yearly for vehicle ownership continuation. Understanding First-Year Registration Tax is crucial for taxpayers to anticipate initial costs and comply with local tax regulations effectively.

Breakdown of Annual Renewal Tax

The Annual Renewal Tax for businesses typically includes fixed fees, variable charges based on revenue or property value, and specific surcharges such as environmental or local improvement levies. In contrast to the one-time First-Year Registration Tax, which covers initial setup and registration costs, the Annual Renewal Tax ensures ongoing compliance and operational legitimacy. Detailed breakdowns vary by jurisdiction but often encompass municipal taxes, state fees, and sector-specific assessments essential for continuous business authorization.

Key Differences Between Registration and Renewal Taxes

First-year registration tax is a one-time fee imposed when a taxpayer or entity initially registers with tax authorities, reflecting the administrative costs of onboarding. Annual renewal tax is a recurring charge required each year to maintain active tax status and compliance, ensuring continued eligibility for business operations or tax benefits. Key differences lie in timing, frequency, and purpose: registration tax occurs once at inception, while renewal tax is periodic, supporting ongoing regulatory oversight.

Why Do Governments Impose Car Taxes?

Governments impose car taxes such as first-year registration tax and annual renewal tax to generate essential revenue for public infrastructure maintenance and development, including roads and transportation systems. These taxes also serve to regulate vehicle ownership, encouraging environmentally friendly choices and reducing congestion and pollution. By differentiating initial registration fees from ongoing renewal costs, governments can balance fiscal needs with incentives for sustainable vehicle use.

How First-Year Tax Is Calculated

First-year registration tax is typically calculated based on the vehicle's type, engine size, CO2 emissions, and market value at the time of registration, setting a baseline cost for new vehicle entry. This initial tax often combines fixed rates and variable charges linked to environmental criteria to encourage eco-friendly choices. Annual renewal tax, by contrast, usually depends on factors like vehicle age and emissions but does not include the upfront registration fees included in the first year.

Factors Influencing Annual Renewal Tax

Annual Renewal Tax is primarily influenced by the type of business entity, its annual turnover, and the location of operations, which determine the applicable tax rates and thresholds. Changes in asset valuation, compliance history, and any adjustments in government tax policies also play critical roles in recalculating the renewal tax amount. Understanding these factors ensures accurate financial planning and compliance with local tax authorities.

Financial Impact: First-Year vs Annual Car Taxes

First-year registration tax typically incurs a higher financial impact as it includes initial fees, vehicle assessments, and administrative charges, often surpassing the cost of annual renewal taxes. Annual renewal tax, calculated based on vehicle type, engine size, and emissions, provides a predictable, recurring expense that tends to be lower than the initial registration. Understanding the distinction between these taxes helps in budgeting vehicle ownership costs effectively.

Comparing Tax Benefits and Exemptions

First-year registration tax often includes significant exemptions or reductions to incentivize new vehicle purchases, such as lower rates for electric or hybrid cars. Annual renewal tax typically applies standard rates based on vehicle type, engine size, or emissions, with fewer exemptions compared to initial registration. Understanding differences in tax benefits and exemptions between these two can lead to substantial savings for vehicle owners and businesses managing fleets.

Which Is More Expensive: Registration or Renewal?

First-year registration tax typically involves higher fees due to initial processing, documentation, and administrative costs associated with new registrations. Annual renewal tax is often lower, reflecting routine maintenance and ongoing compliance expenses rather than initial setup costs. Businesses should evaluate local tax regulations to determine exact cost differences, as rates can vary significantly by jurisdiction.

Tips to Reduce Your Car Tax Burden

To reduce your car tax burden, focus on selecting a vehicle with lower emissions as first-year registration tax rates often depend on CO2 output. Opt for hybrid or electric models to benefit from reduced or zero annual renewal tax fees. Regularly review local tax regulations to take advantage of available exemptions or discounts based on age, usage, or environmental impact.

First-Year Registration Tax vs Annual Renewal Tax Infographic

cardiffo.com

cardiffo.com