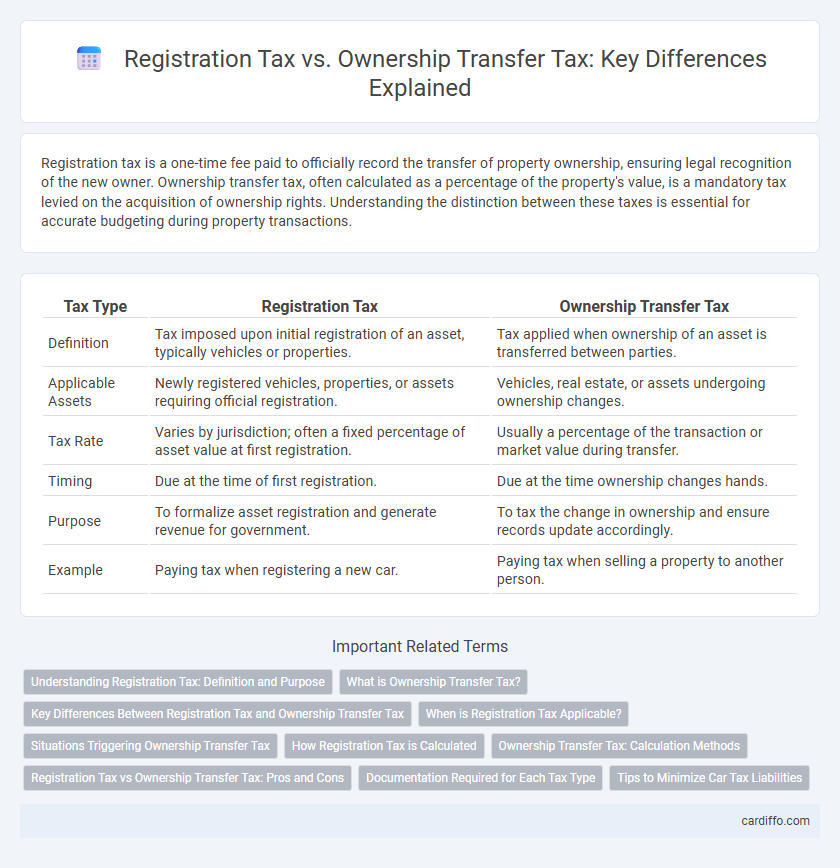

Registration tax is a one-time fee paid to officially record the transfer of property ownership, ensuring legal recognition of the new owner. Ownership transfer tax, often calculated as a percentage of the property's value, is a mandatory tax levied on the acquisition of ownership rights. Understanding the distinction between these taxes is essential for accurate budgeting during property transactions.

Table of Comparison

| Tax Type | Registration Tax | Ownership Transfer Tax |

|---|---|---|

| Definition | Tax imposed upon initial registration of an asset, typically vehicles or properties. | Tax applied when ownership of an asset is transferred between parties. |

| Applicable Assets | Newly registered vehicles, properties, or assets requiring official registration. | Vehicles, real estate, or assets undergoing ownership changes. |

| Tax Rate | Varies by jurisdiction; often a fixed percentage of asset value at first registration. | Usually a percentage of the transaction or market value during transfer. |

| Timing | Due at the time of first registration. | Due at the time ownership changes hands. |

| Purpose | To formalize asset registration and generate revenue for government. | To tax the change in ownership and ensure records update accordingly. |

| Example | Paying tax when registering a new car. | Paying tax when selling a property to another person. |

Understanding Registration Tax: Definition and Purpose

Registration tax is a mandatory fee imposed on the formal recording of property or vehicle ownership with government authorities, ensuring legal recognition and protection of ownership rights. It serves to validate transactions and provide public notice of ownership changes, supporting transparency and reducing disputes. This tax is distinct from ownership transfer tax, which specifically targets the transfer event, while registration tax applies to the official registration process itself.

What is Ownership Transfer Tax?

Ownership Transfer Tax is a fiscal levy imposed when the legal ownership of a property or asset changes hands, distinct from Registration Tax which is charged for registering the transaction. This tax is calculated based on the asset's market value or the agreed sale price, ensuring governments collect revenue during ownership succession. Understanding the specific rates and exemptions applied by local tax authorities is crucial for accurate financial planning in property transactions.

Key Differences Between Registration Tax and Ownership Transfer Tax

Registration tax is imposed on the formal entry of a new asset, typically real estate or vehicles, into official records, reflecting the administrative cost of legal documentation. Ownership transfer tax applies specifically to the act of transferring property rights from one party to another, often calculated as a percentage of the asset's sale value. Key differences include their timing and basis: registration tax occurs during asset registration, while ownership transfer tax arises from the change of ownership, each governed by distinct regulatory frameworks and rates.

When is Registration Tax Applicable?

Registration tax applies when a property is officially registered in the name of the buyer, typically during the initial purchase of real estate or transfer of ownership. It is calculated based on the property's declared value, purchase price, or market value, varying by jurisdiction and property type. Ownership transfer tax, in contrast, pertains specifically to the taxation during the transfer process between parties following the registration phase.

Situations Triggering Ownership Transfer Tax

Ownership Transfer Tax is triggered when there is a change in the legal ownership of an asset, such as during the sale or inheritance of property. Unlike Registration Tax, which applies to the initial registration of a new asset, Ownership Transfer Tax specifically addresses situations where title or ownership rights are transferred between parties. Key triggers include sale agreements, gifting, inheritance, and court-ordered transfers, each subject to specific tax rates and exemptions under local tax laws.

How Registration Tax is Calculated

Registration Tax is calculated based on the vehicle's taxable base, which often corresponds to its market value or purchase price, applying a specific rate set by local tax authorities. The rate can vary depending on factors such as vehicle type, age, engine size, and emissions class, with some regions applying progressive scales or environmental incentives. Accurate valuation is essential since Registration Tax directly impacts initial registration cost, distinguishing it from Ownership Transfer Tax, which typically involves a fixed rate on the transaction value during ownership change.

Ownership Transfer Tax: Calculation Methods

Ownership Transfer Tax calculation methods vary depending on jurisdiction but generally involve a percentage of the property's market value or the agreed sale price. Some regions apply a fixed tax rate, while others use a progressive scale based on the property's value brackets. Accurate property valuation and adherence to specific local tax rate schedules are essential to correctly determine the Ownership Transfer Tax liability.

Registration Tax vs Ownership Transfer Tax: Pros and Cons

Registration Tax applies during the initial vehicle registration, often lower and fixed, benefiting new buyers with predictable costs. Ownership Transfer Tax occurs during ownership changes, typically variable based on vehicle value, potentially resulting in higher expenses for used car buyers. Evaluating Registration Tax versus Ownership Transfer Tax involves balancing upfront affordability against future transfer costs, impacting overall vehicle ownership expenses.

Documentation Required for Each Tax Type

Registration tax requires specific documents including the vehicle's original purchase invoice, proof of identity, and a valid insurance certificate, ensuring proper vehicle registration in the owner's name. Ownership transfer tax mandates submission of the vehicle registration certificate, a completed transfer form, and proof of payment of the sale price or consideration, facilitating the legal handover between parties. Proper documentation minimizes legal complications and ensures compliance with local taxation authorities.

Tips to Minimize Car Tax Liabilities

Strategically timing the purchase and registration of a vehicle can significantly reduce registration tax liabilities, as some jurisdictions offer lower rates during off-peak periods or for certain vehicle types like electric or hybrid cars. Understanding the specific transfer tax regulations, including exemptions for family transfers or trade-ins, allows for optimized ownership transfer tax planning. Consulting with a tax professional ensures compliance while identifying potential deductions or credits to minimize overall car tax costs effectively.

Registration Tax vs Ownership Transfer Tax Infographic

cardiffo.com

cardiffo.com