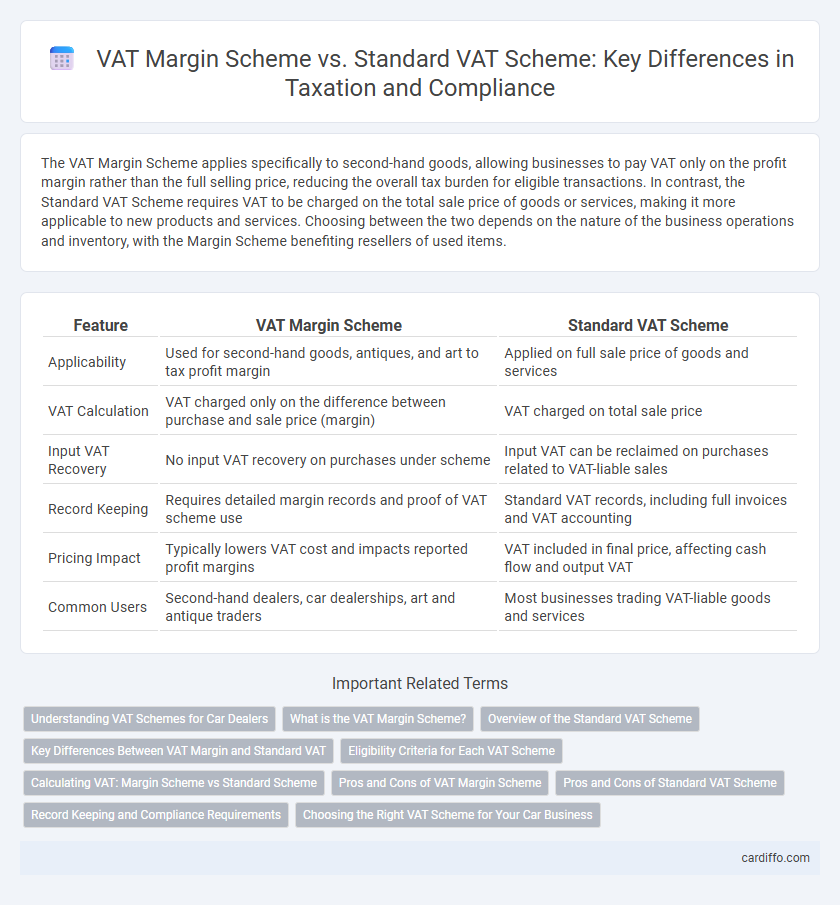

The VAT Margin Scheme applies specifically to second-hand goods, allowing businesses to pay VAT only on the profit margin rather than the full selling price, reducing the overall tax burden for eligible transactions. In contrast, the Standard VAT Scheme requires VAT to be charged on the total sale price of goods or services, making it more applicable to new products and services. Choosing between the two depends on the nature of the business operations and inventory, with the Margin Scheme benefiting resellers of used items.

Table of Comparison

| Feature | VAT Margin Scheme | Standard VAT Scheme |

|---|---|---|

| Applicability | Used for second-hand goods, antiques, and art to tax profit margin | Applied on full sale price of goods and services |

| VAT Calculation | VAT charged only on the difference between purchase and sale price (margin) | VAT charged on total sale price |

| Input VAT Recovery | No input VAT recovery on purchases under scheme | Input VAT can be reclaimed on purchases related to VAT-liable sales |

| Record Keeping | Requires detailed margin records and proof of VAT scheme use | Standard VAT records, including full invoices and VAT accounting |

| Pricing Impact | Typically lowers VAT cost and impacts reported profit margins | VAT included in final price, affecting cash flow and output VAT |

| Common Users | Second-hand dealers, car dealerships, art and antique traders | Most businesses trading VAT-liable goods and services |

Understanding VAT Schemes for Car Dealers

Car dealers can choose between the VAT Margin Scheme and the Standard VAT Scheme to manage value-added tax on vehicle sales efficiently. The VAT Margin Scheme allows dealers to pay VAT only on the profit margin rather than the full sale price, reducing tax liability when selling used cars. In contrast, the Standard VAT Scheme requires VAT to be charged on the entire sale price, which may increase the taxable amount but allows input VAT recovery on purchases.

What is the VAT Margin Scheme?

The VAT Margin Scheme allows businesses to pay VAT only on the difference between the purchase price and the selling price of goods, rather than the full selling price, which is particularly beneficial for second-hand goods, antiques, and collectibles. This scheme simplifies VAT accounting and reduces the tax burden for traders dealing in used goods by avoiding VAT on the entire sales price. It contrasts with the Standard VAT Scheme, where VAT is charged on the total sale value.

Overview of the Standard VAT Scheme

The Standard VAT Scheme requires businesses to charge VAT on their sales and reclaim VAT on their purchases, maintaining detailed records of all taxable transactions. VAT is calculated on the full selling price, with rates varying by country, commonly including standard, reduced, and zero rates. This scheme applies universally to most goods and services, ensuring comprehensive VAT compliance across diverse business activities.

Key Differences Between VAT Margin and Standard VAT

The VAT Margin Scheme applies VAT only to the profit margin on second-hand goods, antiques, and art, whereas the Standard VAT Scheme charges VAT on the full selling price of goods and services. Under the Margin Scheme, businesses cannot reclaim VAT on related purchases, unlike the Standard Scheme, which allows full input tax recovery. This scheme is designed to simplify VAT accounting for dealers in second-hand goods and reduce VAT cascading effects compared to the Standard VAT Scheme.

Eligibility Criteria for Each VAT Scheme

The VAT Margin Scheme applies primarily to second-hand goods, works of art, antiques, and collectors' items sold by eligible traders who have not reclaimed VAT on these goods. Eligibility for the Standard VAT Scheme requires businesses to register if their taxable turnover exceeds the VAT threshold, currently set at PS85,000 in the UK. Businesses dealing in new goods or services generally fall under the Standard VAT Scheme, whereas dealers in qualifying second-hand goods must adhere to the specific record-keeping and calculation rules of the VAT Margin Scheme.

Calculating VAT: Margin Scheme vs Standard Scheme

The VAT Margin Scheme calculates VAT only on the difference between the purchase price and the selling price of second-hand goods, rather than the total selling price, reducing the taxable amount for eligible transactions. In contrast, the Standard VAT Scheme requires VAT to be applied to the full selling price of goods or services, resulting in a higher VAT liability for sellers. Businesses dealing in second-hand goods, antiques, or collectibles often benefit from the Margin Scheme as it simplifies VAT calculations and lowers payable tax compared to the Standard VAT Scheme.

Pros and Cons of VAT Margin Scheme

The VAT Margin Scheme allows businesses to pay VAT only on the profit margin of second-hand goods, antiques, or artworks, reducing the tax burden compared to the Standard VAT Scheme which taxes the full sales price. This scheme benefits businesses by improving cash flow and competitiveness but complicates accounting since input VAT cannot be reclaimed, and detailed records of purchases and sales must be maintained. However, the VAT Margin Scheme is limited to specific goods and cannot be used for new items, potentially restricting its applicability.

Pros and Cons of Standard VAT Scheme

The Standard VAT Scheme allows businesses to reclaim input VAT on purchases, improving cash flow and reducing overall tax liability on goods and services sold. However, the complexity of record-keeping and compliance requirements can increase administrative costs and risk of errors. Additionally, businesses must charge VAT on all taxable supplies, which could lead to higher prices for customers compared to schemes like the VAT Margin Scheme.

Record Keeping and Compliance Requirements

The VAT Margin Scheme demands detailed records of purchase and sale invoices specifically showing the margin calculation, while the Standard VAT Scheme requires comprehensive documentation of all sales and input VAT to claim deductions accurately. Compliance under the Margin Scheme involves strict tracking of goods eligible for margin VAT treatment and maintaining separate records to avoid mixing standard-rated transactions. Failure to maintain these detailed records in either scheme can result in penalties or disallowance of VAT claims by tax authorities.

Choosing the Right VAT Scheme for Your Car Business

Choosing the right VAT scheme for your car business depends on factors such as the type of vehicles sold and your cash flow needs. The VAT Margin Scheme allows you to pay VAT only on the profit margin of second-hand cars, reducing VAT liabilities compared to the Standard VAT Scheme, which requires VAT on the full selling price. Evaluating transaction volume, profit margins, and administrative complexities helps determine whether the Margin Scheme or Standard VAT Scheme maximizes tax efficiency for your automotive business.

VAT Margin Scheme vs Standard VAT Scheme Infographic

cardiffo.com

cardiffo.com