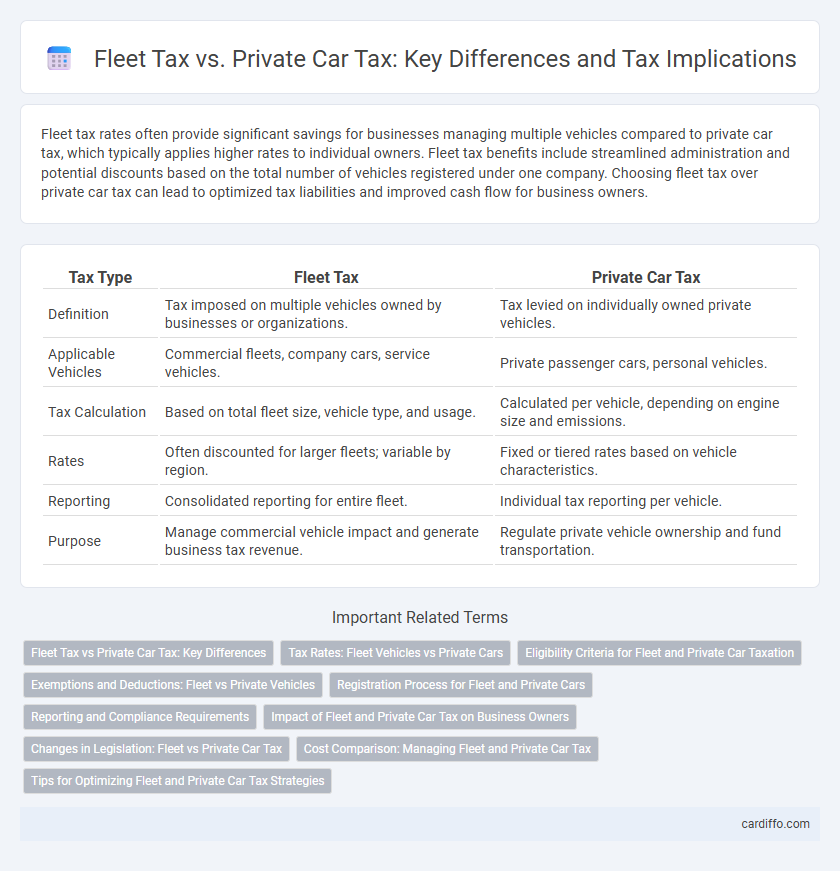

Fleet tax rates often provide significant savings for businesses managing multiple vehicles compared to private car tax, which typically applies higher rates to individual owners. Fleet tax benefits include streamlined administration and potential discounts based on the total number of vehicles registered under one company. Choosing fleet tax over private car tax can lead to optimized tax liabilities and improved cash flow for business owners.

Table of Comparison

| Tax Type | Fleet Tax | Private Car Tax |

|---|---|---|

| Definition | Tax imposed on multiple vehicles owned by businesses or organizations. | Tax levied on individually owned private vehicles. |

| Applicable Vehicles | Commercial fleets, company cars, service vehicles. | Private passenger cars, personal vehicles. |

| Tax Calculation | Based on total fleet size, vehicle type, and usage. | Calculated per vehicle, depending on engine size and emissions. |

| Rates | Often discounted for larger fleets; variable by region. | Fixed or tiered rates based on vehicle characteristics. |

| Reporting | Consolidated reporting for entire fleet. | Individual tax reporting per vehicle. |

| Purpose | Manage commercial vehicle impact and generate business tax revenue. | Regulate private vehicle ownership and fund transportation. |

Fleet Tax vs Private Car Tax: Key Differences

Fleet tax applies to commercial vehicle collections and is calculated based on the total number of vehicles owned by a business, often featuring bulk discount rates. Private car tax is levied on individual car owners, calculated according to vehicle value, engine size, or emissions, with no bulk considerations. Unlike private car tax, fleet tax typically includes additional compliance requirements such as regular reporting and vehicle tracking for tax purposes.

Tax Rates: Fleet Vehicles vs Private Cars

Fleet tax rates are generally lower compared to private car tax rates due to higher depreciation allowances and bulk vehicle registration incentives provided to businesses. Private cars face higher individual tax brackets based on engine size, CO2 emissions, and vehicle age, increasing the overall tax burden. Businesses managing fleet vehicles benefit from reduced per-vehicle tax liabilities, optimizing operational costs through favorable tax policies.

Eligibility Criteria for Fleet and Private Car Taxation

Fleet tax eligibility requires businesses to own multiple vehicles primarily used for commercial purposes, with varying thresholds depending on jurisdiction. Private car tax applies to individual vehicle owners and is calculated based on factors like engine size, emissions, and vehicle age. Tax authorities often require specific documentation such as registration proofs and usage declarations to determine the applicable tax category.

Exemptions and Deductions: Fleet vs Private Vehicles

Fleet vehicles often benefit from broader tax exemptions and deductions, including bulk purchase incentives and operational expense allowances, which are less commonly available to private car owners. Private car tax exemptions typically focus on specific criteria like environmental standards or disability status, resulting in more limited tax relief options compared to fleet vehicles. Understanding these distinctions allows businesses and individuals to strategically optimize their tax liabilities and leverage eligible deductions effectively.

Registration Process for Fleet and Private Cars

Fleet tax registration involves submitting detailed vehicle lists and business documentation to tax authorities, often requiring bulk processing systems that expedite registration for multiple vehicles simultaneously. Private car tax registration typically demands individual vehicle identification details, owner information, and compliance certificates, processed through standard government portals or local offices. Both registration processes mandate vehicle inspections and tax payment verification, though fleet registrations benefit from streamlined procedures tailored for corporate clients.

Reporting and Compliance Requirements

Fleet tax reporting mandates detailed records of all vehicles, including mileage, fuel consumption, and maintenance logs, to ensure compliance with regulatory standards. Private car tax requirements focus primarily on individual vehicle ownership documentation and timely submission of annual tax returns. Both tax types demand adherence to specific deadlines and accurate data reporting to avoid penalties and audits.

Impact of Fleet and Private Car Tax on Business Owners

Fleet tax imposes significant financial obligations on business owners managing multiple vehicles, often calculated based on total fleet weight and usage, influencing operational budgets. Private car tax typically affects businesses offering employee benefits or company cars, increasing taxable income and administrative complexity. Understanding these tax differences helps business owners optimize expenses and compliance strategies, ultimately improving financial planning and resource allocation.

Changes in Legislation: Fleet vs Private Car Tax

Recent changes in legislation have introduced distinct tax rates and compliance requirements for fleet vehicles compared to private cars, reflecting their differing usage and carbon emissions profiles. Fleet tax regulations now incentivize the adoption of low-emission vehicles through enhanced tax credits and stricter reporting obligations, while private car taxes have adjusted to emphasize engine size and fuel efficiency standards. These legislative adjustments aim to promote environmental sustainability and ensure equitable taxation based on vehicle purpose and environmental impact.

Cost Comparison: Managing Fleet and Private Car Tax

Fleet tax often offers cost advantages through bulk rate discounts and simplified administration compared to private car tax, which is assessed individually. Managing fleet tax enables businesses to optimize expenses by consolidating tax obligations, reducing per-vehicle costs significantly. In contrast, private car tax tends to be higher on a per-vehicle basis due to lack of volume-based benefits and varied tax brackets.

Tips for Optimizing Fleet and Private Car Tax Strategies

Maximize tax efficiency by leveraging fleet tax deductions, which often offer higher thresholds and allow for bulk depreciation benefits on commercial vehicles. For private cars, track mileage meticulously to claim accurate business use percentages, reducing taxable income through allowable expenses. Regularly review updated tax codes to apply optimal deduction methods and avoid penalties on both fleet and private vehicle taxes.

Fleet Tax vs Private Car Tax Infographic

cardiffo.com

cardiffo.com