Sales tax deductions allow taxpayers to deduct the amount paid on purchases of goods and certain services, reducing taxable income based on actual sales tax paid rather than state income tax. Income tax deductions, on the other hand, reduce taxable income based on state and local income taxes paid, often benefiting those in states with lower sales tax rates. Choosing between sales tax and income tax deductions depends on individual spending habits and state tax rates, with the IRS allowing taxpayers to select the option that maximizes their tax savings.

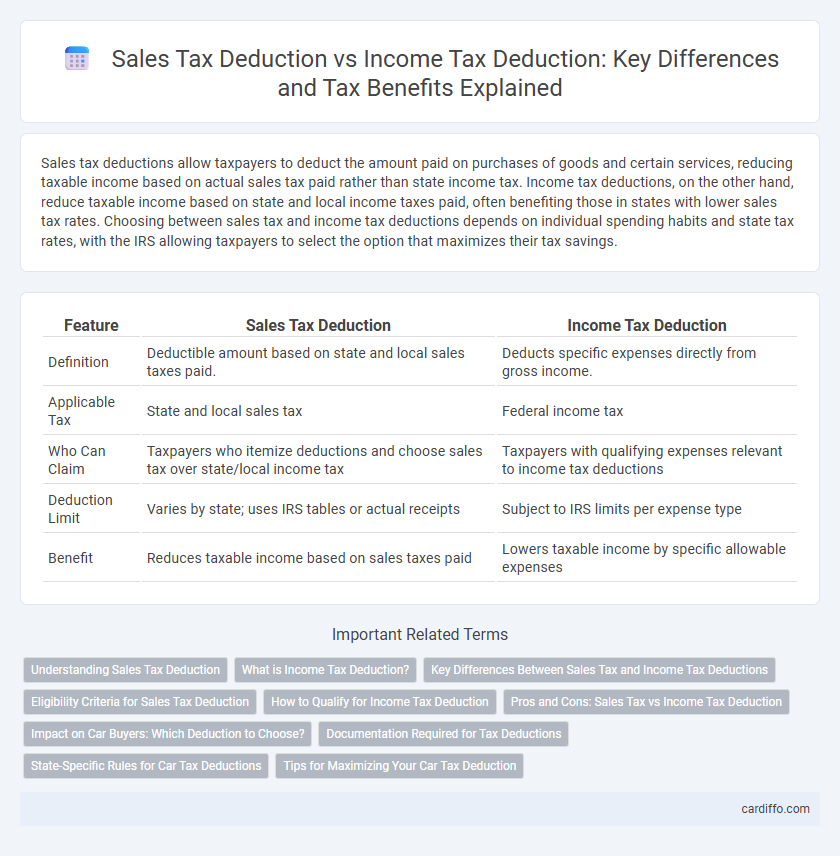

Table of Comparison

| Feature | Sales Tax Deduction | Income Tax Deduction |

|---|---|---|

| Definition | Deductible amount based on state and local sales taxes paid. | Deducts specific expenses directly from gross income. |

| Applicable Tax | State and local sales tax | Federal income tax |

| Who Can Claim | Taxpayers who itemize deductions and choose sales tax over state/local income tax | Taxpayers with qualifying expenses relevant to income tax deductions |

| Deduction Limit | Varies by state; uses IRS tables or actual receipts | Subject to IRS limits per expense type |

| Benefit | Reduces taxable income based on sales taxes paid | Lowers taxable income by specific allowable expenses |

Understanding Sales Tax Deduction

Sales tax deduction allows taxpayers to reduce their taxable income by deducting the amount spent on state and local sales taxes instead of state income taxes, which can be beneficial in states with no or low income tax. Taxpayers must choose between deducting state and local sales taxes or income taxes but cannot claim both deductions in the same tax year. Maintaining accurate records and receipts of purchased items helps optimize the sales tax deduction when filing IRS Form 1040 Schedule A.

What is Income Tax Deduction?

Income tax deduction reduces taxable income by allowing taxpayers to subtract specific expenses, such as mortgage interest, charitable contributions, and certain medical costs, from their gross income. This deduction lowers the overall income subject to federal income tax, effectively decreasing the amount owed. Unlike sales tax deduction, which applies to taxes paid on purchases, income tax deductions target reductions in reported earnings to minimize tax liability.

Key Differences Between Sales Tax and Income Tax Deductions

Sales tax deductions allow taxpayers to deduct state and local sales taxes paid on purchases, while income tax deductions reduce taxable income based on specific expenses incurred during the year. Unlike income tax deductions, which cover a broad range of personal and business expenses, sales tax deductions are limited to sales taxes paid and require careful record-keeping or use of IRS tables. The choice between claiming sales tax or state and local income tax deductions impacts overall tax liability and varies depending on individual financial situations and state tax policies.

Eligibility Criteria for Sales Tax Deduction

Sales tax deduction eligibility requires taxpayers to choose between deducting state and local sales taxes or state and local income taxes but not both. This deduction is particularly beneficial for individuals residing in states without state income tax or those who made significant purchases subject to sales tax. To qualify, taxpayers must itemize deductions on Schedule A and maintain accurate records or receipts of allowable sales tax payments for verification.

How to Qualify for Income Tax Deduction

To qualify for an income tax deduction, taxpayers must ensure that their expenses meet the IRS criteria of being ordinary and necessary for their business or personal finances. Common deductible expenses include mortgage interest, charitable contributions, and medical costs that exceed a specific percentage of adjusted gross income. Proper documentation such as receipts, invoices, and tax forms like Schedule A is essential for substantiating these deductions during tax filing.

Pros and Cons: Sales Tax vs Income Tax Deduction

Sales tax deductions benefit taxpayers in states with high sales taxes or significant purchases, offering potential savings that align with consumer spending patterns, but they can be less advantageous in states with low sales tax rates. Income tax deductions provide a straightforward reduction in taxable income, potentially lowering tax liability regardless of spending habits, yet they depend heavily on the taxpayer's income level and tax bracket. Choosing between sales tax and income tax deductions requires evaluating state tax rates, personal expenditures, and income to maximize overall tax benefits.

Impact on Car Buyers: Which Deduction to Choose?

Car buyers should carefully evaluate Sales Tax Deduction versus Income Tax Deduction to optimize tax savings, as Sales Tax Deduction allows deducting the actual sales tax paid on the vehicle, often benefiting those in states with high sales taxes or purchasing expensive cars. Income Tax Deduction typically refers to the standard deduction or itemized deductions not specifically related to vehicle purchases, making Sales Tax Deduction more advantageous for those itemizing and focusing on auto expenses. Choosing the correct deduction depends on individual tax situations, state tax rates, and whether the buyer opts to itemize deductions, impacting overall tax liability related to car buying.

Documentation Required for Tax Deductions

Accurate documentation is essential for both sales tax and income tax deductions to ensure compliance and maximize eligible benefits. For sales tax deductions, taxpayers must retain receipts, invoices, or sales tax statements that clearly indicate the amount of sales tax paid on purchases. Income tax deductions require supporting documents such as receipts, canceled checks, or bank statements verifying expenses related to deductible items or services claimed on tax returns.

State-Specific Rules for Car Tax Deductions

State-specific rules for car tax deductions vary significantly between sales tax and income tax deductions, influencing overall tax benefits. Some states allow full deduction of vehicle sales tax on state income tax returns, while others limit deductions based on vehicle price, use, or registration type. Understanding individual state regulations is crucial for maximizing eligible tax savings on car purchases.

Tips for Maximizing Your Car Tax Deduction

Maximizing your car tax deduction requires accurately distinguishing between sales tax deduction and income tax deduction, as sales tax paid on a vehicle can be deducted either instead of state and local income tax or as part of itemized deductions. Keeping detailed records of your vehicle's purchase price, applicable sales tax paid, and business mileage enables precise calculation of deductible expenses. Utilizing the standard mileage rate for business use further optimizes deductions by combining vehicle-related expenses with income tax strategies for more significant tax savings.

Sales Tax Deduction vs Income Tax Deduction Infographic

cardiffo.com

cardiffo.com