Choosing between a company car benefit-in-kind and an employee car allowance impacts tax liabilities and employee compensation differently. A company car benefit-in-kind is taxed based on the vehicle's value, emissions, and usage, often resulting in higher taxable income, whereas a car allowance is treated as additional salary, subject to income tax and national insurance contributions. Employers and employees must evaluate these options carefully to balance convenience, cost-effectiveness, and tax efficiency.

Table of Comparison

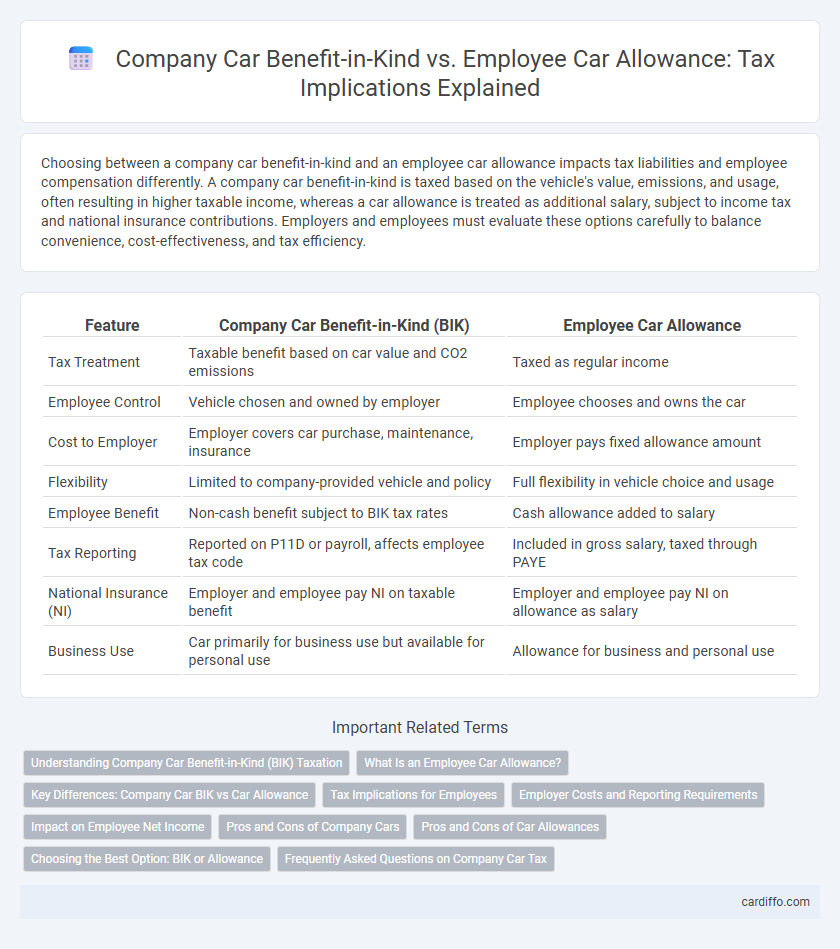

| Feature | Company Car Benefit-in-Kind (BIK) | Employee Car Allowance |

|---|---|---|

| Tax Treatment | Taxable benefit based on car value and CO2 emissions | Taxed as regular income |

| Employee Control | Vehicle chosen and owned by employer | Employee chooses and owns the car |

| Cost to Employer | Employer covers car purchase, maintenance, insurance | Employer pays fixed allowance amount |

| Flexibility | Limited to company-provided vehicle and policy | Full flexibility in vehicle choice and usage |

| Employee Benefit | Non-cash benefit subject to BIK tax rates | Cash allowance added to salary |

| Tax Reporting | Reported on P11D or payroll, affects employee tax code | Included in gross salary, taxed through PAYE |

| National Insurance (NI) | Employer and employee pay NI on taxable benefit | Employer and employee pay NI on allowance as salary |

| Business Use | Car primarily for business use but available for personal use | Allowance for business and personal use |

Understanding Company Car Benefit-in-Kind (BIK) Taxation

Company Car Benefit-in-Kind (BIK) taxation is calculated based on the vehicle's list price, CO2 emissions, and the employee's income tax band, affecting the taxable benefit amount. The BIK rate varies annually and reflects government incentives to promote low-emission vehicles, directly influencing the employee's tax liability. Understanding this system is essential for optimizing tax efficiency and making informed decisions between company car benefits and car allowances.

What Is an Employee Car Allowance?

An employee car allowance is a fixed sum of money provided by an employer to an employee to cover the costs associated with using their personal vehicle for work purposes. This allowance is typically included in the employee's taxable income but offers greater flexibility compared to a company car benefit-in-kind, as employees retain full ownership and can choose their own vehicle. Unlike company cars, car allowances do not incur benefit-in-kind tax charges, though employees must manage maintenance, insurance, and fuel expenses independently.

Key Differences: Company Car BIK vs Car Allowance

Company Car Benefit-in-Kind (BIK) is a taxable benefit where employees pay tax based on the car's list price and CO2 emissions, while employer bears full ownership and maintenance costs. In contrast, Car Allowance provides employees with a fixed sum added to their salary, taxed as income, granting full control over vehicle choice and expenses. The key difference lies in tax treatment, cost responsibility, and flexibility, with BIK often resulting in higher employee tax liabilities but less personal risk, whereas car allowances offer freedom but potential for higher out-of-pocket costs.

Tax Implications for Employees

Company car benefit-in-kind is taxable based on the vehicle's list price and CO2 emissions, resulting in higher taxable income and increased PAYE liability for employees. Employee car allowance is treated as additional salary, subject to income tax and National Insurance contributions, providing straightforward but potentially higher immediate tax deductions. Choosing between the two impacts overall tax efficiency depending on the employee's tax bracket and car usage patterns.

Employer Costs and Reporting Requirements

Company car benefit-in-kind involves higher employer costs due to National Insurance contributions based on the assessed taxable value of the vehicle, while employee car allowance typically results in simpler payroll processing with the allowance treated as taxable income. Employers must report company car details through the P11D form and pay Class 1A National Insurance, whereas car allowances are reported via payroll, subject to standard income tax and National Insurance deductions. Accurate reporting and compliance reduce the risk of penalties and ensure proper tax treatment for both benefit-in-kind and cash allowance schemes.

Impact on Employee Net Income

Company car benefit-in-kind increases taxable income by adding the calculated value of the vehicle use, which raises employee's taxable income and reduces net income due to higher income tax and National Insurance contributions. In contrast, employee car allowance is treated as additional salary, subject to full income tax and National Insurance, often resulting in higher tax liability compared to a company car benefit-in-kind taxed at a lower benefit rate. The choice between company car benefit-in-kind and employee car allowance directly impacts net income after taxation, influencing employee take-home pay and overall compensation value.

Pros and Cons of Company Cars

Company cars offer employees a tax-efficient benefit enabling access to a vehicle without direct purchase costs, often including maintenance and insurance covered by the employer, which can boost job satisfaction and retention. However, the taxable benefit-in-kind (BIK) value calculated based on the car's list price and CO2 emissions can result in substantial income tax liabilities for employees, especially with high-emission vehicles. Employers face higher National Insurance contributions, administrative complexities, and potential environmental concerns, making company cars less favorable for cost-sensitive or sustainability-focused businesses.

Pros and Cons of Car Allowances

Car allowances provide employees with flexible transportation options and potential tax savings since the allowance is treated as taxable income without additional benefit-in-kind reporting complexities. However, employees bear all vehicle-related expenses, which can lead to unpredictable costs and diminished financial advantage if actual expenses exceed the allowance. Employers benefit from simplified administration and reduced compliance risks but may face higher payroll taxes due to the allowance being considered taxable income.

Choosing the Best Option: BIK or Allowance

Choosing between a company car benefit-in-kind (BIK) and an employee car allowance depends on factors such as tax efficiency, total cost, and usage patterns. BIK is taxed based on the vehicle's CO2 emissions and list price, making low-emission cars more tax-efficient, while allowances provide flexibility but are subject to income tax and National Insurance contributions. Evaluating the employee's driving habits, car preferences, and potential tax liabilities is essential to determine the most cost-effective and compliant option.

Frequently Asked Questions on Company Car Tax

Company car benefit-in-kind tax is calculated based on the car's list price, CO2 emissions, and fuel type, impacting both employee taxable income and National Insurance contributions. Employee car allowance is treated as additional salary, subject to income tax and National Insurance, with no direct tax advantage on vehicle usage. Frequently asked questions often concern how emission rates influence company car tax bands, differences in reporting requirements, and the tax implications of using personal versus company-provided vehicles.

Company Car Benefit-in-Kind vs Employee Car Allowance Infographic

cardiffo.com

cardiffo.com