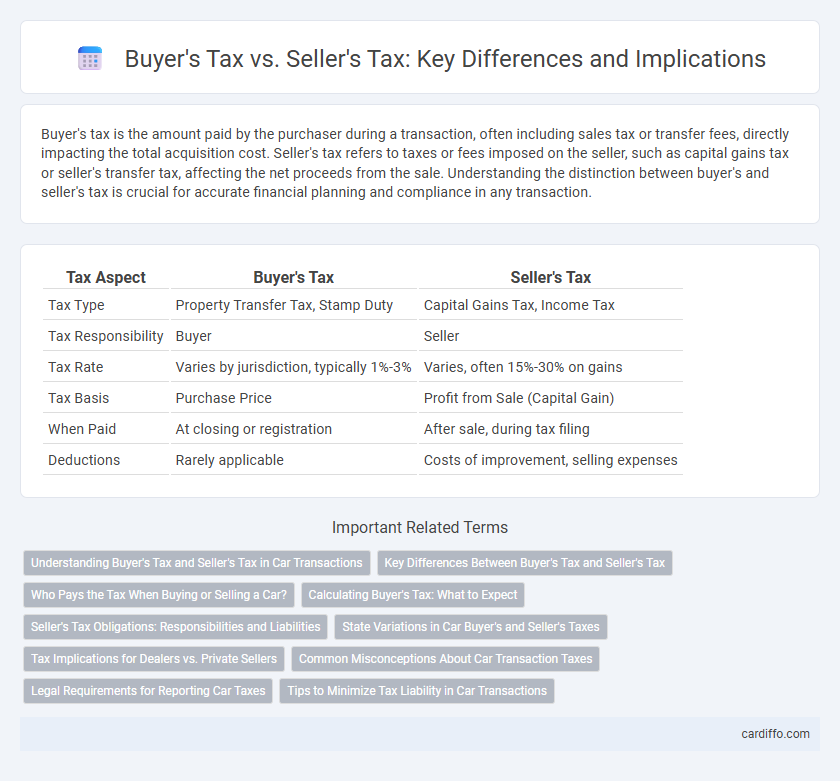

Buyer's tax is the amount paid by the purchaser during a transaction, often including sales tax or transfer fees, directly impacting the total acquisition cost. Seller's tax refers to taxes or fees imposed on the seller, such as capital gains tax or seller's transfer tax, affecting the net proceeds from the sale. Understanding the distinction between buyer's and seller's tax is crucial for accurate financial planning and compliance in any transaction.

Table of Comparison

| Tax Aspect | Buyer's Tax | Seller's Tax |

|---|---|---|

| Tax Type | Property Transfer Tax, Stamp Duty | Capital Gains Tax, Income Tax |

| Tax Responsibility | Buyer | Seller |

| Tax Rate | Varies by jurisdiction, typically 1%-3% | Varies, often 15%-30% on gains |

| Tax Basis | Purchase Price | Profit from Sale (Capital Gain) |

| When Paid | At closing or registration | After sale, during tax filing |

| Deductions | Rarely applicable | Costs of improvement, selling expenses |

Understanding Buyer's Tax and Seller's Tax in Car Transactions

Buyer's tax in car transactions refers to the sales tax or use tax the purchaser must pay based on the vehicle's purchase price, often collected at the time of registration. Seller's tax obligations typically involve reporting the sale and, in some jurisdictions, paying capital gains or transfer taxes if applicable, though most states emphasize buyer responsibility for sales tax. Understanding the distinctions between these taxes helps both parties comply with local tax laws and avoid penalties during vehicle ownership transfer.

Key Differences Between Buyer's Tax and Seller's Tax

Buyer's tax typically refers to transaction taxes such as sales tax, value-added tax (VAT), or use tax imposed on the purchaser during a transaction, affecting the total cost of acquiring goods or services. Seller's tax includes obligations like income tax on profits from sales or capital gains tax, impacting the seller's net income after the transaction. Key differences lie in the tax incidence--buyer's tax increases the purchase price, whereas seller's tax reduces the seller's revenue or profit margin.

Who Pays the Tax When Buying or Selling a Car?

When purchasing a car, the buyer is typically responsible for paying the sales tax based on the purchase price or fair market value, varying by state regulations. Sellers are generally exempt from paying tax on the sale proceeds but may need to report the transaction for tax purposes. Understanding local tax laws ensures the correct party fulfills tax obligations during vehicle transfers.

Calculating Buyer's Tax: What to Expect

Calculating buyer's tax involves determining the applicable sales tax rate based on the property's location and purchase price, often including local and state components. Buyers should expect to include this tax in their closing costs, which varies widely by jurisdiction but typically ranges from 1% to 3% of the purchase price. Understanding these rates and potential exemptions, such as first-time homebuyer credits, is essential for accurate budgeting during a property transaction.

Seller's Tax Obligations: Responsibilities and Liabilities

Seller's tax obligations include reporting the sale and remitting applicable taxes such as capital gains tax or value-added tax (VAT) depending on jurisdictional requirements. Responsibilities encompass accurate calculation of taxable amounts, timely filing of tax returns, and maintaining documentation for audits or disputes. Failure to comply with seller tax liabilities can result in penalties, interest charges, or legal action by tax authorities.

State Variations in Car Buyer's and Seller's Taxes

State variations in car buyer's and seller's taxes significantly impact the total transaction cost, with some states imposing sales tax exclusively on the buyer, while others tax both parties. For example, California requires the buyer to pay a use tax based on the vehicle's purchase price, whereas New York imposes a sales tax on the buyer but may require the seller to collect a portion of it at the point of sale. Understanding state-specific tax regulations, such as Florida's discretionary sales surtax applied only to buyers, is critical for accurately calculating tax liabilities in vehicle transactions.

Tax Implications for Dealers vs. Private Sellers

Buyer's tax typically involves sales tax or value-added tax (VAT) imposed on the purchase price, affecting dealers who must collect and remit these taxes, whereas private sellers often do not charge sales tax, leading to differing tax liabilities. For dealers, taxes are integrated into business accounting, impacting profit margins and pricing strategies, while private sellers may face capital gains tax if the sale exceeds asset cost basis. Understanding these distinctions is critical for compliance with tax regulations and optimizing tax outcomes in vehicle or asset transactions.

Common Misconceptions About Car Transaction Taxes

Buyer's tax and seller's tax in car transactions are often confused, but they serve distinct purposes: the buyer's tax typically applies as a sales or use tax based on the vehicle's purchase price, while the seller's tax obligations may include capital gains or business-related taxes. Many mistakenly believe that only buyers are responsible for taxes in a car sale, overlooking that sellers might face tax implications depending on their status and the transaction type. Understanding state-specific regulations is crucial, as tax rates, exemptions, and reporting requirements vary significantly across jurisdictions, impacting the net cost for both parties.

Legal Requirements for Reporting Car Taxes

Buyers are legally required to report vehicle purchases and pay applicable sales taxes to state motor vehicle departments, often within a specified timeframe such as 30 days. Sellers must provide accurate documentation including a signed title and bill of sale, ensuring compliance with state regulations to avoid penalties. Failure to meet reporting deadlines can result in fines or legal complications for both parties in vehicle transactions.

Tips to Minimize Tax Liability in Car Transactions

Buyers and sellers should understand the differences in tax obligations to minimize liability in car transactions effectively. Utilizing strategies such as negotiating the sales price to reduce taxable value, exploring tax-exempt transfers like family gifts, and maintaining thorough documentation can help lower tax burdens. Consulting with a tax professional on state-specific regulations ensures compliance and optimizes potential savings.

Buyer's Tax vs Seller's Tax Infographic

cardiffo.com

cardiffo.com