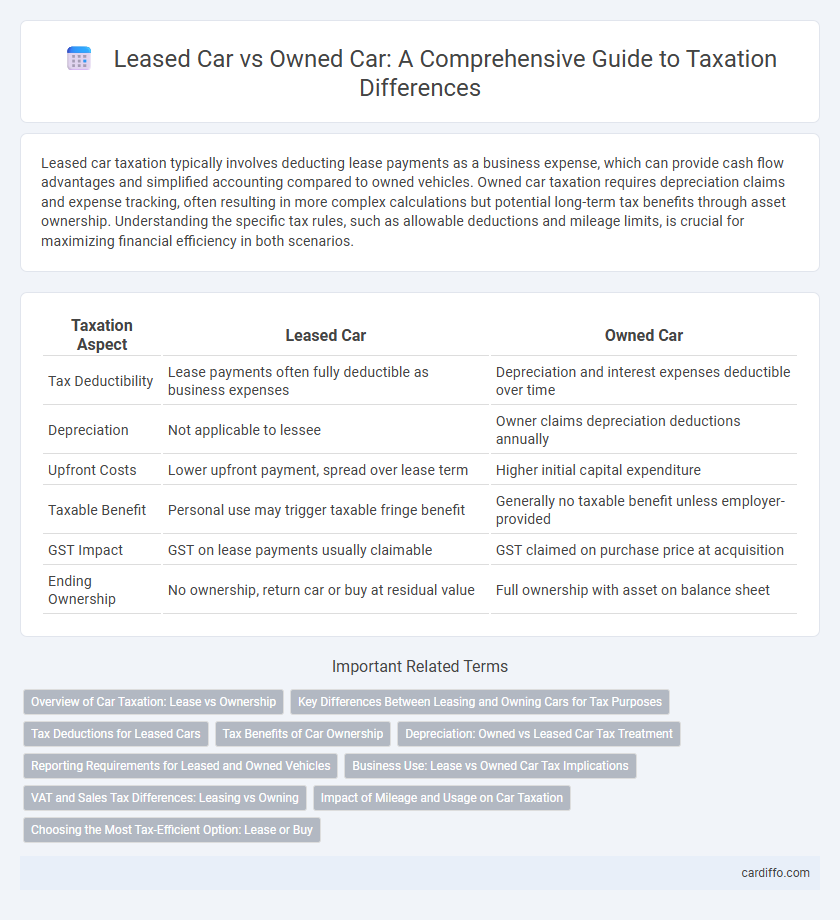

Leased car taxation typically involves deducting lease payments as a business expense, which can provide cash flow advantages and simplified accounting compared to owned vehicles. Owned car taxation requires depreciation claims and expense tracking, often resulting in more complex calculations but potential long-term tax benefits through asset ownership. Understanding the specific tax rules, such as allowable deductions and mileage limits, is crucial for maximizing financial efficiency in both scenarios.

Table of Comparison

| Taxation Aspect | Leased Car | Owned Car |

|---|---|---|

| Tax Deductibility | Lease payments often fully deductible as business expenses | Depreciation and interest expenses deductible over time |

| Depreciation | Not applicable to lessee | Owner claims depreciation deductions annually |

| Upfront Costs | Lower upfront payment, spread over lease term | Higher initial capital expenditure |

| Taxable Benefit | Personal use may trigger taxable fringe benefit | Generally no taxable benefit unless employer-provided |

| GST Impact | GST on lease payments usually claimable | GST claimed on purchase price at acquisition |

| Ending Ownership | No ownership, return car or buy at residual value | Full ownership with asset on balance sheet |

Overview of Car Taxation: Lease vs Ownership

Leased car taxation typically involves monthly lease payments that may include taxes based on the vehicle's value and lease terms, while owned car taxation often requires annual vehicle registration fees and property taxes based on ownership. Lease payments can sometimes offer tax deductions for business use, whereas owned vehicles may qualify for depreciation deductions and potential capital gains tax implications upon sale. Understanding differences in tax treatment helps optimize financial benefits based on usage, ownership status, and applicable local tax regulations.

Key Differences Between Leasing and Owning Cars for Tax Purposes

Leased car taxation primarily allows for deductible lease payments as a business expense, whereas owning a car permits depreciation claims and interest deductions on auto loans. Lease agreements often limit the ability to claim depreciation, while owned vehicles enable tax benefits through capital cost allowance over time. Mileage allowances and personal use restrictions also differ, affecting the overall tax advantages in both leasing and owning scenarios.

Tax Deductions for Leased Cars

Tax deductions for leased cars often allow businesses to deduct a portion of the lease payments as a business expense, potentially lowering taxable income. Unlike owned cars, lease payments are generally fully deductible when the vehicle is used exclusively for business purposes, subject to IRS mileage limits and personal use restrictions. Depreciation deductions are not applicable to leased vehicles, shifting the focus to the lease expense as the primary tax benefit.

Tax Benefits of Car Ownership

Car ownership offers significant tax benefits, including depreciation deductions under Section 179 and bonus depreciation, which reduce taxable income over time. Owners may also deduct interest on auto loans if the vehicle is used for business purposes, enhancing tax savings. Unlike leased vehicles, owned cars provide eligibility for vehicle-related tax credits and the ability to claim actual expenses such as repairs and maintenance.

Depreciation: Owned vs Leased Car Tax Treatment

Depreciation on owned cars is deductible as a business expense, allowing taxpayers to recover the vehicle's cost over its useful life using methods such as the Modified Accelerated Cost Recovery System (MACRS). In contrast, leased car tax treatment permits deductions only for lease payments, with no direct depreciation deduction allowed to the lessee since ownership remains with the lessor. This distinction impacts taxable income calculations and dictates how businesses should structure vehicle acquisition for optimal tax benefits.

Reporting Requirements for Leased and Owned Vehicles

Leased car taxation requires detailed reporting of lease payments, mileage logs, and business use percentage to properly calculate deductible expenses and avoid tax discrepancies. Owned vehicle taxation mandates maintaining accurate records of purchase price, depreciation schedules, fuel, maintenance costs, and mileage for substantiating deductions and claiming depreciation benefits. Both leased and owned vehicle reporting must comply with IRS standards to ensure proper tax treatment and maximize allowable deductions.

Business Use: Lease vs Owned Car Tax Implications

Business use of leased cars allows for monthly lease payments to be deducted as a business expense, often simplifying bookkeeping and potentially maximizing tax benefits. Owned cars provide depreciation deductions through the Modified Accelerated Cost Recovery System (MACRS), including Section 179 and bonus depreciation options, but require tracking actual business use percentage for accurate expense allocation. Tax implications differ as leased vehicles focus on lease payment deductions, while owned vehicles offer asset depreciation and expense write-offs, influencing overall tax strategy based on ownership structure.

VAT and Sales Tax Differences: Leasing vs Owning

Leased car taxation typically involves VAT applied on the monthly lease payments, allowing businesses to reclaim VAT proportionate to business use, while sales tax is usually integrated into the lease cost. Owned car taxation requires paying VAT and sales tax upfront on the vehicle purchase price, with VAT recovery dependent on business usage and eligibility. Leasing offers more flexible VAT deductions spread over time, whereas ownership incurs a one-time sales tax cost but may allow capitalization for tax depreciation benefits.

Impact of Mileage and Usage on Car Taxation

Mileage and usage significantly influence the tax treatment of both leased and owned vehicles, as tax deductions and benefits are often calculated based on business-related miles driven. In leased car taxation, lease payments may be deductible proportionally to business use, while for owned vehicles, depreciation and actual expenses are typically deductible based on documented mileage. Accurately tracking mileage ensures optimal tax savings, as personal use can reduce the allowable deductions and affect the overall taxable benefit of the vehicle.

Choosing the Most Tax-Efficient Option: Lease or Buy

Choosing the most tax-efficient option between leased and owned cars depends on factors like depreciation allowances, deductible expenses, and personal or business usage. Leased vehicles often allow full deductible lease payments and reduced upfront costs, while owned cars may qualify for depreciation deductions and interest on financed amounts. Evaluating mileage limits, usage patterns, and local tax regulations ensures optimal tax benefits in either leasing or purchasing a vehicle.

Leased Car Taxation vs Owned Car Taxation Infographic

cardiffo.com

cardiffo.com