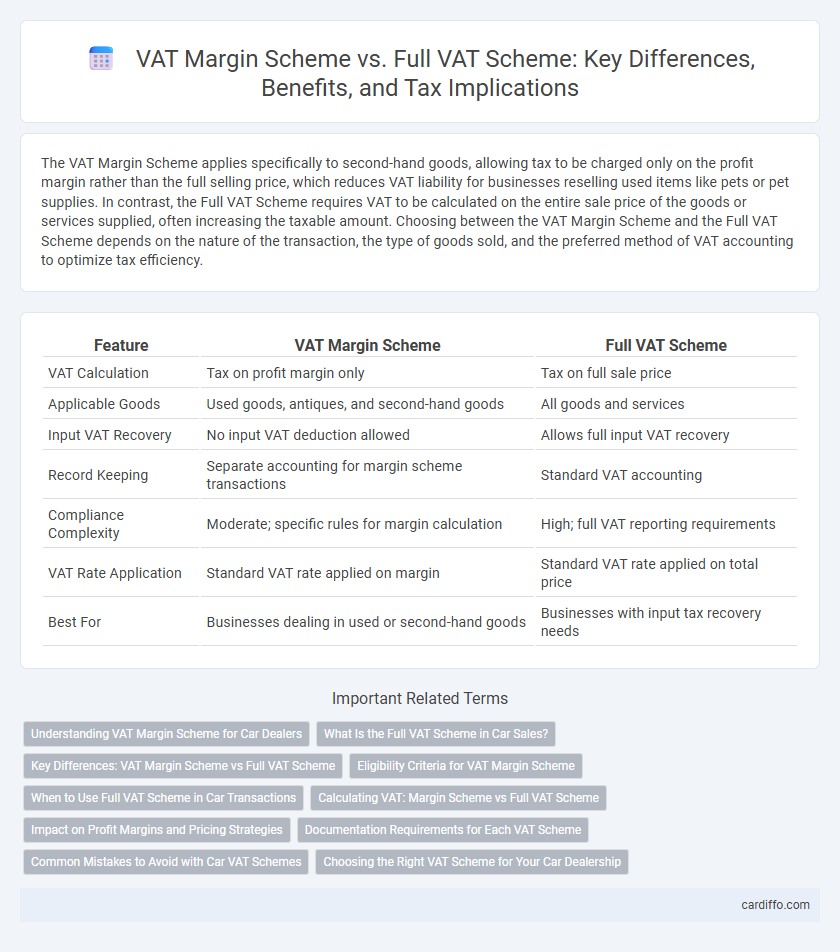

The VAT Margin Scheme applies specifically to second-hand goods, allowing tax to be charged only on the profit margin rather than the full selling price, which reduces VAT liability for businesses reselling used items like pets or pet supplies. In contrast, the Full VAT Scheme requires VAT to be calculated on the entire sale price of the goods or services supplied, often increasing the taxable amount. Choosing between the VAT Margin Scheme and the Full VAT Scheme depends on the nature of the transaction, the type of goods sold, and the preferred method of VAT accounting to optimize tax efficiency.

Table of Comparison

| Feature | VAT Margin Scheme | Full VAT Scheme |

|---|---|---|

| VAT Calculation | Tax on profit margin only | Tax on full sale price |

| Applicable Goods | Used goods, antiques, and second-hand goods | All goods and services |

| Input VAT Recovery | No input VAT deduction allowed | Allows full input VAT recovery |

| Record Keeping | Separate accounting for margin scheme transactions | Standard VAT accounting |

| Compliance Complexity | Moderate; specific rules for margin calculation | High; full VAT reporting requirements |

| VAT Rate Application | Standard VAT rate applied on margin | Standard VAT rate applied on total price |

| Best For | Businesses dealing in used or second-hand goods | Businesses with input tax recovery needs |

Understanding VAT Margin Scheme for Car Dealers

The VAT Margin Scheme allows car dealers to pay VAT only on the profit margin of used vehicles rather than the full sale price, reducing their tax liability and improving cash flow. Unlike the Full VAT Scheme, where VAT is charged on the entire vehicle value, the Margin Scheme benefits dealers selling second-hand cars by avoiding VAT on the purchase price. This scheme requires accurate record-keeping of purchase and sale prices to ensure compliance with HMRC regulations.

What Is the Full VAT Scheme in Car Sales?

The Full VAT Scheme in car sales requires dealers to charge VAT on the total sale price, allowing them to reclaim VAT paid on purchases, ensuring transparency and simplicity in tax calculations. This scheme is typically used when dealers buy vehicles from VAT-registered suppliers and sell them to VAT-registered customers, enabling full input VAT recovery. Unlike the VAT Margin Scheme, the Full VAT Scheme applies VAT to the entire sale value, impacting cash flow and pricing strategies in the automotive market.

Key Differences: VAT Margin Scheme vs Full VAT Scheme

The VAT Margin Scheme applies VAT only on the difference between the purchase price and selling price of eligible second-hand goods, whereas the Full VAT Scheme charges VAT on the entire selling price. Under the Margin Scheme, input VAT recovery on purchase is not possible, contrasting with the Full VAT Scheme, which allows businesses to reclaim VAT on purchases. Businesses dealing primarily with second-hand goods often prefer the Margin Scheme to reduce VAT liabilities, while the Full VAT Scheme suits those selling new goods or offering a broader range of services.

Eligibility Criteria for VAT Margin Scheme

The VAT Margin Scheme applies primarily to second-hand goods, works of art, antiques, and collectibles, requiring sellers to be VAT-registered and exclude new goods or items with full VAT already reclaimed. Eligibility criteria demand that the margin be calculated on the difference between purchase price and selling price, excluding VAT from the input side to avoid double taxation. Businesses must maintain proper records and ensure the goods were acquired without claiming input VAT to qualify for the VAT Margin Scheme.

When to Use Full VAT Scheme in Car Transactions

The Full VAT Scheme applies when purchasing vehicles from VAT-registered suppliers who charge VAT on the sale, allowing the buyer to reclaim VAT on purchase and charge VAT on resale. This scheme is suitable for businesses that maintain detailed VAT records and intend to claim input tax on the vehicle's full purchase price. Use the Full VAT Scheme for new cars or when dealing with vehicles purchased directly from VAT-registered dealers rather than through second-hand margin schemes.

Calculating VAT: Margin Scheme vs Full VAT Scheme

Calculating VAT under the Margin Scheme involves applying VAT only to the profit margin, which is the difference between the sale price and the purchase cost of goods, rather than the full sale price. In contrast, the Full VAT Scheme requires calculating VAT on the entire sale price of goods and services, allowing for full input VAT recovery but increasing the VAT liability. Businesses dealing with second-hand goods or unique assets often prefer the Margin Scheme to minimize VAT payments, while the Full VAT Scheme suits suppliers eligible to reclaim input VAT on purchases.

Impact on Profit Margins and Pricing Strategies

The VAT Margin Scheme allows businesses to pay VAT only on the profit margin of second-hand goods, enhancing profit margins by reducing overall VAT liabilities compared to the Full VAT Scheme, which requires VAT on the total sale price. This scheme enables more competitive pricing strategies, as lower VAT costs can be reflected in reduced consumer prices or increased profit retention. Businesses using the Full VAT Scheme must factor VAT into all sales transactions, often leading to higher consumer prices and tighter profit margins.

Documentation Requirements for Each VAT Scheme

The VAT Margin Scheme requires detailed documentation showing the margin on second-hand goods, including purchase and sale invoices to prove VAT cannot be reclaimed on acquisitions. The Full VAT Scheme demands comprehensive VAT invoices for all sales and purchases, with clear VAT amounts explicitly stated to support input tax recovery. Accurate record-keeping is essential under both schemes, but the Margin Scheme emphasizes margin calculation and proof of eligibility for specific goods.

Common Mistakes to Avoid with Car VAT Schemes

Common mistakes to avoid with car VAT schemes include incorrectly applying the margin scheme to vehicles that do not qualify, such as those that are new or have undergone substantial refurbishment. Dealers often fail to maintain accurate purchase and sales records, impairing the correct calculation of VAT due under the margin scheme. Misinterpreting the eligibility criteria for full VAT reclaim can lead to overpaying VAT or facing penalties for non-compliance.

Choosing the Right VAT Scheme for Your Car Dealership

Choosing the right VAT scheme for your car dealership depends on factors like turnover, profit margins, and administrative capacity. The VAT Margin Scheme allows dealers to pay VAT only on the profit margin of second-hand vehicles, reducing tax liability and simplifying cash flow management. In contrast, the Full VAT Scheme requires VAT payment on the total sale price but enables reclaiming VAT on purchase costs, benefiting dealers with high input VAT on newly acquired vehicles.

VAT Margin Scheme vs Full VAT Scheme Infographic

cardiffo.com

cardiffo.com