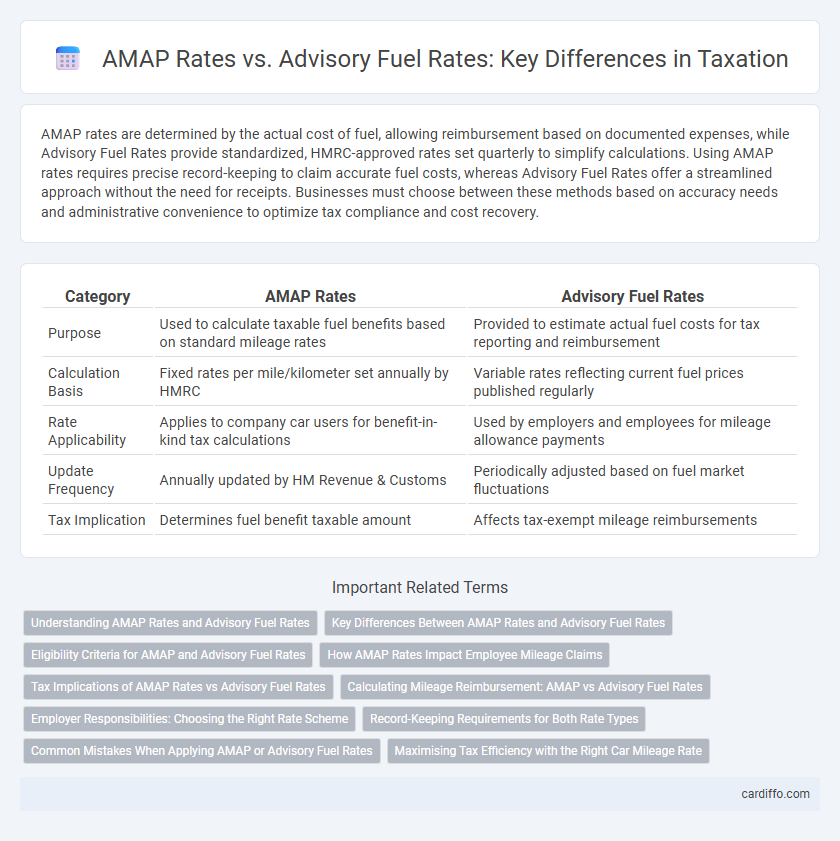

AMAP rates are determined by the actual cost of fuel, allowing reimbursement based on documented expenses, while Advisory Fuel Rates provide standardized, HMRC-approved rates set quarterly to simplify calculations. Using AMAP rates requires precise record-keeping to claim accurate fuel costs, whereas Advisory Fuel Rates offer a streamlined approach without the need for receipts. Businesses must choose between these methods based on accuracy needs and administrative convenience to optimize tax compliance and cost recovery.

Table of Comparison

| Category | AMAP Rates | Advisory Fuel Rates |

|---|---|---|

| Purpose | Used to calculate taxable fuel benefits based on standard mileage rates | Provided to estimate actual fuel costs for tax reporting and reimbursement |

| Calculation Basis | Fixed rates per mile/kilometer set annually by HMRC | Variable rates reflecting current fuel prices published regularly |

| Rate Applicability | Applies to company car users for benefit-in-kind tax calculations | Used by employers and employees for mileage allowance payments |

| Update Frequency | Annually updated by HM Revenue & Customs | Periodically adjusted based on fuel market fluctuations |

| Tax Implication | Determines fuel benefit taxable amount | Affects tax-exempt mileage reimbursements |

Understanding AMAP Rates and Advisory Fuel Rates

AMAP Rates and Advisory Fuel Rates are critical components in fuel taxation and reimbursement calculations. AMAP (Actual Mileage Allowance Payment) Rates reflect actual fuel consumption based on mileage, optimizing cost efficiency for businesses, while Advisory Fuel Rates provide government-recommended fuel cost averages to standardize expense claims. Understanding the differences ensures accurate fuel tax reporting and compliance with HMRC regulations.

Key Differences Between AMAP Rates and Advisory Fuel Rates

AMAP rates are based on average market prices for fuel, offering a standardized reimbursement rate reflecting typical regional fuel costs, whereas Advisory Fuel Rates adjust more frequently to current fuel price fluctuations, providing dynamic compensation aligned with actual fuel expenses. AMAP rates are commonly used for tax mileage deductions allowing simplified, predictable calculations, while Advisory Fuel Rates serve to fine-tune fuel cost reimbursements in response to short-term market changes. The primary difference lies in AMAP's reliance on historical averages versus the Advisory Rates' emphasis on real-time price adjustments, impacting tax reporting accuracy and reimbursement fairness.

Eligibility Criteria for AMAP and Advisory Fuel Rates

Eligibility criteria for AMAP (Average Mileage Allowance Payments) rates require employees to use their personal vehicles for business purposes and keep detailed mileage records to claim allowances based on actual miles driven. Advisory Fuel Rates, set by HMRC, apply when employers reimburse employees for business mileage and set maximum rates to cover fuel costs without tax liability, typically requiring the vehicle to be fuel-efficient and meet specific engine size thresholds. Both schemes necessitate accurate record-keeping and adherence to fuel type classifications to ensure compliance with tax regulations.

How AMAP Rates Impact Employee Mileage Claims

AMAP rates, established by HMRC, set a maximum tax-free mileage allowance for employee vehicle use, directly influencing reimbursement amounts in mileage claims. Claiming above AMAP rates triggers taxable benefits, increasing employees' tax liabilities compared to advisory fuel rates, which only guide reimbursements for fuel costs. Understanding AMAP rates ensures compliance and prevents unexpected tax charges on excess mileage claim payments.

Tax Implications of AMAP Rates vs Advisory Fuel Rates

AMAP rates, set by the Ministry of Defence, provide a tax-efficient method for reimbursing employees' fuel expenses, ensuring claims are based on actual business mileage. Advisory Fuel Rates (AFRs) are published by HMRC and serve as a benchmark for calculating taxable fuel benefits, potentially leading to higher taxable income if reimbursements exceed AFRs. Misalignment of reimbursements with AMAP or AFR rates can trigger tax liabilities, making adherence crucial for optimizing tax outcomes related to employee fuel expenses.

Calculating Mileage Reimbursement: AMAP vs Advisory Fuel Rates

Calculating mileage reimbursement using AMAP rates involves applying HMRC's approved mileage allowances, which include a fixed pence-per-mile rate for business travel to cover fuel and vehicle costs. Advisory fuel rates, set monthly by HMRC, reflect fluctuating fuel prices and are used specifically to reimburse actual fuel expenses when employees provide mileage records. Comparing both methods, AMAP rates offer a simplified, all-inclusive calculation, while advisory fuel rates require tracking fuel consumption, impacting tax reporting and employer compliance.

Employer Responsibilities: Choosing the Right Rate Scheme

Employers must carefully evaluate AMAP rates and Advisory Fuel Rates to ensure compliance with HMRC guidelines when reimbursing employee fuel expenses. Selecting the appropriate scheme affects taxable benefits calculations and payroll reporting accuracy, minimizing risks of penalties. Understanding the differences between AMAP flat rates and fluctuating Advisory Fuel Rates supports informed decisions for optimal tax efficiency and record-keeping.

Record-Keeping Requirements for Both Rate Types

AMAP rates require detailed record-keeping of actual miles traveled and fuel expenses to comply with IRS regulations and substantiate reimbursements. Advisory Fuel Rates allow for simplified documentation, often relying on standardized mileage logs without extensive fuel receipt tracking. Maintaining accurate records for either rate type is essential to avoid tax audit issues and ensure proper expense reporting.

Common Mistakes When Applying AMAP or Advisory Fuel Rates

Incorrect application of AMAP (Actual Mileage Allowance Payments) rates often arises from failing to distinguish between business and personal mileage, leading to overstated claims. Confusing AMAP rates with advisory fuel rates causes taxpayers to apply incorrect reimbursement values, since advisory rates are published monthly for fuel costs and not intended for actual mileage compensation. Many overlook HMRC updates, resulting in use of outdated rates that trigger tax penalties or disallowed expenses during HMRC audits.

Maximising Tax Efficiency with the Right Car Mileage Rate

Maximizing tax efficiency requires choosing between AMAP rates and Advisory Fuel Rates based on accurate car mileage records and fuel consumption patterns. AMAP rates offer a fixed per-mile allowance that simplifies claiming vehicle expenses, while Advisory Fuel Rates adjust according to fluctuating fuel prices, reflecting actual costs more precisely. Selecting the appropriate rate ensures optimal tax deductions by aligning mileage claims with current fuel market conditions and individual driving habits.

AMAP Rates vs Advisory Fuel Rates Infographic

cardiffo.com

cardiffo.com