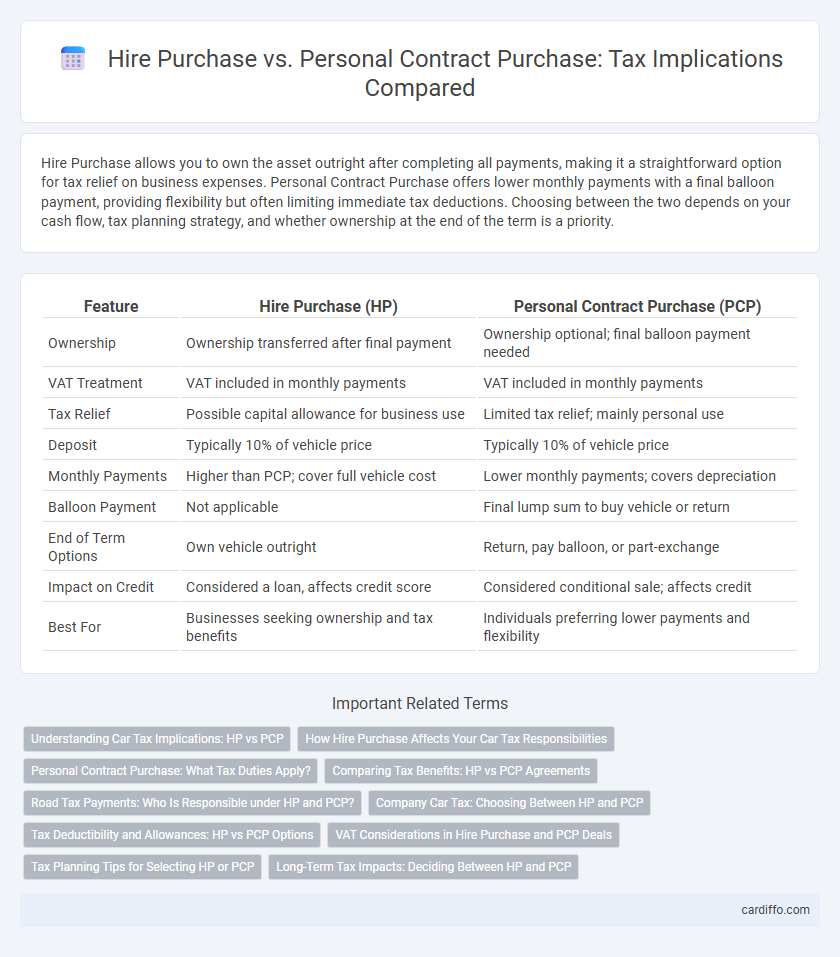

Hire Purchase allows you to own the asset outright after completing all payments, making it a straightforward option for tax relief on business expenses. Personal Contract Purchase offers lower monthly payments with a final balloon payment, providing flexibility but often limiting immediate tax deductions. Choosing between the two depends on your cash flow, tax planning strategy, and whether ownership at the end of the term is a priority.

Table of Comparison

| Feature | Hire Purchase (HP) | Personal Contract Purchase (PCP) |

|---|---|---|

| Ownership | Ownership transferred after final payment | Ownership optional; final balloon payment needed |

| VAT Treatment | VAT included in monthly payments | VAT included in monthly payments |

| Tax Relief | Possible capital allowance for business use | Limited tax relief; mainly personal use |

| Deposit | Typically 10% of vehicle price | Typically 10% of vehicle price |

| Monthly Payments | Higher than PCP; cover full vehicle cost | Lower monthly payments; covers depreciation |

| Balloon Payment | Not applicable | Final lump sum to buy vehicle or return |

| End of Term Options | Own vehicle outright | Return, pay balloon, or part-exchange |

| Impact on Credit | Considered a loan, affects credit score | Considered conditional sale; affects credit |

| Best For | Businesses seeking ownership and tax benefits | Individuals preferring lower payments and flexibility |

Understanding Car Tax Implications: HP vs PCP

Hire Purchase (HP) allows you to claim Vehicle Excise Duty (VED) as the vehicle owner from the start, while Personal Contract Purchase (PCP) requires careful attention since ownership often lies with the finance company until the final payment. Tax relief on HP deals can be more straightforward for business use, as the car is usually on your balance sheet, enabling full VED liability and possible capital allowances. PCP contracts may incur additional tax considerations due to retention of ownership, affecting Vehicle Excise Duty and potential benefit-in-kind calculations for company car users.

How Hire Purchase Affects Your Car Tax Responsibilities

Hire Purchase (HP) agreements require you to pay vehicle tax for the entire duration of ownership, as you are considered the registered keeper from the start. You must ensure continuous car tax payments or risk fines and penalties since responsibility does not transfer to the finance company. Unlike Personal Contract Purchase (PCP), HP does not alter your tax duties, making it essential to budget for ongoing Vehicle Excise Duty throughout the contract term.

Personal Contract Purchase: What Tax Duties Apply?

Personal Contract Purchase (PCP) agreements involve tax duties primarily related to VAT on the financed amount and potential Benefit-in-Kind (BiK) tax if the vehicle is used for personal purposes by employees. Unlike Hire Purchase, PCP payments often exclude VAT on monthly installments but VAT is charged on the initial deposit and final balloon payment. Businesses may reclaim VAT on PCP agreements only if the vehicle is used exclusively for business, while individuals must consider income tax implications if the car is provided as a taxable benefit.

Comparing Tax Benefits: HP vs PCP Agreements

Hire Purchase (HP) agreements allow full ownership of the vehicle after the final payment, making the entire cost potentially deductible as a business expense, subject to capital allowances and VAT rules. Personal Contract Purchase (PCP) agreements typically offer lower monthly payments with a large final balloon payment, limiting tax relief to only the rental portion rather than the full purchase price. For businesses, HP is often more tax-efficient due to capital allowance claims on the asset, whereas PCP benefits depend heavily on the structure of payments and residual value agreements.

Road Tax Payments: Who Is Responsible under HP and PCP?

Under Hire Purchase (HP), the registered owner, often the buyer, is responsible for paying road tax throughout the agreement duration, as ownership transfers after the final payment. Personal Contract Purchase (PCP) agreements typically place tax liability on the finance company or leasing entity until the buyer exercises the option to buy, at which point responsibility shifts. Ensuring clarity on tax payment obligations under HP and PCP is crucial to avoid legal penalties and maintain compliance.

Company Car Tax: Choosing Between HP and PCP

Choosing between Hire Purchase (HP) and Personal Contract Purchase (PCP) for company cars impacts taxable benefits and overall company car tax liability. HP ownership means the vehicle is added to the company's balance sheet, allowing capital allowances and VAT recovery, while PCP often results in lower monthly costs but higher taxable benefit-in-kind due to residual value risks. Careful analysis of annual mileage, contract terms, and expected vehicle use is crucial to optimizing tax efficiency and managing benefit-in-kind tax rates effectively.

Tax Deductibility and Allowances: HP vs PCP Options

Hire Purchase (HP) agreements allow businesses to claim capital allowances on the full value of the asset, enhancing tax deductibility over the asset's life, as repayments are treated as a combination of capital and interest. Personal Contract Purchase (PCP) typically offers lower monthly payments but does not provide capital allowances on the asset, with interest payments being the only deductible portion for tax purposes. Choosing between HP and PCP depends on the business's cash flow, tax position, and the desire to benefit from capital allowances versus simplified monthly payment structures.

VAT Considerations in Hire Purchase and PCP Deals

VAT considerations in Hire Purchase (HP) deals require the VAT on the full cash price of the vehicle to be paid upfront, as ownership is transferred during the contract period. In contrast, Personal Contract Purchase (PCP) agreements typically involve VAT only on the deposit and monthly payments, with a VAT charge on the final balloon payment if the customer chooses to buy the vehicle. Businesses claiming VAT back must carefully evaluate these differences, as HP allows full input VAT recovery, whereas PCP VAT recovery depends on the specific deal structure and usage.

Tax Planning Tips for Selecting HP or PCP

Choosing between Hire Purchase (HP) and Personal Contract Purchase (PCP) significantly impacts tax planning for business vehicles. HP allows full ownership with potential capital allowances and VAT reclaim on business-use vehicles, while PCP often offers lower monthly payments but limited tax relief and no ownership until the final balloon payment. Evaluating cash flow, business mileage, and eligibility for capital allowances helps optimize tax efficiency when selecting HP or PCP for company cars.

Long-Term Tax Impacts: Deciding Between HP and PCP

Hire Purchase (HP) agreements typically result in higher monthly payments but offer full ownership at the end with asset depreciation and interest payments impacting taxable profits. Personal Contract Purchase (PCP) arrangements often feature lower monthly costs and flexible end-of-term options, but the potential residual value risks and balloon payments can affect tax planning differently. Assessing long-term tax impacts requires evaluating interest relief eligibility, capital allowances, and how vehicle use influences deductible expenses over the contract period.

Hire Purchase vs Personal Contract Purchase Infographic

cardiffo.com

cardiffo.com