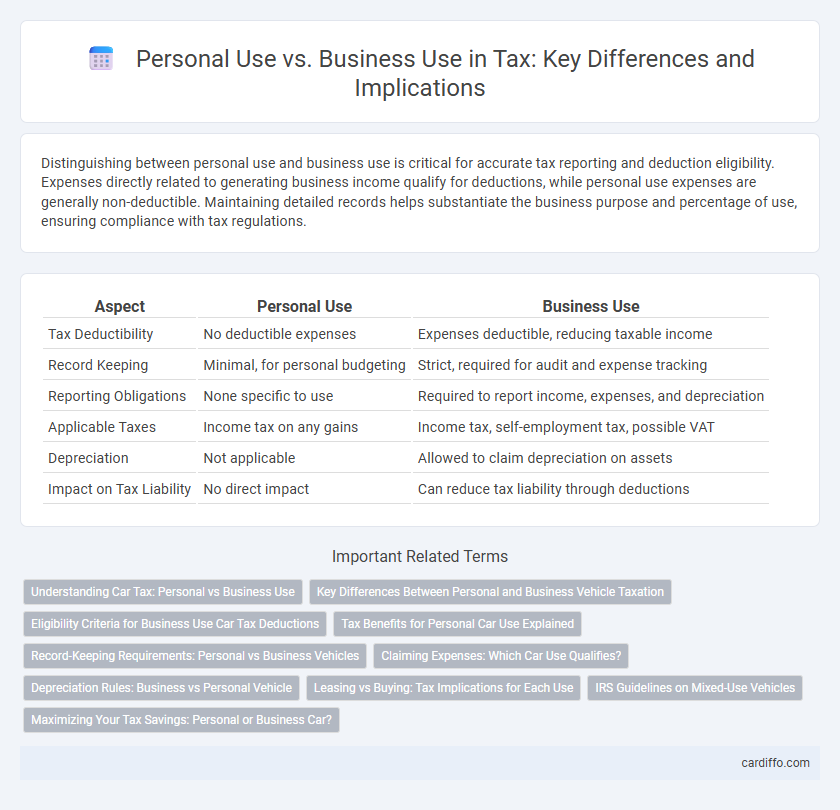

Distinguishing between personal use and business use is critical for accurate tax reporting and deduction eligibility. Expenses directly related to generating business income qualify for deductions, while personal use expenses are generally non-deductible. Maintaining detailed records helps substantiate the business purpose and percentage of use, ensuring compliance with tax regulations.

Table of Comparison

| Aspect | Personal Use | Business Use |

|---|---|---|

| Tax Deductibility | No deductible expenses | Expenses deductible, reducing taxable income |

| Record Keeping | Minimal, for personal budgeting | Strict, required for audit and expense tracking |

| Reporting Obligations | None specific to use | Required to report income, expenses, and depreciation |

| Applicable Taxes | Income tax on any gains | Income tax, self-employment tax, possible VAT |

| Depreciation | Not applicable | Allowed to claim depreciation on assets |

| Impact on Tax Liability | No direct impact | Can reduce tax liability through deductions |

Understanding Car Tax: Personal vs Business Use

Understanding car tax distinctions between personal and business use is essential for accurate tax reporting and compliance. Vehicles used primarily for business purposes may qualify for tax deductions on expenses like fuel, maintenance, and depreciation, while personal use typically disqualifies these claims. Detailed mileage logs and clear separation of business and personal travel are crucial to substantiate claims during tax audits and optimize allowable deductions.

Key Differences Between Personal and Business Vehicle Taxation

Personal vehicle use typically involves non-deductible expenses, as costs related to commuting and daily personal activities are considered non-business. Business vehicle taxation allows for deductions on expenses such as fuel, maintenance, and depreciation directly associated with business operations, reducing taxable income. Accurate record-keeping of mileage and usage is essential to differentiate and justify tax claims between personal and business vehicle use.

Eligibility Criteria for Business Use Car Tax Deductions

Eligibility criteria for business use car tax deductions require that the vehicle is primarily used for business purposes, such as traveling to client meetings, transporting equipment, or visiting job sites. Accurate mileage logs and records must be maintained to differentiate between personal and business use, with the IRS typically requiring at least 50% business use for eligibility. Expenses directly related to business use, including fuel, maintenance, and depreciation, can be deducted proportionally based on the documented business mileage.

Tax Benefits for Personal Car Use Explained

Tax benefits for personal car use primarily include deductions related to medical appointments, moving expenses, and charitable activities, which are often calculated using the IRS standard mileage rate or actual expenses. Tracking personal use separately from business use is crucial to ensure accurate tax reporting and maximize allowable deductions without triggering audits. The IRS permits taxpayers to deduct certain costs only when the vehicle is used for qualified personal purposes, offering financial relief while maintaining compliance with tax regulations.

Record-Keeping Requirements: Personal vs Business Vehicles

Accurate record-keeping is essential for distinguishing between personal and business vehicle use for tax purposes. Business vehicle records require detailed logs of mileage, dates, purpose of each trip, and expenses, while personal vehicle use generally does not require such documentation beyond maintaining registration and insurance. The IRS mandates comprehensive documentation to claim deductions, ensuring only legitimate business expenses reduce taxable income.

Claiming Expenses: Which Car Use Qualifies?

Claiming car expenses for tax purposes requires distinguishing between personal use and business use, with only the business use portion being deductible. The IRS uses methods like the actual expense method or the standard mileage rate to calculate deductible costs, emphasizing the importance of accurate records such as mileage logs and receipts. Expenses related solely to personal travel, including commuting, do not qualify for tax deductions.

Depreciation Rules: Business vs Personal Vehicle

Depreciation rules allow businesses to deduct the cost of vehicles used for business purposes over time, while personal vehicles do not qualify for such deductions. The IRS requires detailed records to distinguish business use from personal use, with only the business percentage of vehicle use eligible for depreciation. Using the Modified Accelerated Cost Recovery System (MACRS), businesses can recover vehicle costs through annual depreciation deductions, whereas personal vehicle depreciation is not tax-deductible.

Leasing vs Buying: Tax Implications for Each Use

Leasing a vehicle for business use allows for monthly lease payments to be deducted as a business expense, often providing more consistent tax benefits compared to depreciation deductions from buying. Buyers can claim depreciation and interest expenses but face limitations like the luxury auto depreciation caps and potential recapture rules. Personal use of either leased or purchased vehicles limits deductible expenses, requiring detailed mileage tracking and allocation between personal and business use to ensure accurate tax reporting.

IRS Guidelines on Mixed-Use Vehicles

The IRS provides specific guidelines for mixed-use vehicles, distinguishing between personal and business use to determine deductible expenses accurately. Taxpayers must maintain detailed mileage logs documenting business versus personal trips, as only the business use percentage of vehicle expenses is deductible. Proper adherence to IRS rules ensures compliance and maximizes allowable deductions while avoiding penalties.

Maximizing Your Tax Savings: Personal or Business Car?

Maximizing your tax savings hinges on accurately distinguishing personal use from business use of your vehicle, as the IRS allows deductions based on the percentage of business miles driven. Keeping detailed mileage logs and receipts ensures you can claim the precise portion of expenses such as gas, maintenance, and depreciation related to business use. Opting for the standard mileage rate or actual expense method depends on your specific situation, but diligent record-keeping maximizes allowable deductions and reduces your taxable income effectively.

Personal Use vs Business Use Infographic

cardiffo.com

cardiffo.com