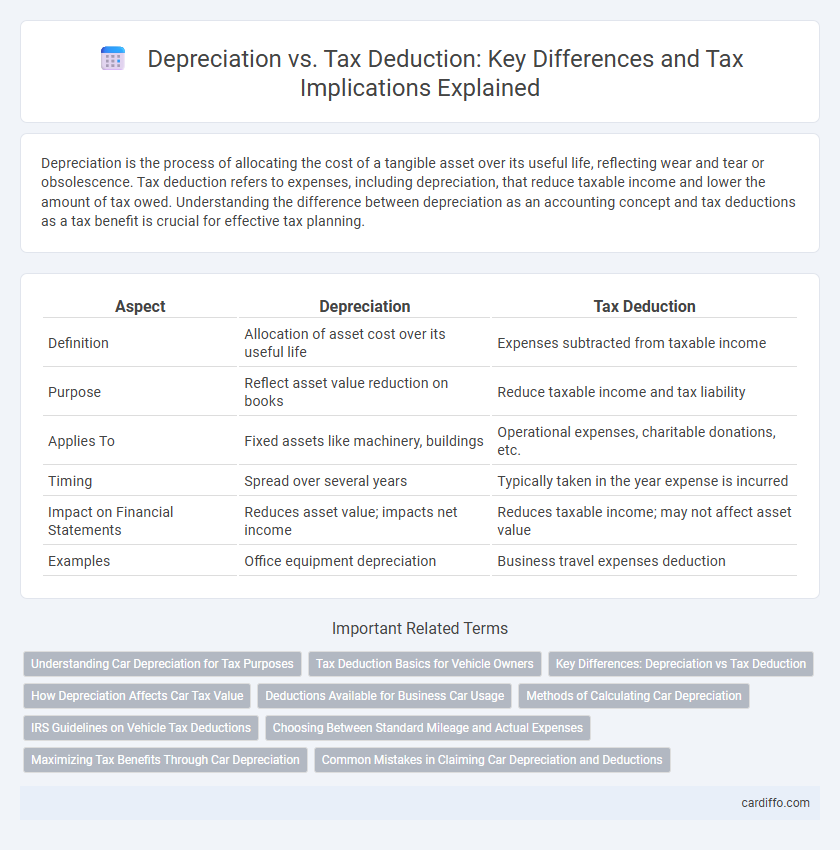

Depreciation is the process of allocating the cost of a tangible asset over its useful life, reflecting wear and tear or obsolescence. Tax deduction refers to expenses, including depreciation, that reduce taxable income and lower the amount of tax owed. Understanding the difference between depreciation as an accounting concept and tax deductions as a tax benefit is crucial for effective tax planning.

Table of Comparison

| Aspect | Depreciation | Tax Deduction |

|---|---|---|

| Definition | Allocation of asset cost over its useful life | Expenses subtracted from taxable income |

| Purpose | Reflect asset value reduction on books | Reduce taxable income and tax liability |

| Applies To | Fixed assets like machinery, buildings | Operational expenses, charitable donations, etc. |

| Timing | Spread over several years | Typically taken in the year expense is incurred |

| Impact on Financial Statements | Reduces asset value; impacts net income | Reduces taxable income; may not affect asset value |

| Examples | Office equipment depreciation | Business travel expenses deduction |

Understanding Car Depreciation for Tax Purposes

Car depreciation for tax purposes allows business owners to gradually deduct the cost of their vehicle over its useful life, reducing taxable income year by year. The IRS sets specific depreciation methods and recovery periods, such as the Modified Accelerated Cost Recovery System (MACRS), that determine the rate at which the car's value decreases on tax returns. Differentiating between depreciation and immediate tax deductions, like Section 179 expensing, is crucial for optimizing tax benefits while complying with IRS regulations.

Tax Deduction Basics for Vehicle Owners

Tax deduction basics for vehicle owners involve understanding how expenses related to vehicle use can reduce taxable income. Eligible costs include fuel, maintenance, insurance, and depreciation, but only the portion attributable to business use qualifies. Accurate record-keeping is essential to substantiate claims and maximize allowable deductions on tax returns.

Key Differences: Depreciation vs Tax Deduction

Depreciation represents the systematic allocation of the cost of a tangible asset over its useful life, directly impacting an asset's book value and taxable income. In contrast, a tax deduction refers to expenses that reduce taxable income in the year they are incurred, such as business expenses or charitable contributions. The key difference lies in timing and purpose: depreciation spreads the cost over multiple years, while tax deductions provide immediate tax relief within the same fiscal year.

How Depreciation Affects Car Tax Value

Depreciation affects car tax value by systematically reducing the vehicle's book value over its useful life, which lowers the taxable income reported on tax returns. As depreciation expense increases, the taxable value of the car decreases, leading to reduced tax liability for businesses or individuals claiming the deduction. Accurate calculation of depreciation methods, such as straight-line or declining balance, directly impacts the annual tax deductions related to the vehicle.

Deductions Available for Business Car Usage

Business cars qualify for tax deductions primarily through depreciation and operational expenses such as fuel, maintenance, and insurance. Depreciation allows businesses to recover the vehicle's cost over time, typically using the Modified Accelerated Cost Recovery System (MACRS) for passenger vehicles, with specific limits imposed by the IRS. In contrast, immediate tax deductions can be claimed for expenses directly related to business use, adhering to percentage-based mileage tracking or actual expense methods to maximize deductible amounts.

Methods of Calculating Car Depreciation

Car depreciation can be calculated using several methods, including the straight-line method, which spreads the car's cost evenly over its useful life, and the declining balance method, which applies a fixed depreciation rate to the car's reducing book value each year. Another method is the sum-of-the-years'-digits approach, allocating higher depreciation expenses in the earlier years of the vehicle's life. Choosing the appropriate depreciation method impacts the timing and amount of tax deductions, affecting overall tax liability for businesses using vehicles.

IRS Guidelines on Vehicle Tax Deductions

IRS guidelines for vehicle tax deductions distinguish between depreciation and standard tax deductions, allowing taxpayers to recover vehicle costs over time or deduct actual expenses. Depreciation follows specific IRS schedules based on the vehicle's service life, typically 5 years under the Modified Accelerated Cost Recovery System (MACRS), enabling gradual cost recovery. Taxpayers must choose between the standard mileage rate or actual expense methods, with depreciation applied differently depending on the chosen deduction method.

Choosing Between Standard Mileage and Actual Expenses

When deciding between the standard mileage rate and actual expenses methods for vehicle depreciation and tax deductions, taxpayers must evaluate which option maximizes their deductible amount. The standard mileage rate simplifies calculations by applying a fixed rate per mile driven, incorporating depreciation, maintenance, and other expenses, while the actual expenses method requires detailed tracking of depreciation costs, fuel, repairs, and insurance. Choosing the best method depends on factors such as vehicle usage, ownership duration, and total expenses, with depreciation deductions often higher under actual expenses for vehicles with significant wear or costly repairs.

Maximizing Tax Benefits Through Car Depreciation

Maximizing tax benefits through car depreciation involves strategically leveraging the vehicle's annual depreciation allowance to reduce taxable income effectively. Understanding the difference between depreciation, which allocates the car's purchase cost over its useful life, and direct tax deductions is essential for optimizing tax savings. Proper documentation and adherence to IRS guidelines on depreciation methods, such as the Modified Accelerated Cost Recovery System (MACRS), ensure compliance while enhancing overall tax efficiency.

Common Mistakes in Claiming Car Depreciation and Deductions

Common mistakes in claiming car depreciation and tax deductions include misclassifying personal vehicle use as business use, leading to inaccurate deduction amounts, and failing to apply the correct depreciation method such as the Modified Accelerated Cost Recovery System (MACRS). Taxpayers often overlook maintaining detailed mileage logs and purchase records, which are essential for substantiating deductible expenses during IRS audits. Understanding the distinction between actual expense method and standard mileage rate can optimize deductions while preventing costly errors in tax filings.

Depreciation vs Tax Deduction Infographic

cardiffo.com

cardiffo.com